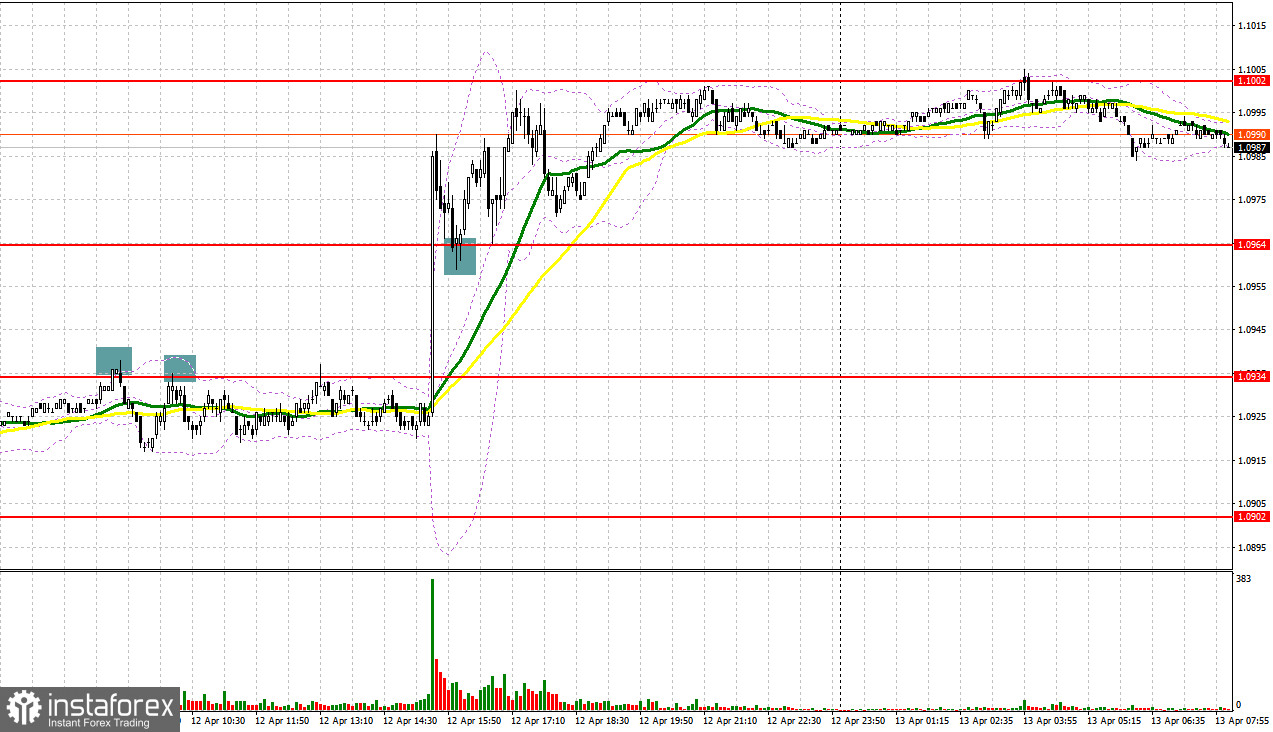

Yesterday, there were several entry points. Now, let's look at the 5-minute chart and figure out what actually happened. In my morning article, I turned your attention to 1.0934 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A rise and a false breakout of this level gave a sell signal. However, the downward movement totaled 15 pips. After that, the pressure on the euro weakened. The euro rose sharply after the release of US inflation data. A breakout and a downward retest of 1.0964 provided entry points into long positions. As a result, the pair climbed by another 40 pips.

When to open long positions on EUR/USD:

