EUR/USD

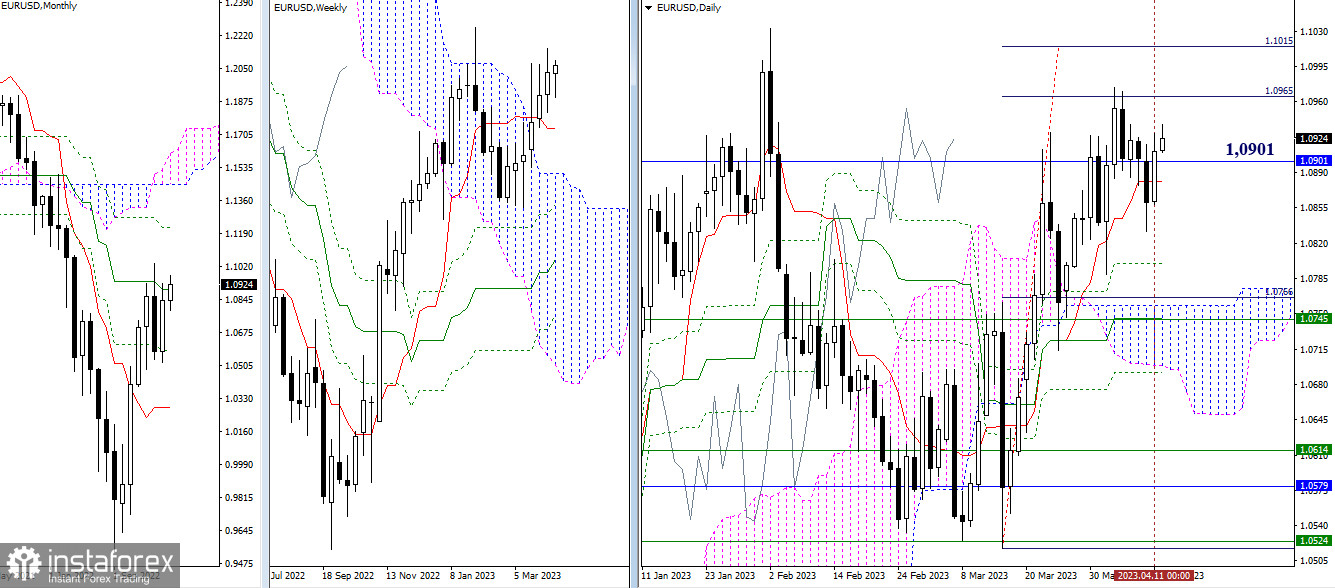

Larger timeframes

On the daily timeframe, EUR/USD made another bounce from the daily short-term trend (1.0881) over the last 24 hours. The instrument again settled above the monthly level of 1.0901. The nearest bullish targets in the current situation are represented by the intraday target for breaking the Ichimoku cloud (1.0965 – 1.1015) and the highest level of February (1.1033). They still retain their position and levels.

