US stock indices edged higher in early trade on Thursday. However, pressure is gradually increasing as investors have digested US inflation data and statements from Fed officials but have so far failed to foresee the future of interest rates.

S&P 500 futures and Nasdaq 100 futures closed near their session lows on Wednesday. They are currently seen trading up by 0.2% and 0.3% respectively. Treasury bond yields are still in a narrow range, with policy-sensitive 2-year notes staying below 4%.

The latest US inflation report shows both bullish and bearish positions on bonds. Annual inflation dropped, while core rates increased. Swap markets are still betting on a 0.25% rate hike by the Federal Reserve in May despite the fact that traders expect a decrease in borrowing costs by the Federal Reserve at the end of the year.

Yesterday's inflation figures confused investors rather than cleared things out. There is considerable uncertainty surrounding high rates and the US banking sector. Markets have clearly calmed down with no bad news coming. Nevertheless, traders are still reluctant to buy risk assets, especially at the current levels, due to the Fed's monetary stance, which is far from being dovish.

The FOMS Minutes for March, delivered on Wednesday, revealed that policymakers lowered their expectations for rate hikes for this year, following the collapse of several banks. Moreover, officials remain cautious about a possible credit crunch, which may slow the economy even more.

European stock indices showed modest growth after ECB member Francois Villeroy de Galhau hinted at a dovish pivot.

Oil prices are near their 5-month highs, with WTI futures hovering around $83 per barrel amid signs of a tighter global markets situation on the back of decreasing crude stocks in the US and China's growing imports.

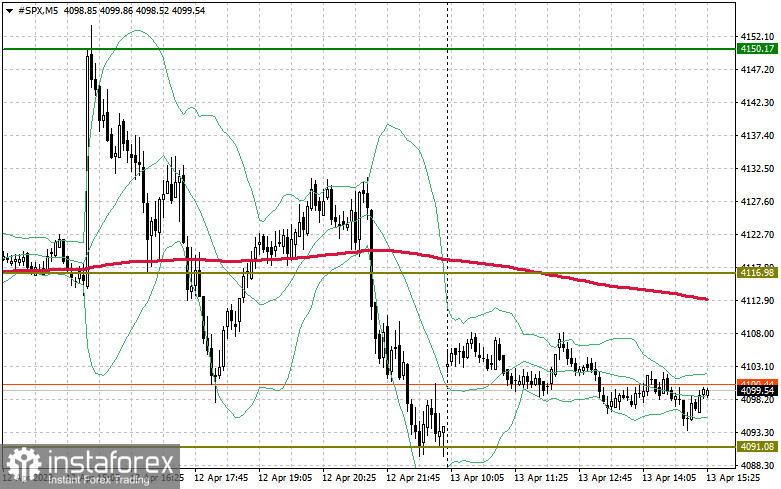

Demand for risk assets is still high. Technically, the S&P500 may extend gains if the bulls manage to break above $4,116 and $4,150, targeting $4,184. In addition, it is important that the bulls maintain control over the mark of $4,208, which will contribute to the new bull market. Should the price go down amid the lack of target points and demand, the bulls will have to defend the level of $4,090. A breakout through it could cause a fall in price to $4,060 with the target at $4,038.