EUR/USD

Larger Timeframes

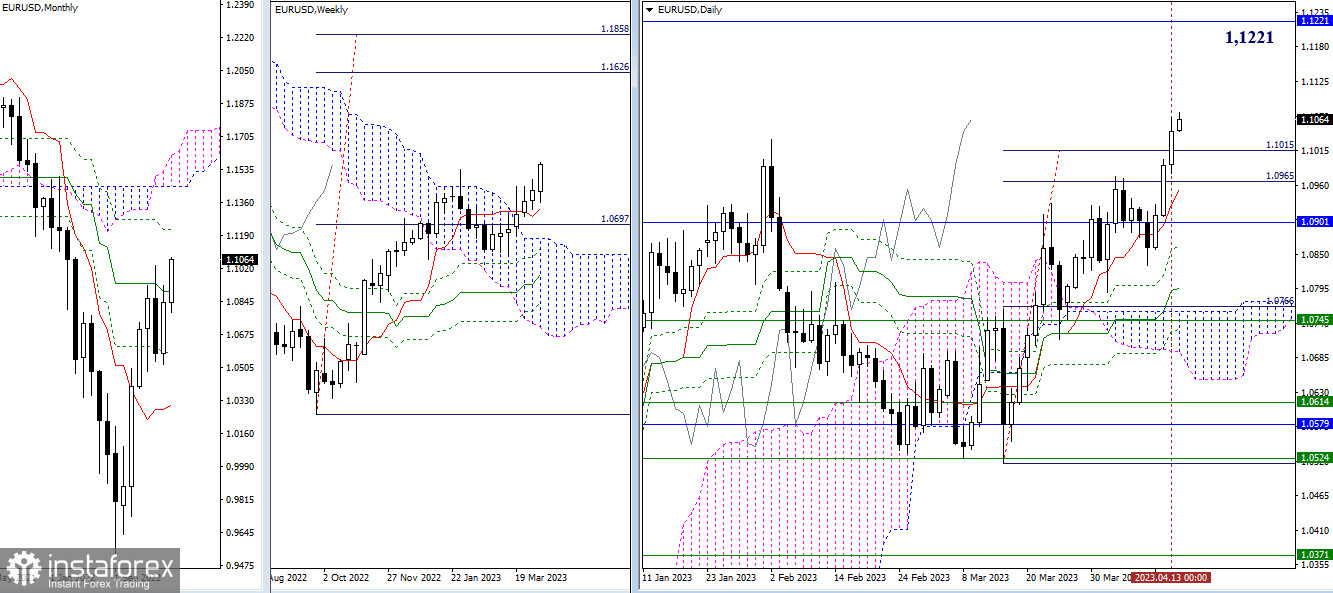

Yesterday, the euro bulls updated the February high of 1.1033 and easily surpassed the daily target, thus showing that the current upward movement may have good prospects. The next target milestone on the larger timeframes in the current situation is one-month resistance of 1.1221. The previously passed intraday target levels (1.1015 - 1.0965) and the intraday short-term trend (1.0953) now act as the nearest support in case of another change in sentiment.

