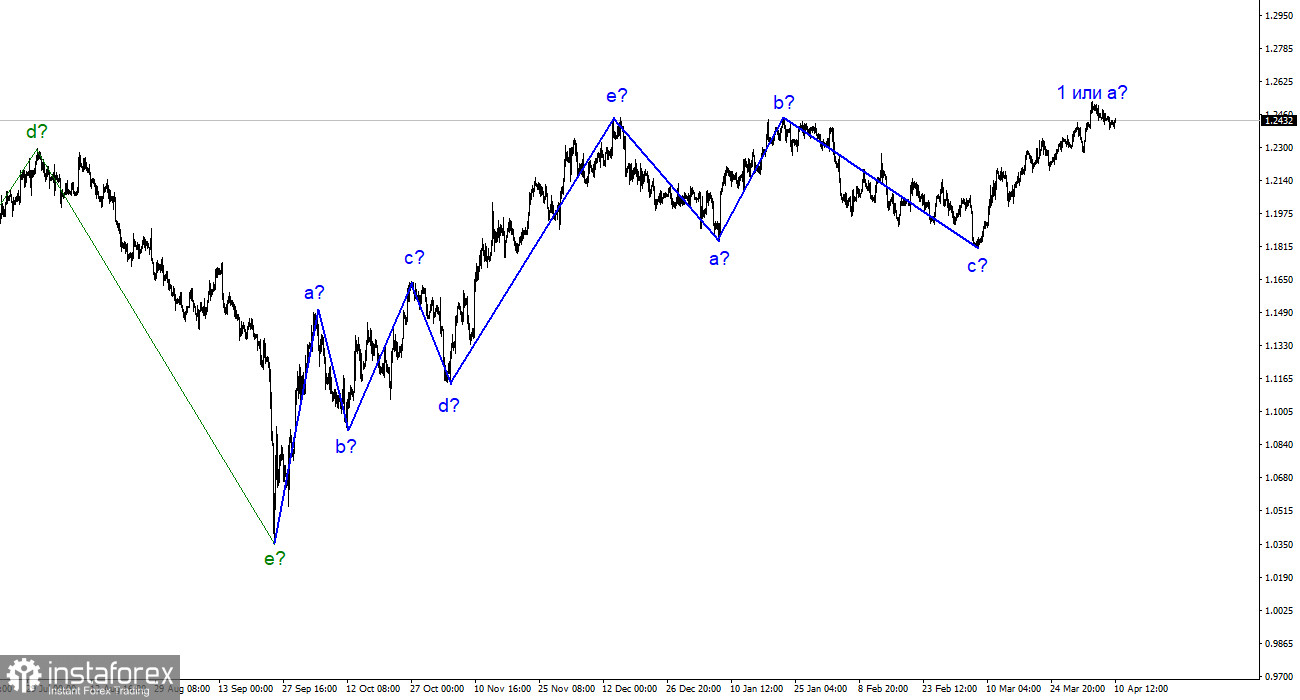

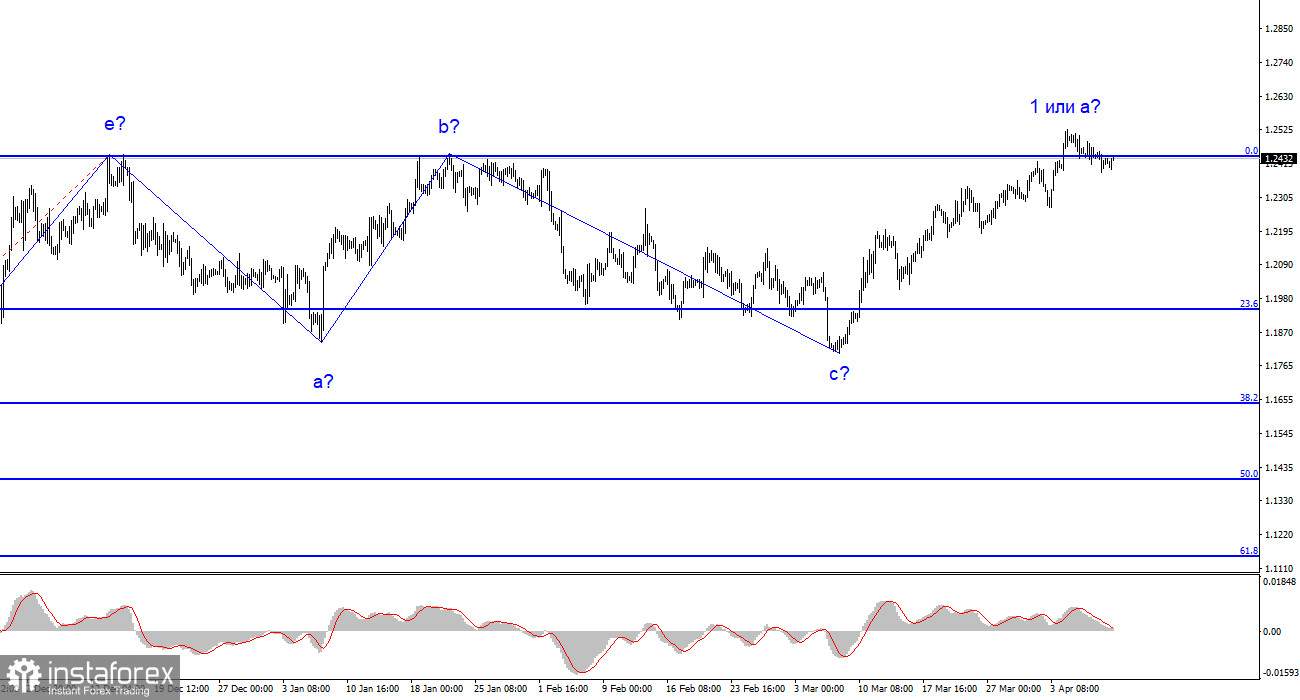

The wave markup for the pound/dollar pair still looks complex and has undergone minor changes. Since the current upward wave is higher than the peak of the last downward wave b, the downward trend of waves a, b, and c is over. Although it barely resembles the trend section for the same period in the euro currency, both pairs have built three-wave downward sets of waves. If this assumption is correct, a new upward trend has started for the pound. Since I can only single out one wave starting from March 8, there is every reason to assume that the British currency's rise will be lengthy and strong. It is difficult to say how it will be for the euro currency simultaneously. Both pairs should build similar wave formations, but this has been the problem lately. For the pound, wave b formation may begin shortly, after which the increase in quotes should resume with targets located up to the 30th figure. Unless wave c turns out to be the same as in the case of the downward wave set. The news background needs to be clarified, and I would not bet on the strong growth of the British currency based solely on it.

The dollar got a chance, and it may get another on Wednesday. The pound/dollar exchange rate on Monday again moved with minimal amplitude. There are practically no movements. The situation on Friday is repeated when the pair stood still for a whole day, only once showing that it is not "dead." But today is Easter Monday, so there is nothing to expect, neither in terms of movements nor background news. The calendar is empty, and the market does not want to do anything. All that remains is to wait. And most likely, you will have to wait not for Tuesday but for Wednesday because tomorrow, the news background will