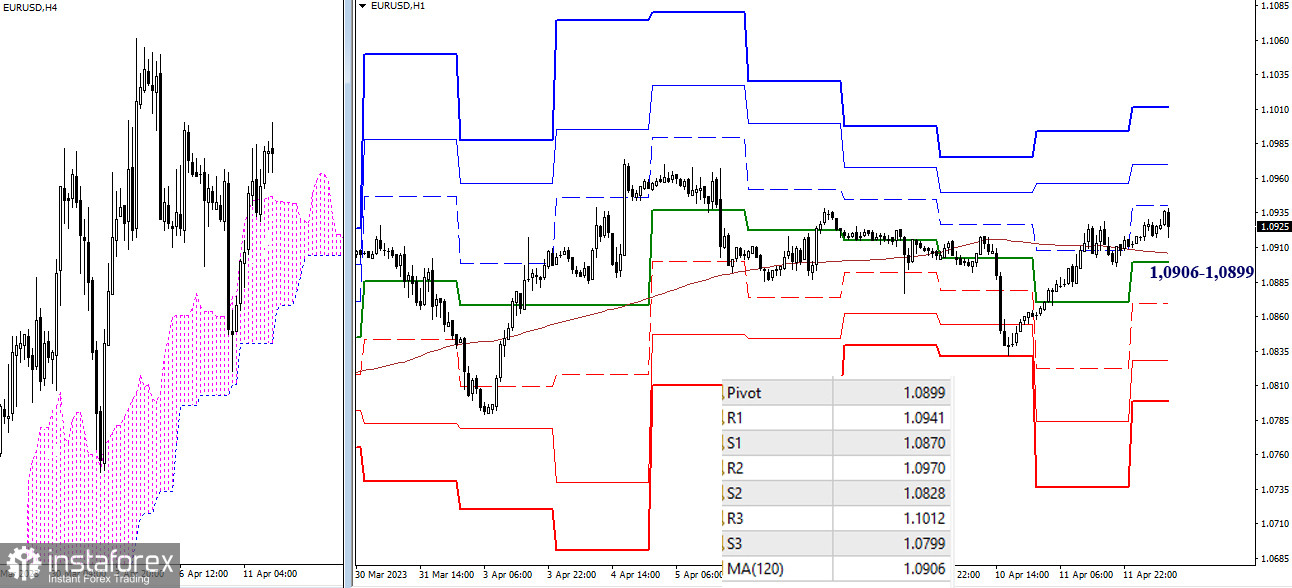

H4 – H1

On the lower timeframes, GBP/USD has consolidated above the key levels, which today are combining their efforts around 1.0906 – 1.0899 (central Pivot level + weekly long-term trend). The instrument's position above the key levels gives the main advantage to the bulls. Their intraday targets today are placed at 1.0941 – 1.0970 – 1.1012 (all classic Pivot levels). Consolidation and trading below the key levels (1.0906 – 1.0899) will change the current balance of trading forces, reinforcing bearish sentiment. The bearish targets of the lower timeframes today are located at the borders of 1.0870 – 1.0828 – 1.0799 (classic daily Pivot levels).

