The Fed may not continue raising interest rates as the banking crisis could flare up again. US inflation also seems to be decreasing, and there is a slowdown in job growth in the US. Perhaps, the earlier talks of a 0.25% rate hike in May, which will be followed by a pause, may really take place. However, it will depend on the consumer inflation data due out in the US tomorrow. A slowdown will certainly lead to a noticeable change in the market dynamics.

To be precise, the clear easing of inflationary pressures will result in a surge in risk appetite, primarily on corporate equities not only in the US, but globally. Treasury yields will also fall which, in turn, will push demand for dollar down. The ICE dollar index could even fall to 100.00 points.

Forecasts for today:

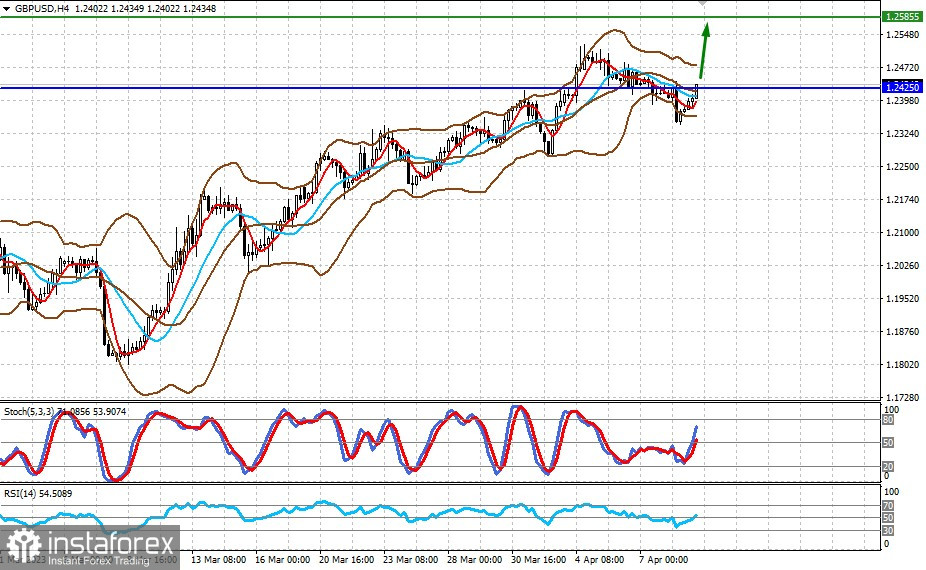

GBP/USD

The pair is testing the resistance level of 1.2425. If there is a breakout, which will happen if demand for dollar falls and rates in the UK continue to rise, the quote will rise to 1.2585.

USD/CAD

The pair is trading at the level of 1.3480. Rising oil prices and a likely decline in US inflation could put a lot of pressure on the pair and cause a fall to 1.3340.