become less abundant. On Tuesday, only a report on retail trade in the European Union is scheduled, and in the evening - speeches by Neel Kashkari and Patrick Harker from the FOMC. These performances can be exciting and give the market important information, but the market doesn't expect the Federal Reserve to tell them anything important.

The inflation report may convince the FOMC of the need to abandon further interest rate hikes. If, as the market currently expects, core inflation falls to 5.2%, demand for the US currency may decrease even more. But there is another indicator that can save the dollar. At the same time (March), core inflation may rise from 5.5% to 5.6%. As a result, for the first time in a long time, core inflation (which is more critical for the Federal Reserve) will be stronger than main inflation. And this can lead to an interest rate hike in May by another 25 basis points, also increasing demand for the US currency.

General conclusions

The wave pattern of the pound/dollar pair suggests completing the downward trend section. The wave markup needs to be clarified, but I'd suggest being careful about purchases with targets above 25 figures. I do not see any news background supporting the pound in the long term, and wave b formation may begin now. In general, if trading, trade upward and very cautiously. If you want to take a risk, you can sell if the pair is below the 1.2440 mark (calculating for wave b formation).

The picture is similar to the euro/dollar pair on a larger wave scale, but some differences remain. At this time, the upward correction section of the trend is completed. If this assumption is correct, we are still waiting for the continuation of the downward trend section formation on five waves with the prospect of a decrease in the area of 14-16 figures.