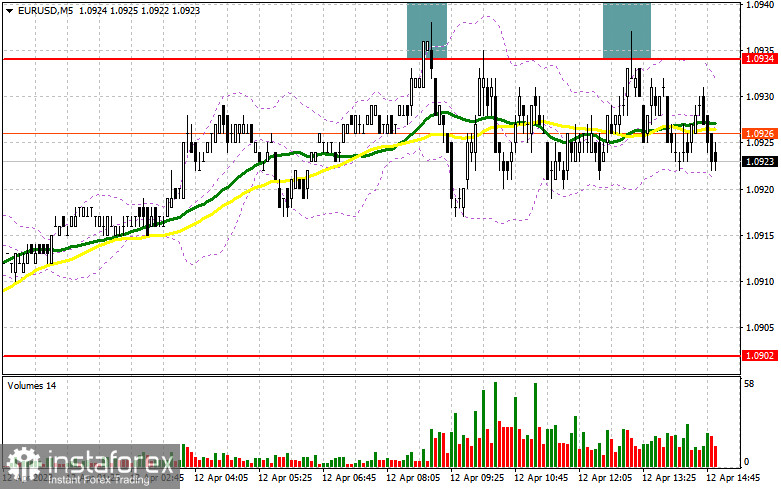

In my morning forecast, I called attention to the 1.0934 level and recommended making market entry decisions from it. Let's look at the 5-minute chart and figure out what happened there. The growth and formation of a false breakout allowed for an entry point for selling the euro. However, the downward movement was about 15 points, after which the pressure on the euro weakened as we await some important statistics. The technical picture has changed slightly for the second half of the day.

To open long positions on EUR/USD, it is required:

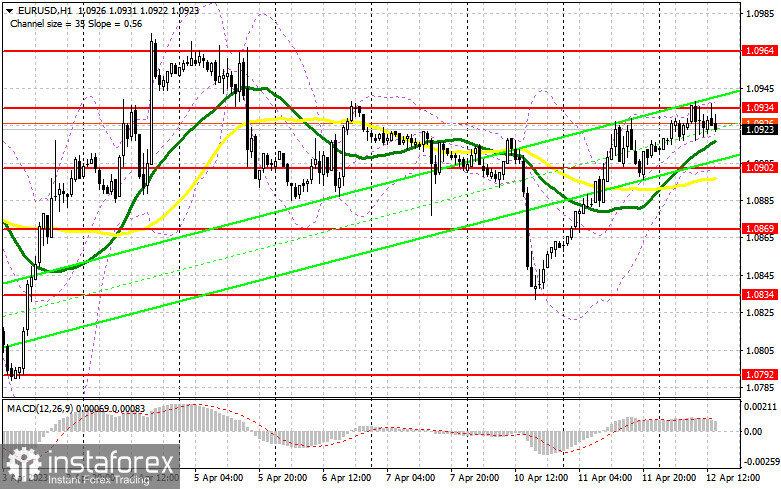

Euro buyers are preparing for growth, but it entirely depends on the inflation data in the US. If the annual indicator value is lower than economists' forecasts, expect the euro at monthly highs and count on their update. If there is no slowdown in growth, it will be very sluggish - a signal to buy the US dollar against the euro. In the case of the pair's decline due to the preservation of the high consumer price index in the US, only the formation of a false breakout at the 1.0902 level, where the moving averages also pass, will lead to a good entry point for long positions in the continuation of the bullish scenario with the next test of 1.0934. The breakthrough and top-down test of this range amid positive news will form an additional entry point for increasing long positions with a return to the monthly high at 1.0964. The ultimate target remains the 1.1002 area, where I will fix the profit. In the case of a decline in EUR/USD and the absence of buyers at 1.0902 in the second half of the day, which may happen if the markets believe in a further increase in interest rates in the US, pressure on the euro will increase. In this case, we will see a downward movement to 1.0869. Only the formation of a false breakout there will give a signal to buy the euro. I will open long positions immediately on the rebound from the minimum of 1.0834 with the target of an upward correction of 30-35 points within the day.