H4 – H1

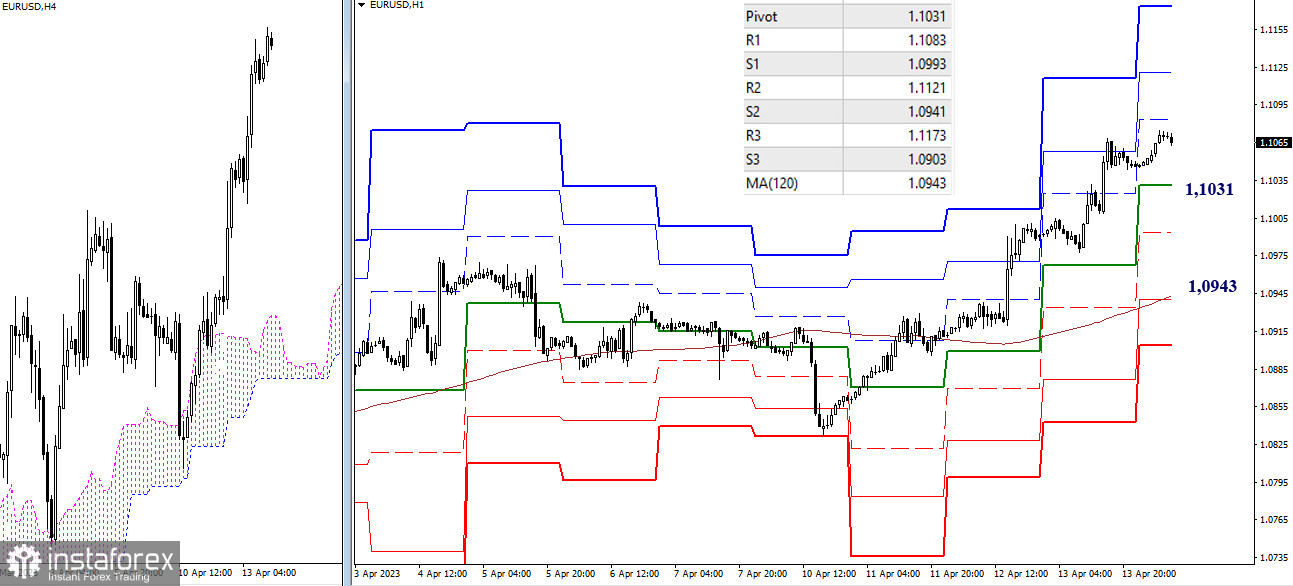

On smaller timeframes, the bulls are developing an upward trend. The intraday upward targets are the classic Pivot levels, which are seen today at 1.1083 - 1.1121 - 1.1173. If the bulls lose the initiative, the following support levels will be significant during the downward correction development: 1.1031 (central Pivot level), 1.0993 (S1), and 1.0943 (weekly long-term trend). Consolidation below 1.0943 will change the current balance of trading interests, so it will be better to reassess the overall situation.

