EUR/USD

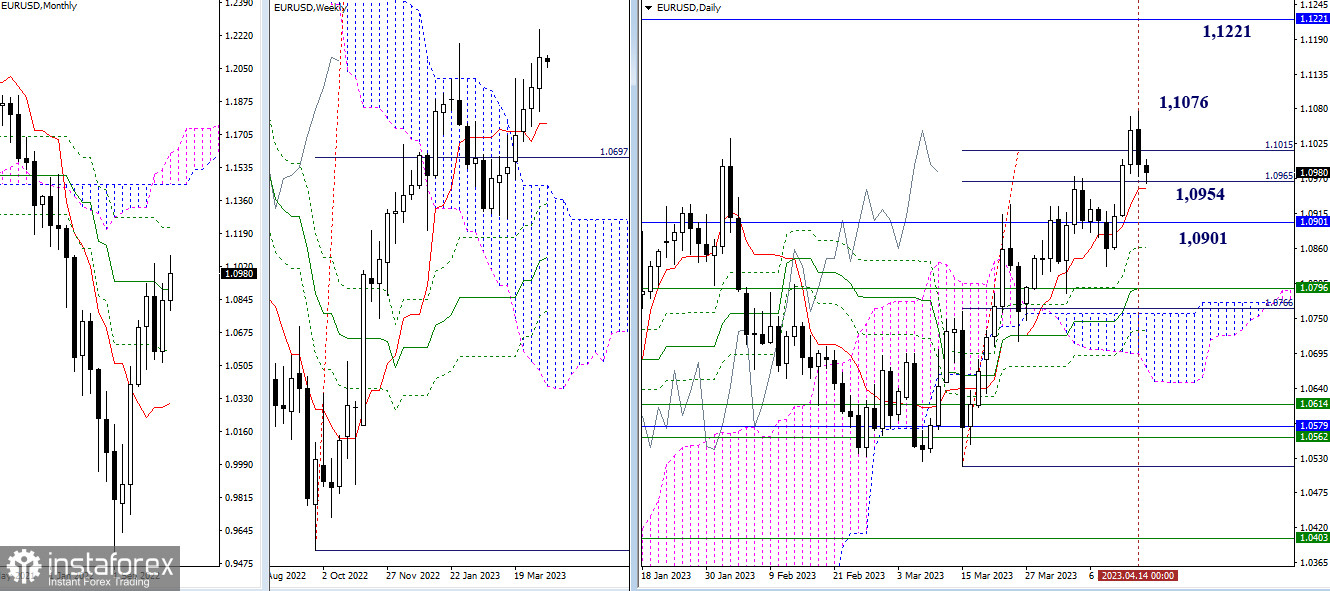

Larger Timeframes

Last week, the euro buyers managed to notch the daily target and push the price above the February high at 1.1033. If the high of last week (1.1076) is updated and the rise continues, the bulls' attention will now be focused on the next target, a one-month resistance at 1.1221. Importantly, the sellers displayed significant activity on the last day of the trading week. As a result, the upper shadow of the weekly candle turned out to be quite long. Therefore, if the bearish sentiment continues to strengthen now, the sellers will primarily return to the supports of the daily short-term trend (1.0954) and the monthly medium-term trend (1.0901).

