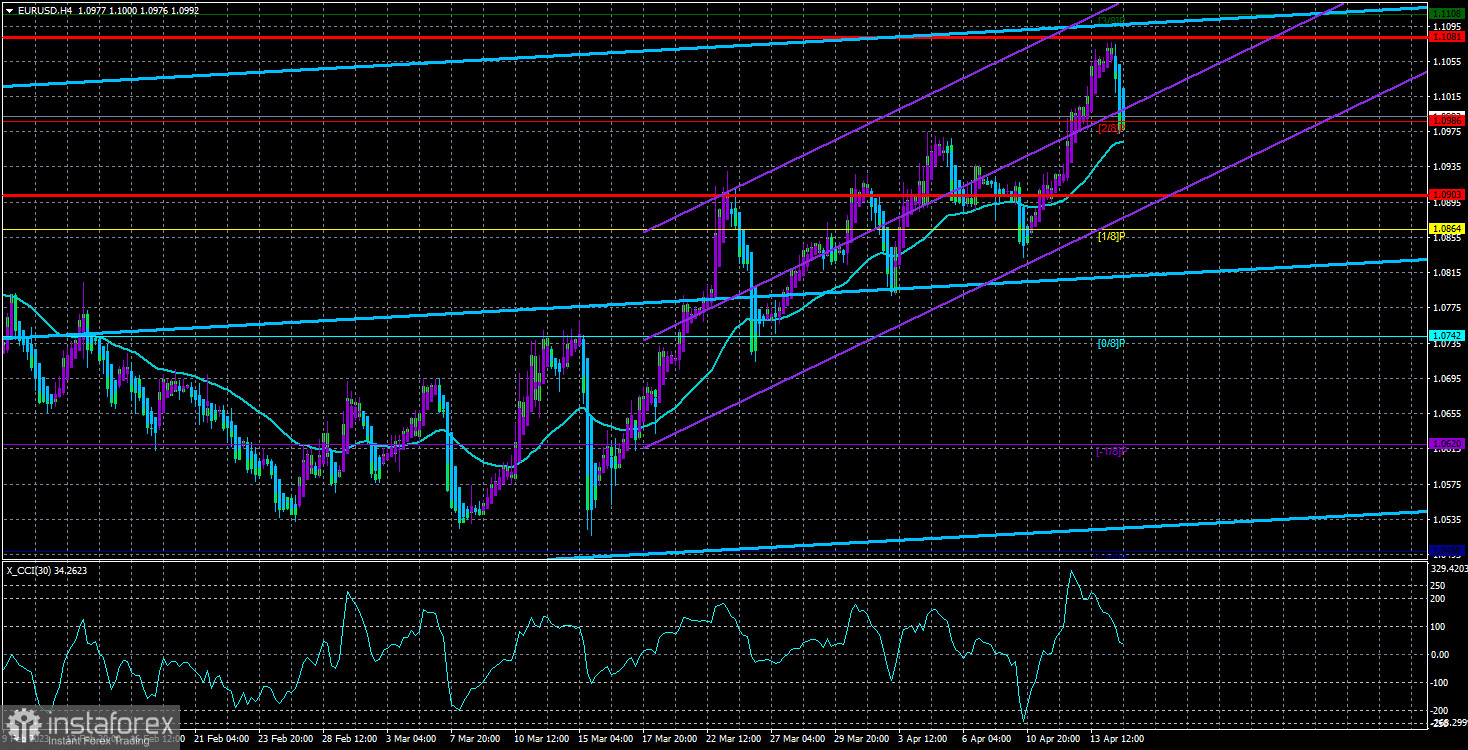

The currency pair EUR/USD on Friday began a new round of correction, which again looks more like a rollback. Despite the quote decline by about 100 points, the price remains above the moving average line, which means the upward trend is also maintained. Thus, as early as tomorrow, on technical grounds, the growth of the European currency may resume. Recall that neither a fundamental nor macroeconomic background on Friday contributed to the pair's decline. Or, it's impossible to say that these two factors were the only ones responsible for the dollar's 1 cent increase. Traders had the right to buy the dollar, as Christopher Waller stated that the Fed rate would continue to rise. But only some thought that the Federal Reserve completed its monetary policy tightening program in March. Thus, Waller still needs to provide new information. However, for technical reasons, the dollar should have risen long ago and should continue to do so. But will the bears have enough strength this time to push the pair down? Or will the bulls who don't have a good reason to buy the euro currency continue to advance?

Whatever the case, we still recommend being cautious about buy signals. It should be understood that any such signal can lead to a sharp decline in the pair and high profits for traders. But at the same time, it can be false, as had happened more than once when the moving average was overcome.

Lagarde and de Cos guided the market.

Last week, there were several speeches by ECB representatives. First, ECB President Christine Lagarde said that inflation in the European Union would continue to decline. She noted that the high wage growth was related to some tension in the labor market and the consequence of high inflation. Lagarde believes that these factors will keep core inflation at a high level. Recall that the core consumer price index indicator has not decreased even once, which causes concern for the regulator.