The euro climbed markedly following the US inflation report. Consumer prices declined again. The euro may rise higher today of macros stats from Germany and the eurozone are somewhat upbeat. Germany will unveil the Consumer Price Index and the eurozone will publish the Industrial Production Index. Traders are also waiting for the speech of ECB board member Joachim Nagel. However, there is also a risk that after touching the psychologically important level of 1.1000, the euro may lose momentum. For this reason, I would advise you not to rush with long positions. Weak data from the eurozone may lead to a decline and a test of the support level of 1.0964, where moving averages are benefiting the bulls. A false breakout of this level will give a buy signal within the bull market. The euro could hit 1.1002. A breakout and a downward retest of this level will boost bullish sentiment, providing an additional entry point into long positions. The pair could rise to a high of 1.1031. The target level is located at 1.1059 where I recommend locking in profits. However, the pair will be able to reach this level after US data, which we will discuss in more detail in the afternoon forecast. If the EUR/USD declines and buyers show no activity at 1.0964, which may happen in the morning, pressure on the euro will increase. It could return to 1.0934. Only a false breakout there will provide a buy signal. You could open long positions at a bounce at 1.0902, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Sellers had to retreat after US inflation data. They might regain ground only if the pair fails to break through the resistance level of 1.1002. If the euro rises in the morning after positive figures from Germany and the eurozone, bears will have to protect this level. A false breakout, which may lead to a decrease to the support level of 1.0964 Bulls and bears will fight for this level. This level is crucial in the short term. So, only a breakout and an upward retest will increase the pressure on the pair, pushing it to 1.0934. A decline below this level will trigger a fall to 1.0902 where I recommend locking in profits. It will stimulate the bearish sentiment. If EUR/USD rises during the European session and bears show no energy at 1.1002, which is more likely, especially after yesterday's inflation data and the Fed minutes, I would advise you to postpone short positions until a false breakout of 1.1031. You could sell EUR/USD at a bounce from 1.1059, keeping in mind a downward intraday correction of 30-35 pips.

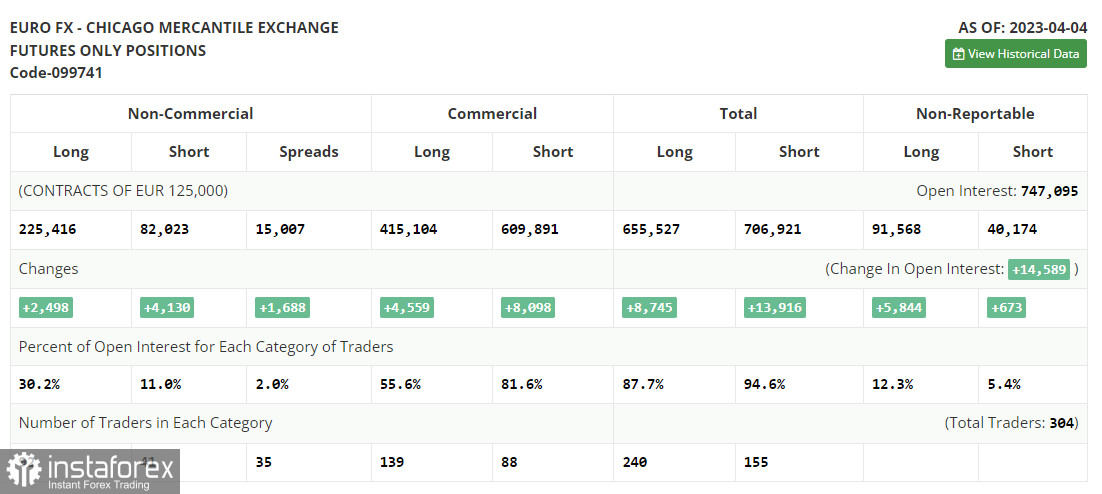

COT report

The COT report (Commitment of Traders) for April 4 logged growth in both long and short positions. Nothing interesting happened last week because the US nonfarm payrolls didn't come as a bombshell. Now buyers of risky assets, including the euro, are looking forward to crucial economic data such as US inflation data and retail sales for March. The FOMC's March meeting minutes will also matter a lot to market sentiment. If all this indicates the need for further interest rate hikes, the US dollar may recoup some of the losses incurred last month. However, if in the macroeconomic data and the minutes, investors discover the signs that the US Fed could moderate its aggressive monetary tightening, the euro will have arguments to cement its growth. The COT report states that non-commercial long positions increased by 2,498 to 225,416, while non-commercial short positions jumped by 4,130 to 82,023. As a result of the week, the overall non-commercial net position decreased and amounted to 143,393 against 145,025. EUR/USD closed last week higher at 1.1 against 1.0896 a week ago.

Indicators' signals:

Trading is carried out above the 30 and 50 daily moving averages, which indicates a further increase in the euro.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 1.0945 will serve as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.