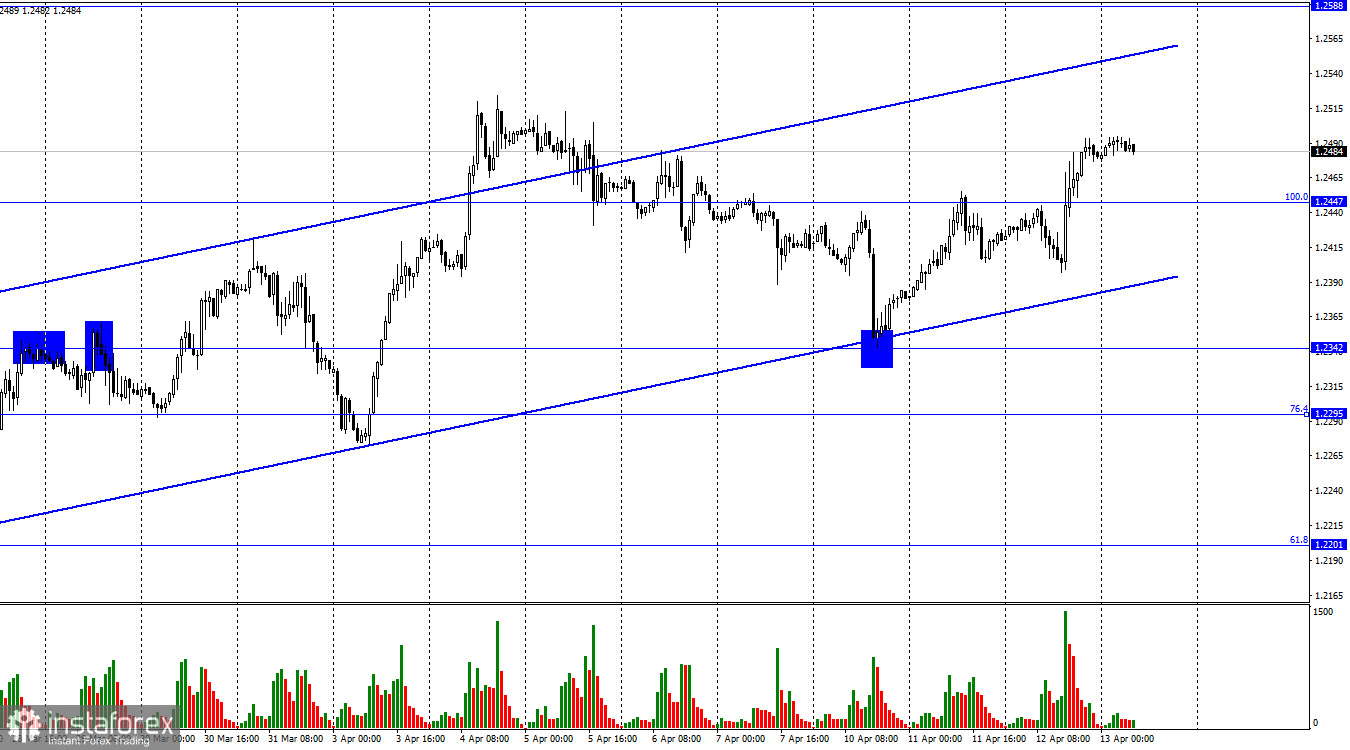

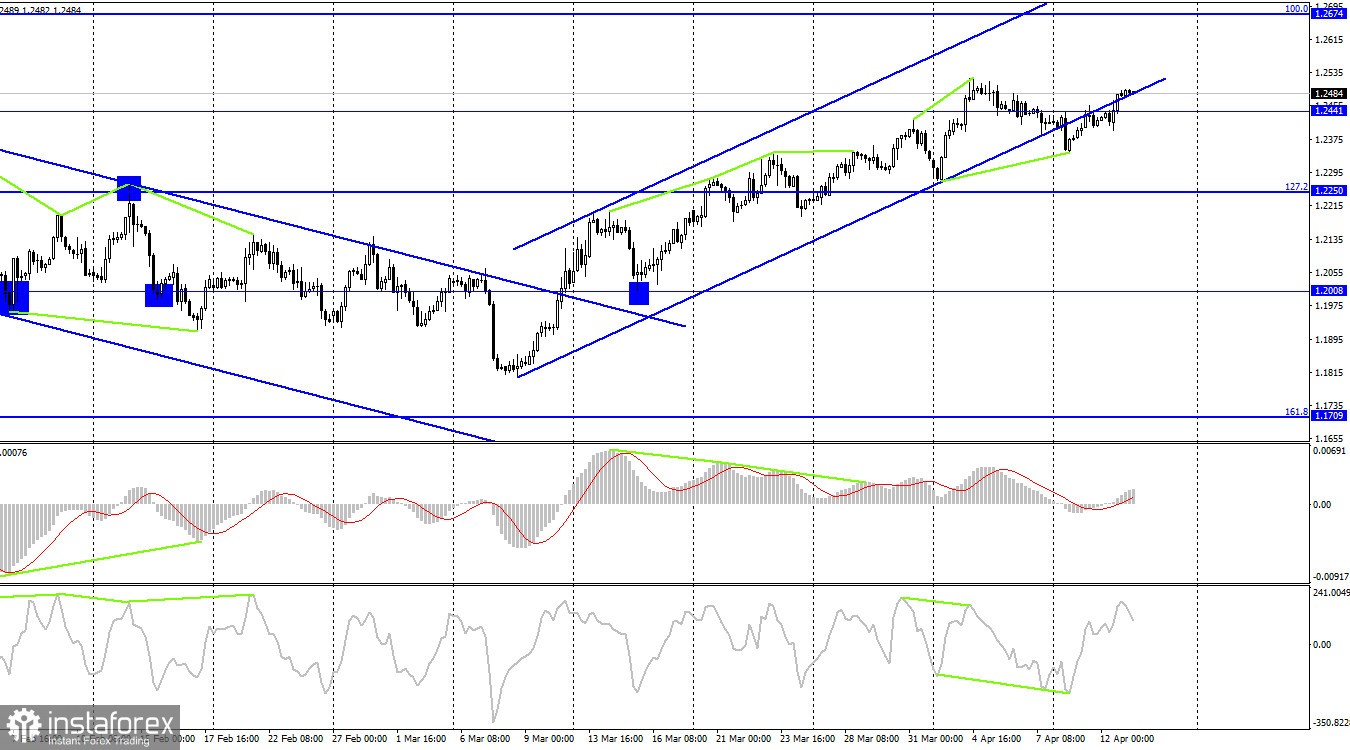

Yesterday could have been a very important day for the pair for several reasons. Bank of England Governor Andrew Bailey made two statements yesterday but there is currently no information about them. Judging by the pair's movements, traders reacted only to the US inflation report. Thus, it seems that Andrew Bailey did not say anything new. The US inflation report caused another decline in the US dollar, which I have already mentioned in my review of the euro. This morning, important reports on the UK's GDP and industrial production were released, which could have helped the pound bears. The UK economy showed 0% growth in February although traders expected at least a 0.1% increase. Industrial production for the same month decreased by 0.2%, contrary to forecasts suggesting a 0.2% rise. As we can see, both reports supported the pound-dollar bears, not bulls. However, a few hours after the release, one thing has become clear: traders paid no attention to this data. Moreover, the pound is eager to continue its uptrend. Yesterday bulls had a good reason to buy the pair but today there is no ground for this. Still, the pound is heading for new highs. In the second half of the day, the information background will be even weaker, so the market is unlikely to respond to the US data publication.