To open short positions on EUR/USD, it is required:

Sellers need to regain control of 1.0902. Otherwise, the pair's growth will continue. But a much more important task is protecting the nearest resistance at 1.0934, where several entry points have already been formed. From this level, along with high core inflation in the US, I expect to see major players, so the optimal scenario for opening new short positions remains the formation of a false breakout there. This will lead to a decline in the pair to the nearest support area of 1.0906. The breakthrough and reverse test of this range will push EUR/USD down to 1.0869. Consolidation below this range will open the way to 1.0834, bringing back the bearish trend to the market. There I will fix the profit. Regarding an upward movement in EUR/USD during the American session and the absence of bears at 1.0934, I advise postponing short positions to the 1.0964 level. You can sell only after unsuccessful consolidation. I will open short positions immediately on the rebound from the maximum of 1.1002 with the target of a downward correction of 30-35 points.

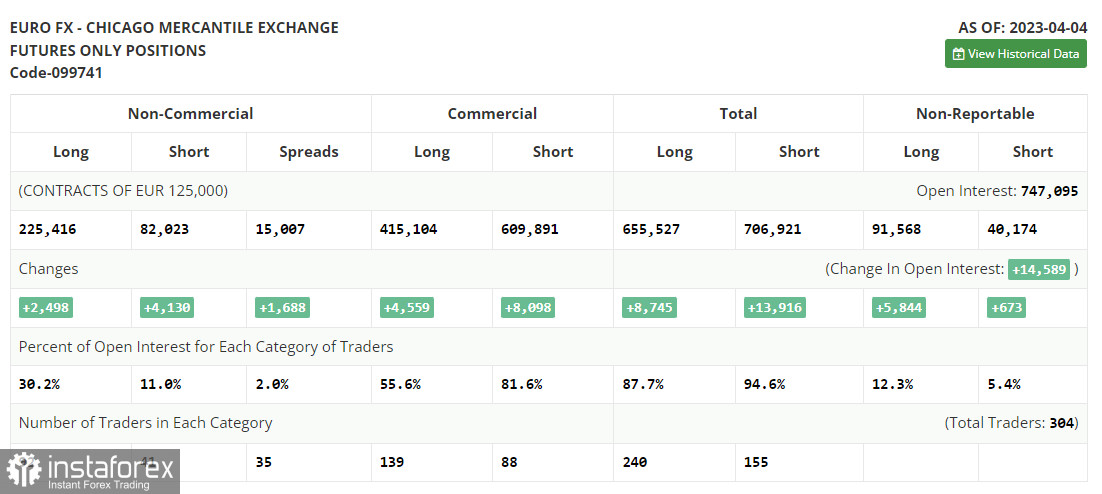

The COT report (Commitment of Traders) for April 4 recorded an increase in both long and short positions. Considering that nothing interesting happened last week, and the labor market data did not surprise much, buyers of risk assets, including the euro, will likely be preparing for important data on inflation and the volume of retail sales in the US for March of this year. The minutes of the Fed's March meeting will also be interesting. If it all points to the need for further interest rate hikes, the dollar may recover some of its losses from last month. However, if investors see figures indicating the possibility of abandoning a tightening policy, further euro growth will be ensured. The COT report states that non-commercial long positions increased by 2,498 to 225,416, while non-commercial short positions jumped by 4,130 to 82,023. As a result, the total non-commercial net position decreased to 143,393 from 145,025. The weekly closing price increased to 1.1 from 1.0896.

Indicator signals:

Moving averages

Trading occurs above the 30 and 50-day moving averages, indicating further euro growth.

Note: The author considers the period and prices of the moving averages on an hourly H1 chart and differ from the general definition of classic daily moving averages on a daily D1 chart.

Bollinger Bands

In case of a decline, the lower border of the indicator at around 1.0905 will act as support.

Description of indicators:

• Moving average (smoothing volatility and noise determines the current trend). Period 50. Marked in yellow on the chart.

• Moving average (smoothing volatility and noise determines the current trend). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

• Non-commercial long positions represent the total long open position of non-commercial traders.

• Non-commercial short positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.