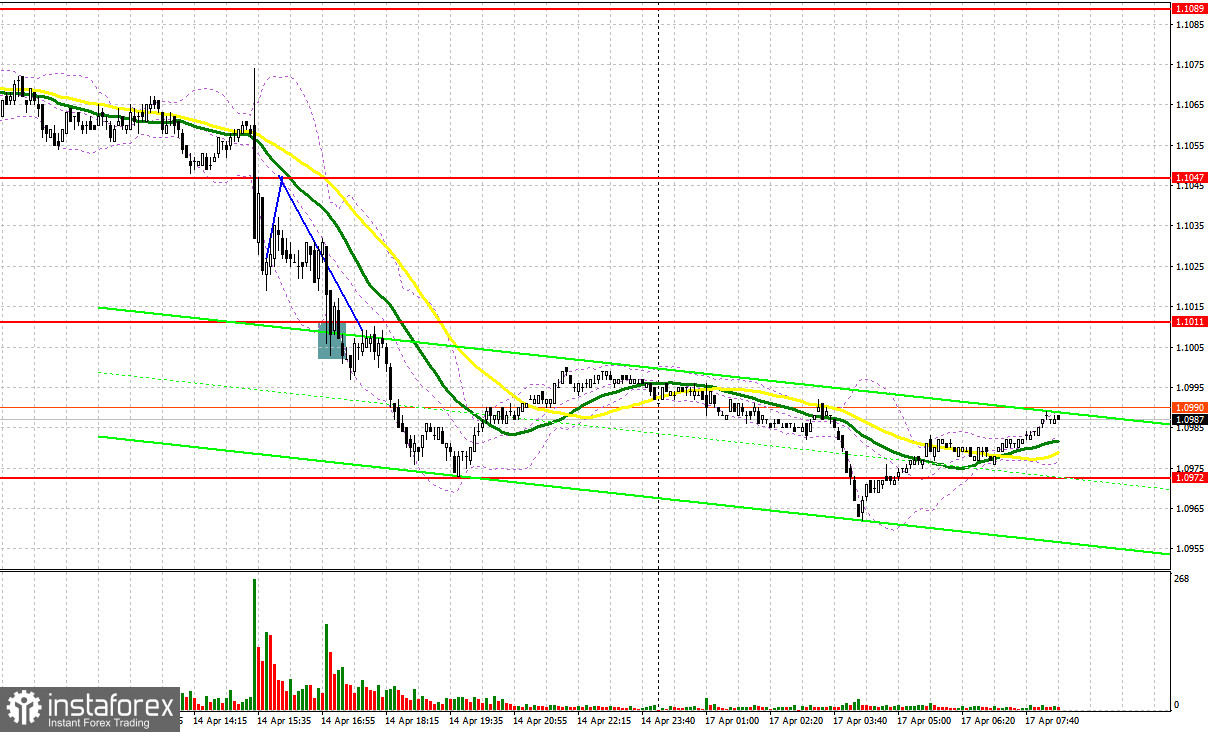

Last Friday, only one market entry signal was formed. Let's have a look at the 5-minute chart and see what happened there. In my morning forecast, I mentioned the level of 1.1047 and recommended making market entry decisions based on this level. Considering low market volatility ahead of important US data, the pair did not reach the nearest levels, so I couldn't find any entry points in the first half of the day. After a significant drop in the pair in the second half of the day, which occurred without a reverse test of 1.1047, only a false breakout at 1.1011 formed a buy signal. Unfortunately, it brought me losses.

To open long positions on EUR/USD:

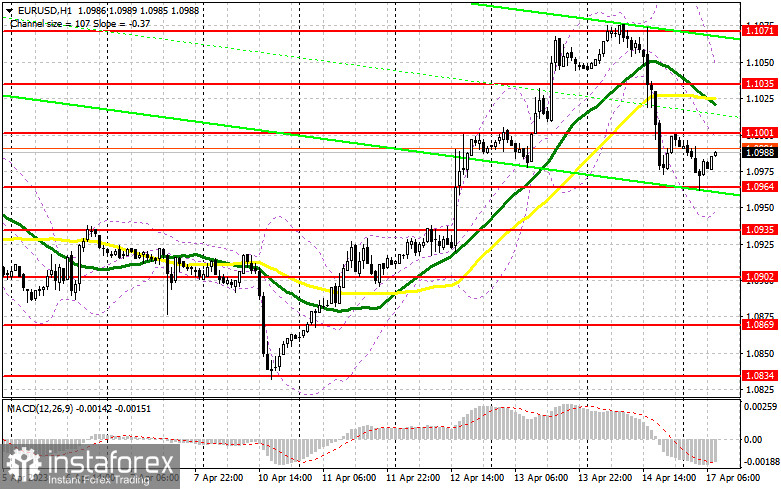

Although the US retail sales report disappointed traders, it did not lead to a significant drop in the dollar. A closer look at the reading shows that, excluding energy sales, the indicator fell by only 0.3% which is not too bad. Considering that other fundamental reports were better than economists' expectations and that the euro was overbought, we saw a good downward correction in the euro which may continue today. For this reason, bulls need to assert strength around 1.0964, but without fundamental data which is absent today, this will be hard to achieve. The statements by European policymakers may somehow influence the pair's trajectory and strengthen the euro, but this is also doubtful. Today, markets await speeches from ECB representative Elizabeth McCaul, Bundesbank President Joachim Nagel, and ECB President Christine Lagarde. If pressure returns to the euro in the first half of the day, it is best to trade on a decline around the nearest support of 1.0964. The formation of a false breakout at this level will lead to a buy signal and growth to the nearest resistance of 1.1001. A breakthrough and a top-down test of this range will strengthen buyers' confidence, returning the upward trend and forming an additional entry point for adding long positions with the target at 1.1035. Slightly below this level, moving averages are playing on the bears' side. The highest target is seen at the area of 1.1071 where I will take profit. In the case of a decline in EUR/USD and the absence of buyers at 1.0964, which could happen already in the first half of the day, pressure on the euro will increase, and we will see a new downward movement towards 1.0935. Only the formation of a false breakout there will provide a buy signal for the euro. I will open long positions immediately on a rebound from a low of 1.0902, keeping in mind an upward correction of 30-35 pips within the day.

To open short positions on EUR/USD:

Sellers have performed a good downward correction, and to continue this trend, they need to defend the nearest resistance at 1.1001, which was formed last Friday. There is no doubt that bears will show themselves there, but whether they can defend this range is still a question. Therefore, only the formation of a false breakout at 1.1001 may lead to a decline in the pair towards the nearest support at 1.0964, which was formed in the Asian trading session. This level is crucial in the short-term perspective as its breakout and a retest will increase pressure, leading to a continuation of the downward correction and pushing EUR/USD towards 1.0935. Consolidation below this range will pave the way to 1.0902 where I recommend taking profit. In the case of an upward movement in EUR/USD during the European session and the absence of bears at 1.1001, which is more likely, especially in such a bullish market, I recommend waiting until the pair reaches the level of 1.1035. Going short at this level will be possible only after failed consolidation. I will open short positions immediately on a rebound from a high of 1.1071, bearing in mind a downward correction of 30-35 pips.

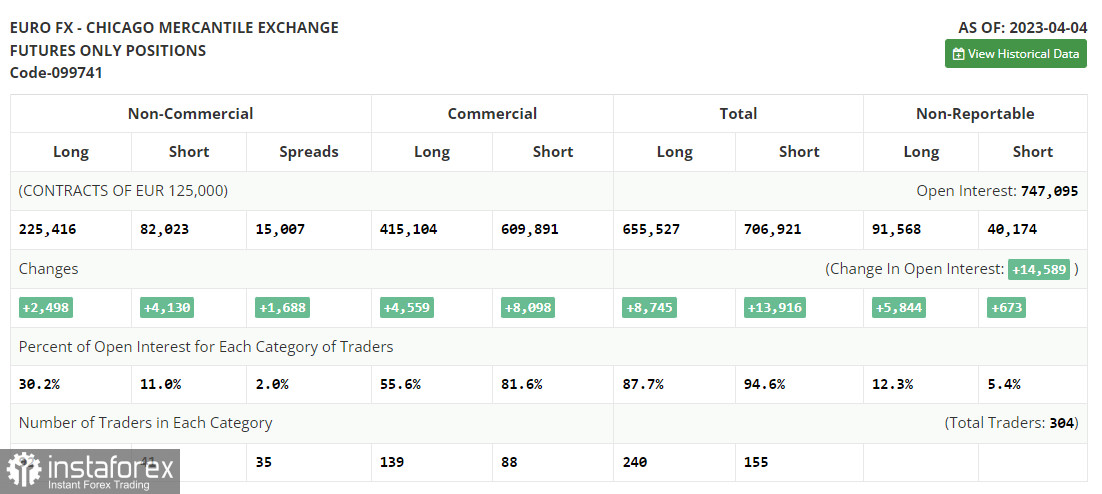

COT report

The COT report for April 4th recorded a rise in both long and short positions. Considering that nothing particularly interesting happened last week, and the jobs data met market expectations, buyers of risk assets, including the euro, will be waiting for a crucial batch of inflation and retail sales data in the US for March. The minutes of the Federal Reserve's March meeting will also be in the focus of traders. If it suggests a need for further interest rate hikes, the US dollar may recover some of its recent losses. However, if the incoming data suggests that the Fed could ease its monetary policy, the euro is likely to rise further. The COT report shows that long positions of the non-commercial group of traders increased by 2,498 to 225,416, while short positions jumped by 4,130 to 82,023. As a result, the total non-commercial net position fell to 143,393 from 145,025. The weekly closing price increased to 1.1 against 1.0896.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a further fall in the euro.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the pair declines, the lower band of the indicator at 1.0945 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.