Long positions on EUR/USD:

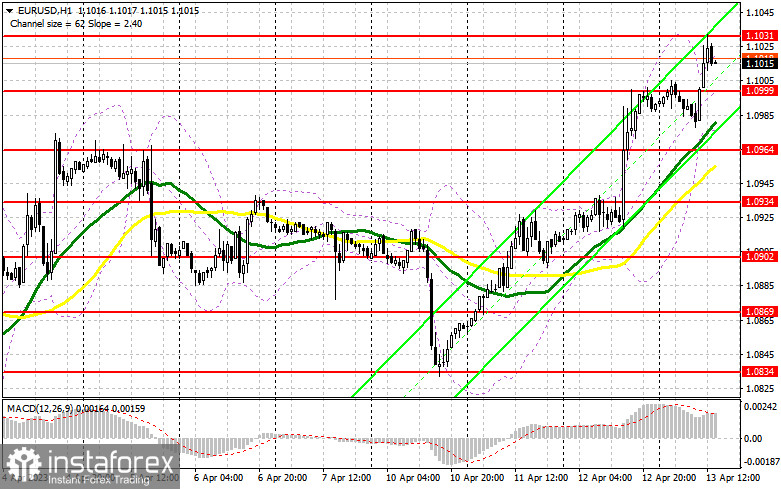

During the European session, the EUR/USD pair broke through 1.1002 but did not test this level from above. In the second half of the day, attention will be drawn to the data on the number of initial jobless claims and the Producer Price Index. While the labor market situation is clear, and no significant changes are expected, producer prices may surprise with a decline, further weakening the US dollar and strengthening investors' confidence that the interest rate hike cycle by the Fed may come to an end. However, if inflation spikes, pressure on the pair will return. However, the first signs of big buyers near 1.0999 are expected. If the price forms a false breakout at this level, it may give a good entry point into long positions, continuing the development of the bullish scenario with a test of 1.1031, a new resistance. A breakout and a downward test of this level amid positive news on US inflation will form an additional entry point into long positions, pushing the price to a new monthly high near 1.1059. The next target remains in the area of 1.1089, where traders may fix their profits. If the euro/dollar pair declines and we see weak bullish activity at 1.0999 in the second half of the day, pressure on the euro is likely to increase. In this case, the pair may drop to 1.0964, where the moving averages pass. Only a false breakout at this level may give a buy signal. One may open long positions on a rebound from the low of 1.0934, allowing an upward intraday correction of 30-35 pips.

Short positions on EUR/USD:

Bears should prevent the pair from rising above 1.0999. Otherwise, the pair's growth will continue. Meanwhile, they also need to protect the resistance of 1.1031, where several entry points have already been formed today. Against the background of high producer price inflation in the US, I expect to see large players at this level. Thus, the optimal scenario for opening new short positions remains the formation of a false breakout there, similar to what I analyzed above. This will lead to a decline in the pair to the support of 1.0999. A breakout and a test of this range may push the EUR/USD pair down to 1.0964. Settling below this range, the pair may go to 1.0934. As a result, the pair may move in a sideways channel. In addition, traders can fix profits at this level. If the pair increases during the US session and weak bearish activity at 1.1031, it would be better to postpone opening short positions until the pair reaches 1.1059. One can sell the euro at this level if the price fails to consolidate below it. Short positions can be opened on a rebound from the high of 1.1089, allowing a downward correction of 30-35 pips.

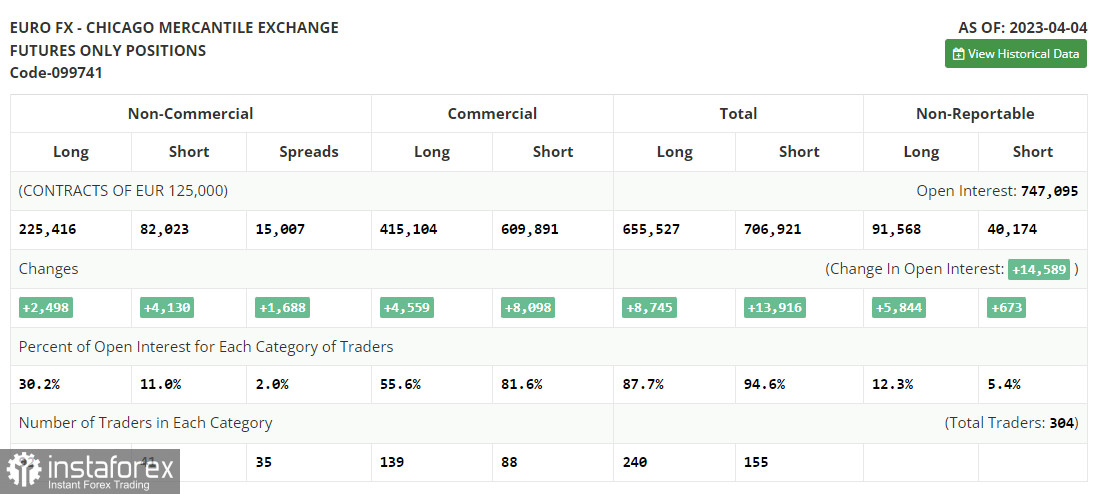

The COT report for April 4 posted an increase in both long and short positions. Last week, the economic calendar had no important reports and the labor market data came in line with traders' expectations. Buyers of risk assets, including the euro, are likely to be preparing for an important batch of data on inflation and retail sales volume in the US for March this year. The minutes of the March FOMC meeting will also be evaluated. If all of this suggests the need for further interest rate hikes, the US dollar may offset some of the losses seen last month. However, if investors see figures indicating the possibility of abandoning tightening policies, the euro may grow. The COT report states that non-commercial long positions increased by 2,498 to 225,416, while non-commercial short positions jumped by 4,130 to 82,023. As a result, the overall non-commercial net position decreased and amounted to 143,393 against 145,025. The weekly closing price increased and was 1.1000 against 1.0896.

Signals of indicators:

Moving averages

The pair is trading above the 30 and 50-day moving averages, which indicates a further rise in the euro.

Note: Period and prices of moving averages are considered by the author on hourly chart H1 and differ from the common definition of classic daily moving averages on daily chart D1.

Bollinger Bands

If the pair declines, the lower boundary of the indicator near 1.0964 will offer support.

Description of indicators

- Moving average defines the current trend by smoothing out market volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average defines the current trend by smoothing out market volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence) indicator. Fast EMA 12. Slow EMA 26. SMA 9

- Bollinger Bands. Period 20

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, which use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.