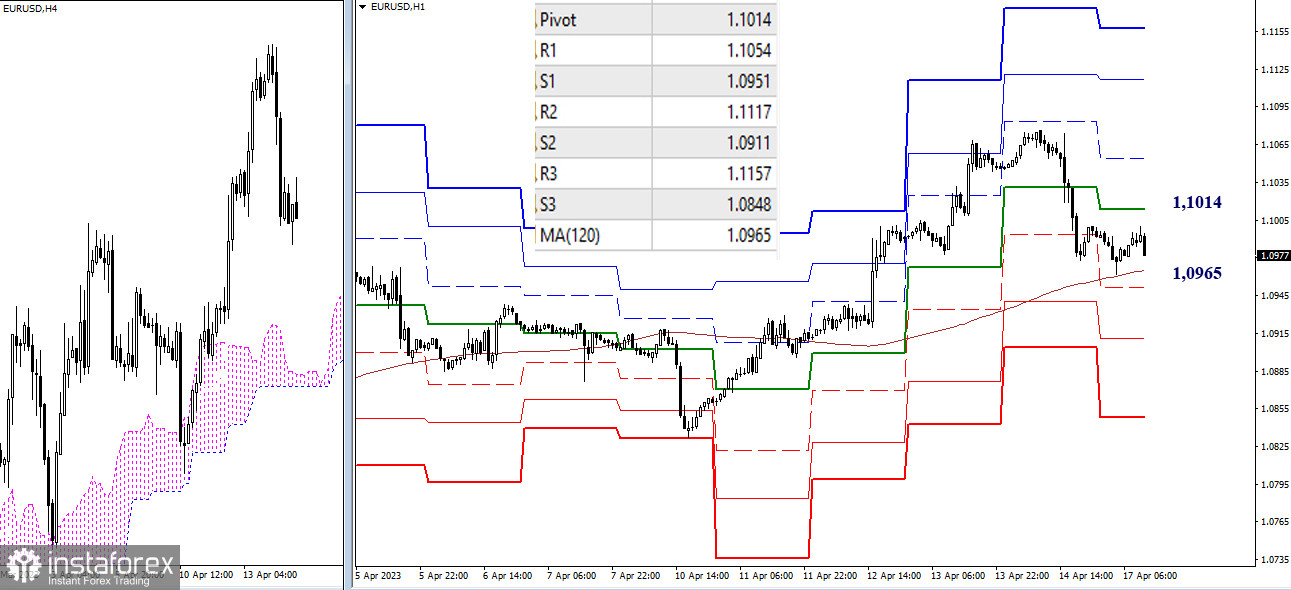

H4 – H1

The corrective decline on smaller timeframes has currently enabled the pair to test the key level, which is the support of the weekly long-term trend (1.0965). Breaking this level and reversing it will change the balance of trading interests on smaller timeframes, so more traders will be poised to sell GBP/USD. The next bearish intraday targets will be the supports of the classic Pivot levels, located today at 1.0951 – 1.0911 – 1.0848. If the price remains above the weekly long-term trend and can bounce off it, the buyers will be able to regain their positions will by passing resistances at 1.1014 – 1.1054 – 1.1117 – 1.1157 (classic Pivot levels).