***

GBP/USD

Larger timeframes

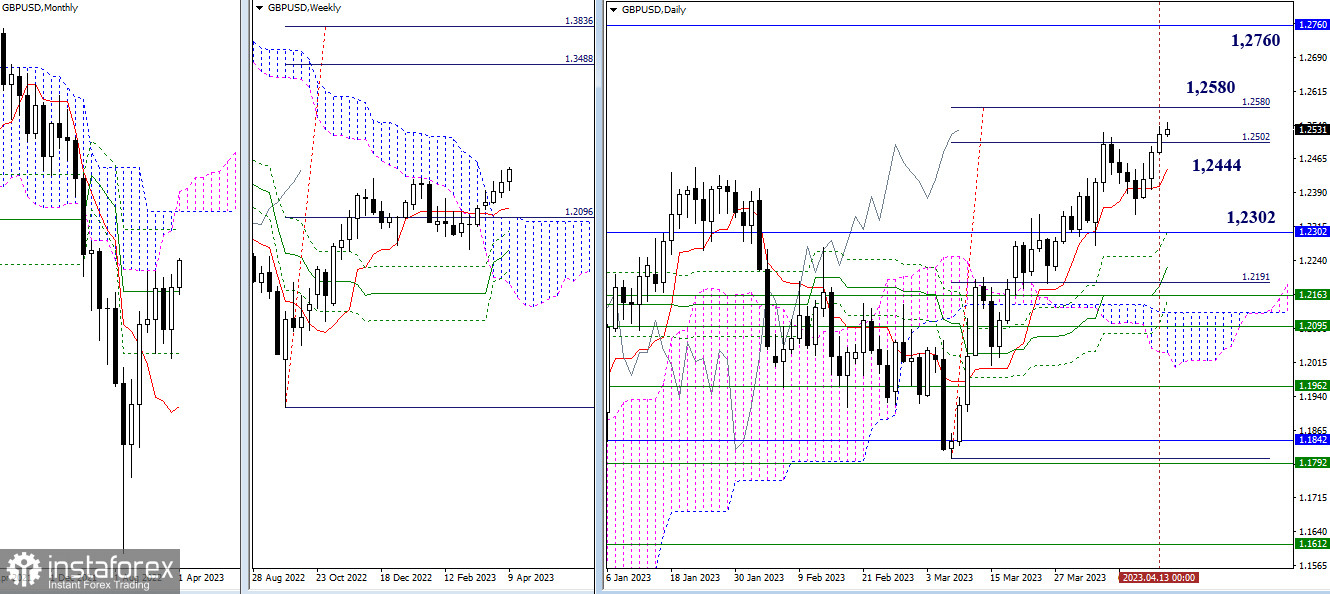

The bulls managed to complete the downward correction the day before and revive the daily upward trend. To reinforce the uptrend, the major task for the bulls now is to ensure a breakout of the daily cloud target (1.2580) and a further rise towards one-month resistance of 1.2760. If the bulls fail again, the support of the intraday short-term trend (1.2444) and the one-month medium-term trend (1.2302) will still be important during the decline.

H4 – H1

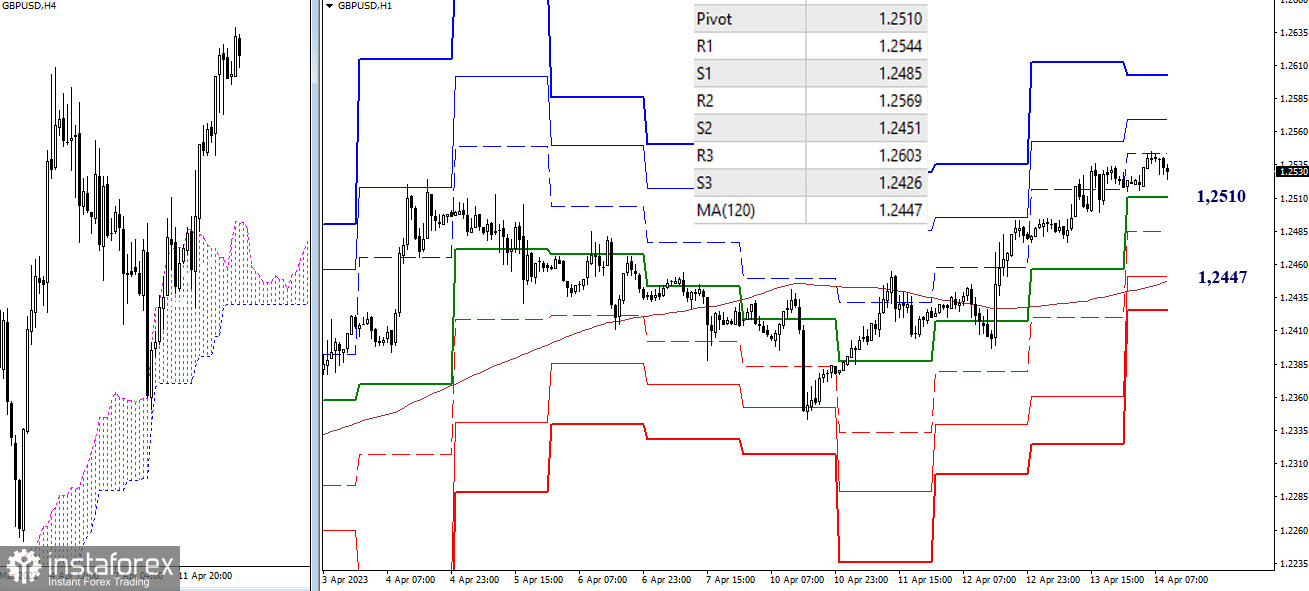

The bulls have tested the first resistance of the classic Pivot levels (1.2544). Meanwhile, the uptrend is slowing down and we are watching a downward correction popping up. If GBP/USD continues its rise, the next resistances will be determined at 1.2569 (R2) and 1.2603 (R3). If the corrective decline continues, support will come into play. The most significant downward levels today are 1.2510 (central daily Pivot level), 1.2485 (S1), and 1.2447 (one-week long-term trend). The current balance of trading interests could be changed in favor of the bears in case GBP/USD settles below and reverses downward.

***

This technical analysis is based on the following ideas:

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Smaller timeframes - H1 – classic pivot points + 120-period Moving Average (weekly long-term trend line)