Gold experienced a sensational rally in March, but in April, the precious metal appears to have hit the pause button. Market participants are battling for control over the key level of $2,000 per ounce. While bears argue that gold cannot sustain its position above this threshold, bulls anticipate new record highs. Who will prevail? Only time will tell.

In the first month of spring, gold surged by 9%, with the reserves of specialized ETFs increasing by 32 tons. Concurrently, China added 18 tons to its reserves, raising its total holdings to 2,068 tons. Interestingly, while China has been actively purchasing gold since December, ETF reserves have been steadily declining for nine consecutive months. Despite a positive March performance, capital outflow at the end of Q1 exceeded 28 tons.

The sharp increase in gold's price alongside gold ETF reserves suggests a pivotal shift in market sentiment. Previously, the focus was primarily on inflation and the Federal Reserve's aggressive measures to raise the Fed funds rate. However, concerns about a US economic recession are now taking center stage. Some market participants argue that the fragile state of the banking system and other sectors could halt the Fed's actions, potentially leading to a dovish U-turn as early as 2023.

Fears of an impending economic downturn have reduced both the nominal and real return rates on Treasury bonds, while weakening the US dollar. As a result, assets like gold, which lack intrinsic yield, stands to benefit in this situation, particularly because it is traded in a pair with in the weakening US currency in the forex market.

Price trajectory of gold and the US dollar:

XAU/USD traders are betting on the Federal Reserve ending its monetary policy tightening cycle, as well as higher recession risks. Skeptics argue that the market and the Fed have drastically different expectations. According to recent FOMC outlooks, the Fed funds rate will remain steady until at least 2024. Investors may eventually need to adjust their outlook and abandon the idea of a dovish reversal in 2023. Metals Focus predicts that gold will not remain above $2,000 for long and could slide down to $1,700.

If the Federal Reserve meets the IMF's challenge and continues to raise interest rates despite the visible cracks in the US economy, gold may weaken. However, it seems unlikely that the precious metal will drop as far as Metals Focus predicts. Ultimately, higher borrowing costs bring the recession closer. Gold serves as a more effective hedge against economic downturns than against inflation, even though conventional wisdom suggests otherwise.

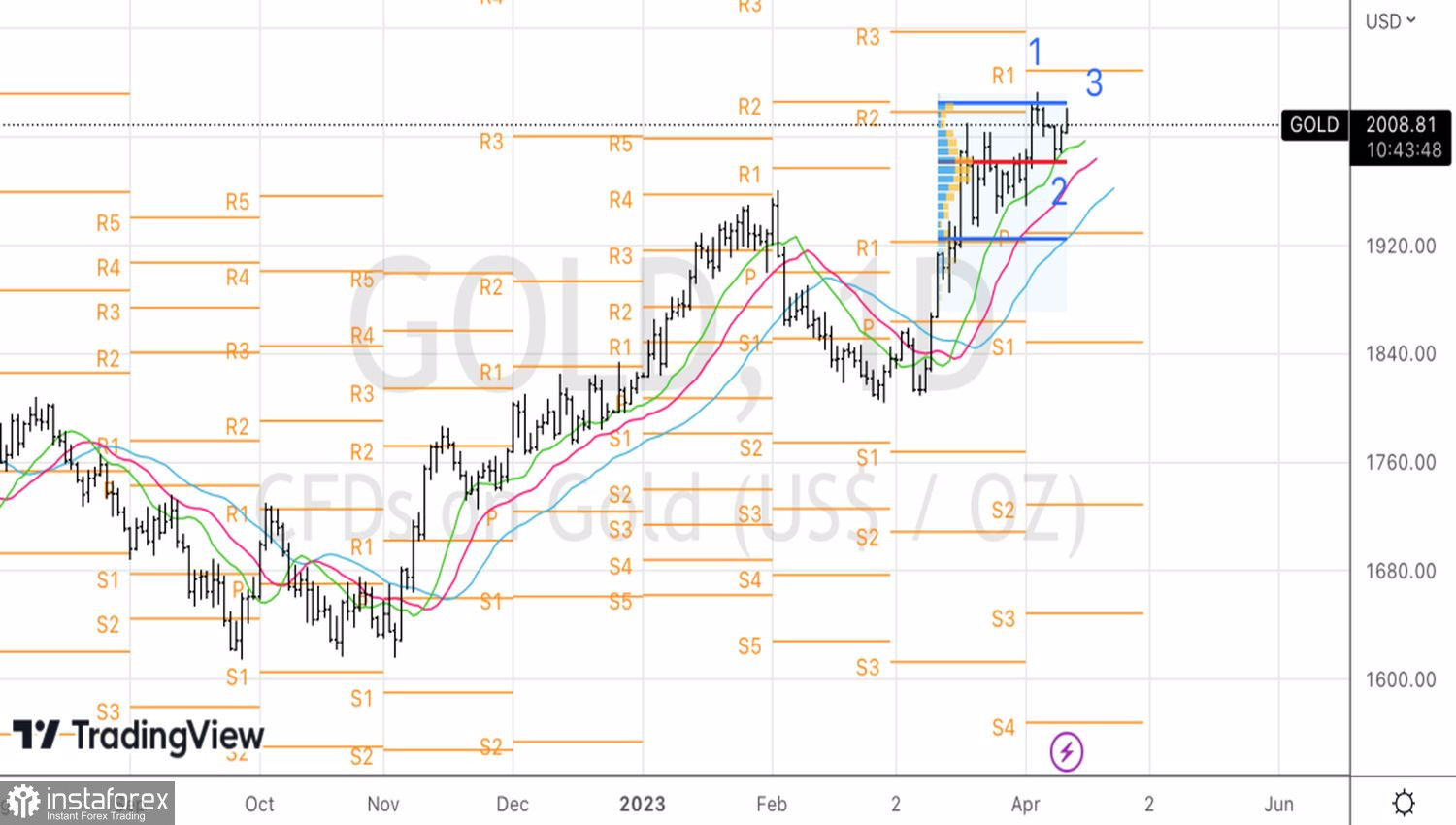

From a technical perspective, a 1-2-3 reversal pattern could come into play in the daily time frame. For this to happen, gold must successfully break through the support level of $1,982, where the fair value is located. This would provide an opportunity for opening short-term short position. On the other hand, a breakout above the fair value range of $1,926-2,026 could make gold's continued upward movement towards $2,080 and $2,110 more likely. In this scenario, traders should go long on gold.