***

GBP/USD

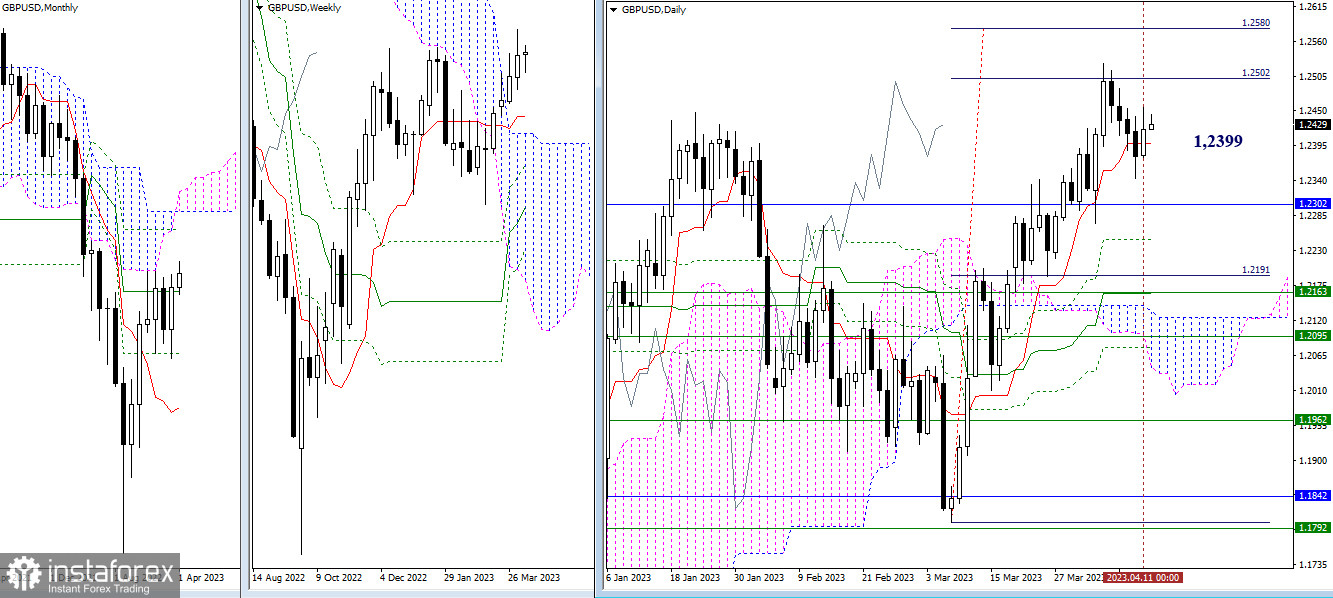

Larger timeframes

The support of the intraday short-term trend (1.2399) has once again halted the corrective decline. The development of the current bounce movement will bring the price back to the resistance levels of the daily target to break the Ichimoku cloud whose landmarks are still seen at 1.2502 – 1.2580. If the bulls fail to maintain the situation and the short-term trend (1.2399) is broken, GBP/USD will resume its corrective decline. The next target in this case will be the monthly medium-term trend (1.2302).

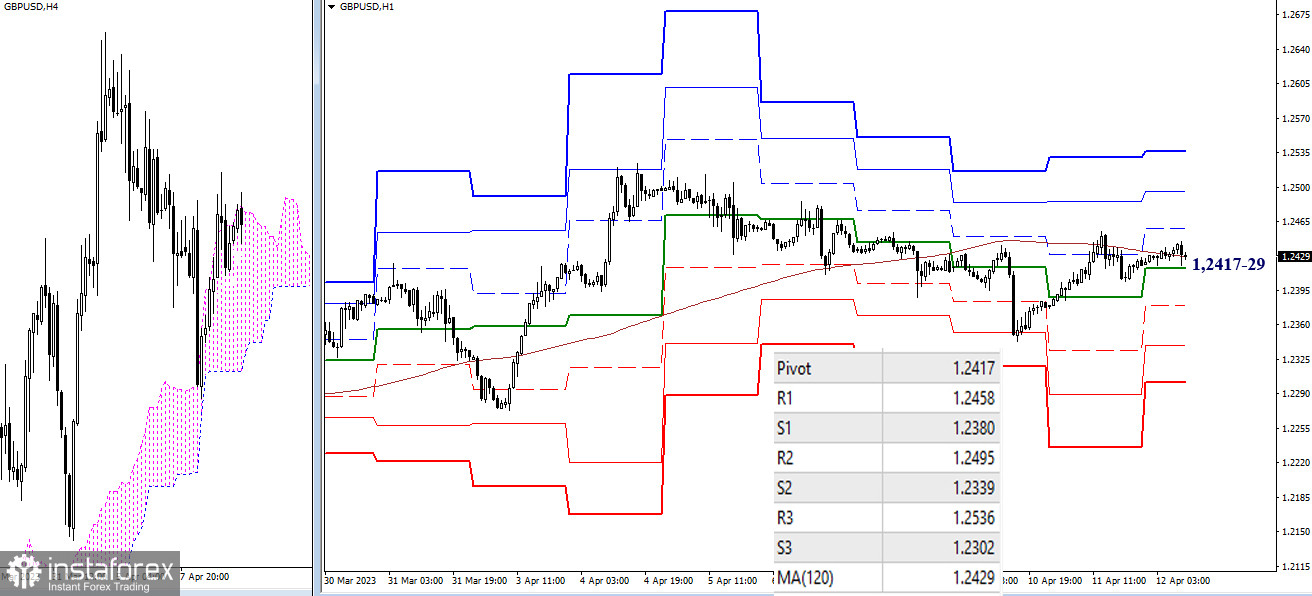

H4 – H1

In the meantime, on the lower timeframes, the struggle for the weekly long-term trend (1.2429) is still going on. The key levels today have literally merged into a fairly narrow range of 1.2417-29 (central Pivot level + weekly long-term trend). If the key levels are taken by the bulls, we can expect a further rise. Traders will aim at the bullish targets 1.2458 – 1.2495 – 1.2536 (classic Pivot levels). Alternatively, if the key levels remain in the grip of the bears, the new downward sequence will pass through the supports of the classic Pivot levels (1.2380 – 1.2339 – 1.2302).

***

This technical analysis is based on the following ideas:

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Smaller timeframes - H1 – classic pivot points + 120-period Moving Average (weekly long-term trend line)