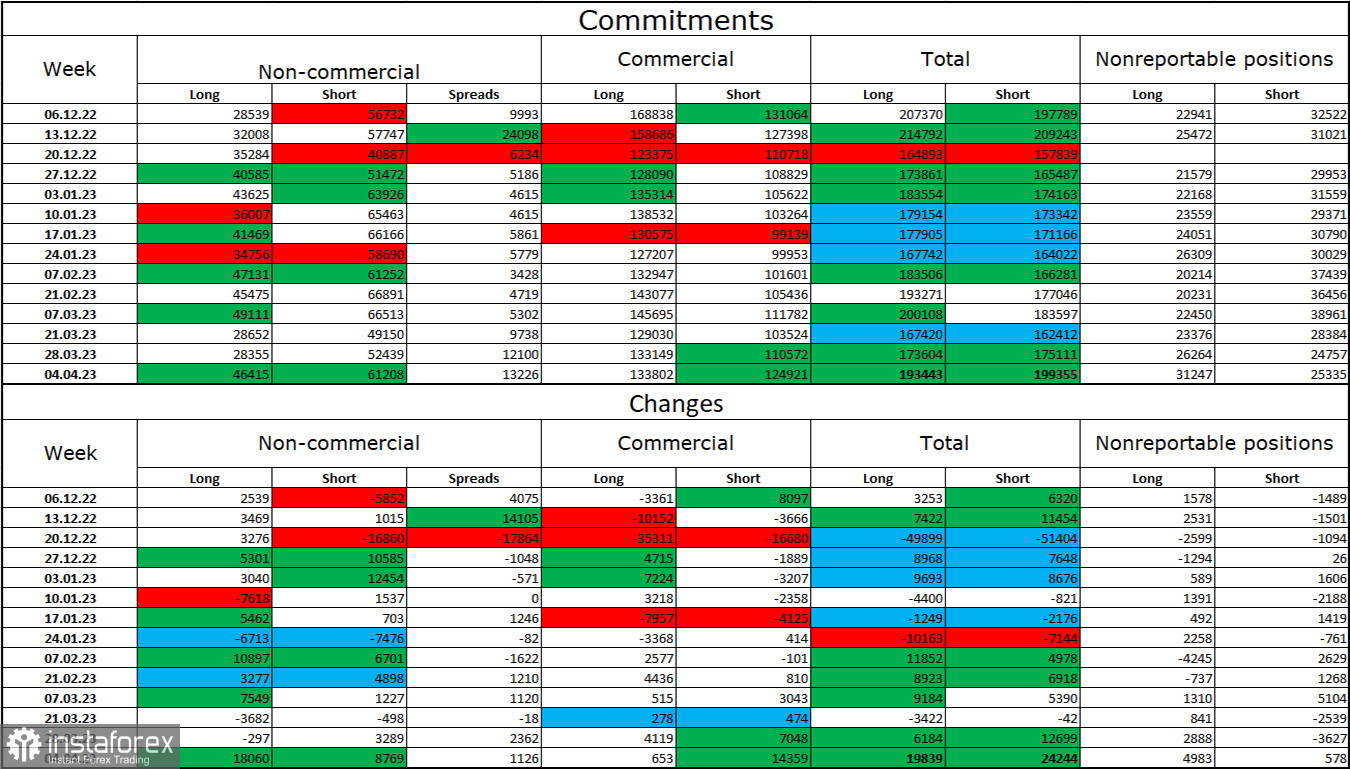

COT report:

The sentiment of the non-commercial group of traders changed significantly over the last reporting week. The number of long contracts held by speculators increased by 18,060, while short contracts rose by 8,769. The overall sentiment of major market players remains bearish, with the number of short positions still exceeding the number of long ones. Over the last few months, the situation has been changing in favor of the pound sterling, but the difference between the number of long and short contracts held by speculators remains significant. Thus, the outlook for the pound has been improving although GBP has been trading without significant changes in the last few months. On the 4-hour chart, the price left the descending channel which is why the pound could be strengthening. However, there are many contradicting factors at the moment, and the information background provides little support for the sterling. On the 4-hour chart, the pair may close below the ascending channel.

Economic calendar for US and UK:

UK – GDP (Feb) (06-00 UTC)

UK – Industrial Production (06-00 UTC)

US – Producer Price Index (PPI) (12-30 UTC)

US – Initial Jobless Claims (12-30 UTC)

On Thursday, the economic calendar features several interesting events, but the first two have had no impact on the currency pair. The influence of the information background on traders' sentiment for the remaining part of the day will be weak.

GBP/USD forecast and trading tips:

I recommend selling the pound if the pair closes below the ascending channel or if there is a rebound from the 1.2524 level on the 1-hour chart with the targets at 1.2447 and 1.2342. Buying the pound was possible when the price closed above the 1.2441 level on the 4-hour chart, with the targets at 1.2524 and 1.2588.