Later, Pablo Hernandez de Cos, a member of the Monetary Committee, also spoke. He also stated that core inflation will remain high until the end of the year and "monetary policy still needs to be worked on." Thus, we can draw the following conclusions. At the upcoming ECB meetings, the rate will continue to rise. Most likely, we will see three more increases of 0.25%. An increase of 0.5% in May is also possible. The ECB began raising the key rate later than the Fed and the Bank of England, so it will finish this process later. The question is only what peak rate level the market has already factored into current prices. Since the euro currency has been growing for a long time and significantly, the market has already taken into account all possible tightenings, so new rate hikes will not support the euro. In almost any case, the euro currency should decline in the near future, but technical analysis cannot be argued with. If buy signals constantly appear, trading should be on the rise.

In summary, the correlation between inflation and central bank rates is beginning to disappear. A weak decline in inflation or the absence of it no longer means that the central bank will significantly raise the key rate at the next meeting and increase its growth rate. As we have already said, the effect of policy tightening can be observed even after a year, so regulators are likely counting on this. On the other hand, inflation in the US has already fallen to 5%, and the Fed rate continues to rise. However, despite no annual effect, the correlation between inflation and rates is still disappearing, as central banks can only raise rates for a while. This is especially true for the Bank of England, where inflation has hardly decreased despite 11 rate hikes.

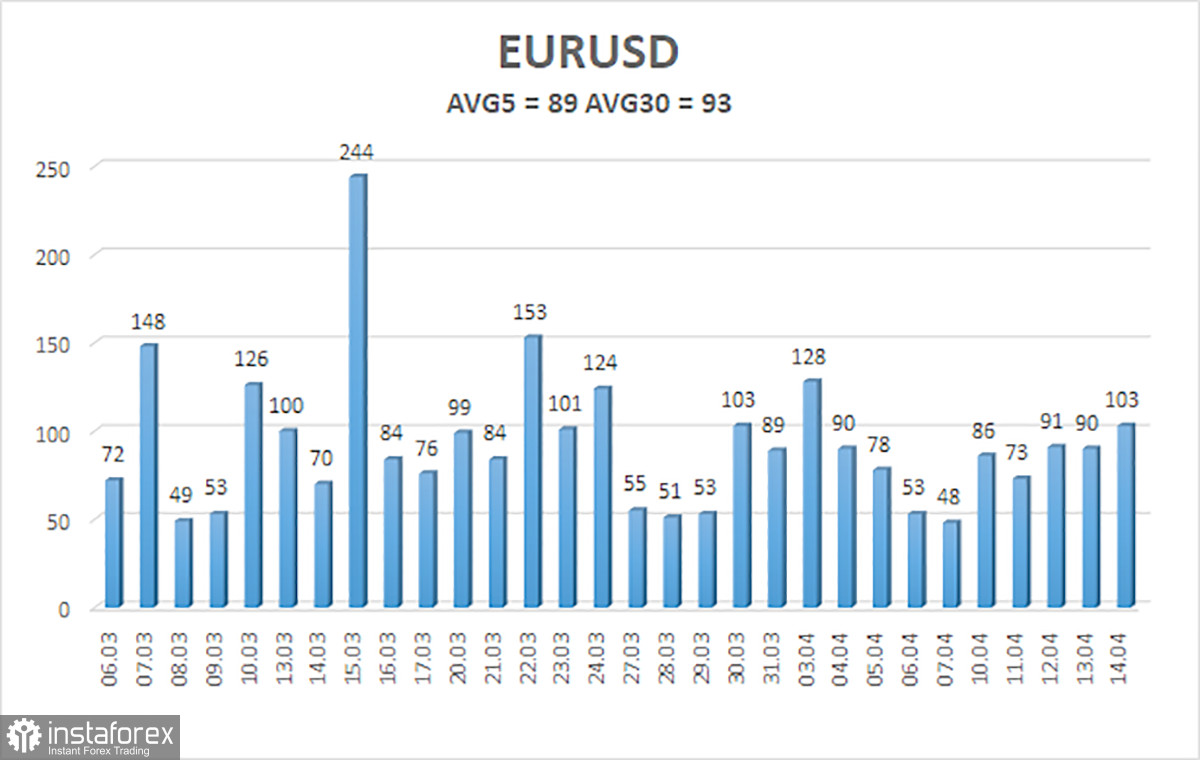

The average volatility of the euro/dollar currency pair over the last five trading days as of April 16th is 89 points and is characterized as "average." Thus, we expect the pair to move between levels 1.0903 and 1.1081 on Monday. The reversal of the Heiken Ashi indicator back up will indicate the resumption of the upward movement.

Nearest support levels:

S1 - 1.0986

S2 - 1.0925

S3 - 1.0865

Nearest resistance levels:

R1 - 1.1047

R2 - 1.1108

R3 - 1.1230

Trading recommendations:

The EUR/USD pair has begun the long-awaited correction. New long positions can be considered with targets of 1.1081 and 1.1108 if the Heiken Ashi indicator is reversed upward or there is a price bounce from the moving average. Short positions can be opened after the price consolidates below the moving average with targets of 1.0903 and 1.0864, but cautiously.

Explanations for illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term tendency and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.