***

GBP/USD

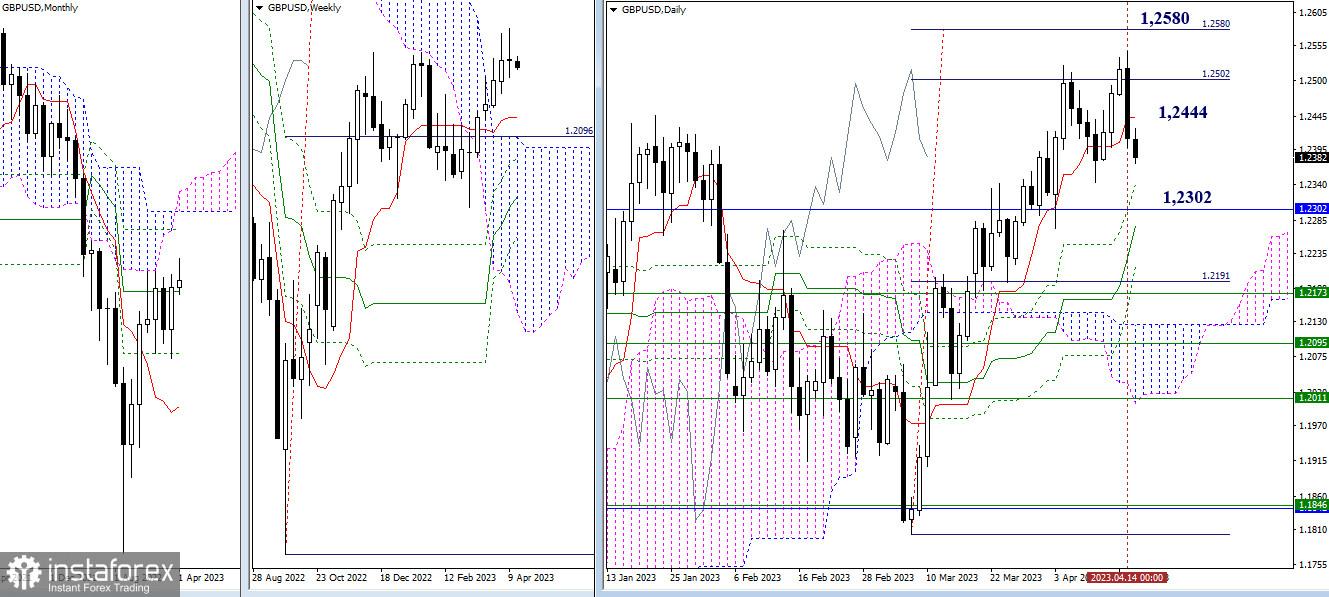

Larger timeframes

By the end of the week, the buyers lost all their gains and returned to the opening levels of the week. As a result, the manner of trading revealed uncertainty in market sentiment. This price action was recorded at the top of the market after the ascending movement of the past few weeks. We can assume that the buyers decided to take a break, and bearish sentiment may now gain fresh impetus. The bullish targets remain at 1.2580 (100% completion of the daily target) and 1.2761 (one-month Fibo Kijun level). In case of a downward movement, the focus will be on passing the monthly medium-term trend (1.2302), liquidating the daily Ichimoku cross whose levels are currently located at 1.2340 – 1.2277 – 1.2214, and subsequently finding support for the weekly short-term trend (1.2173).

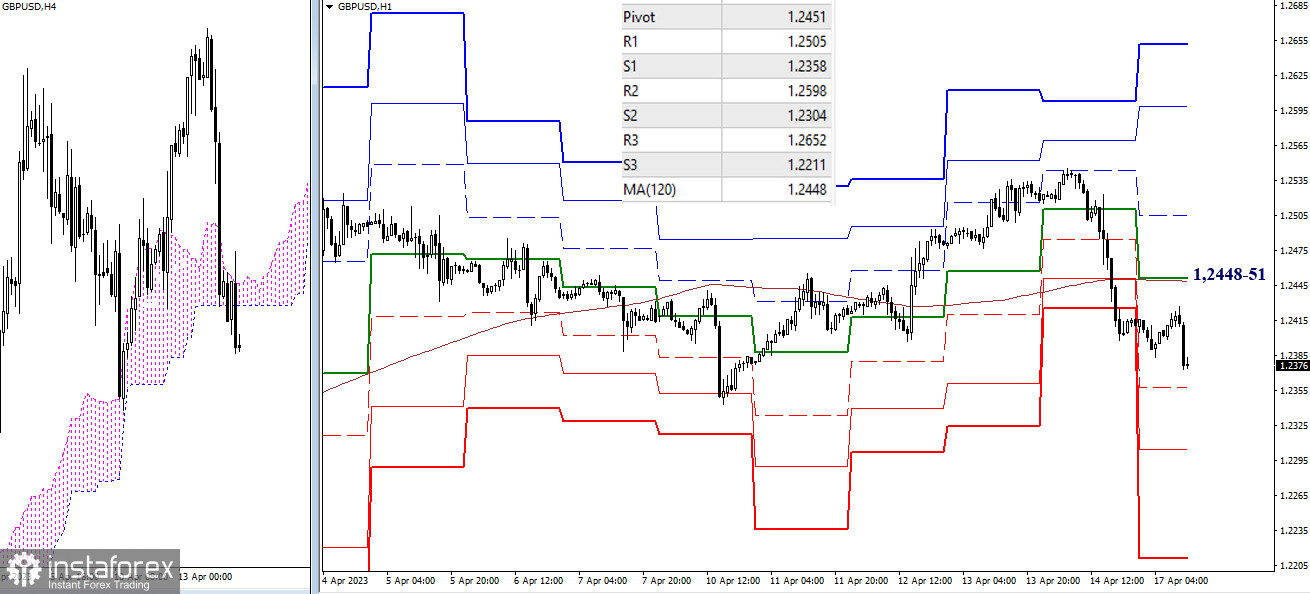

H4 – H1

On smaller timeframes, the sellers have declined below the key levels, thereby gaining the main advantage. If the down move continues, the support levels of the classic Pivot levels (1.2358 – 1.2304 – 1.2211) may be relevant intraday. However, if the buyers manage to regain the key levels, which today have combined their efforts around 1.2448-51 (weekly long-term trend + central Pivot level of the day), the balance of trading interests will change again. In this case, the resistances of the classic Pivot levels (1.2505 – 1.2598 – 1.2652) will become higher upward targets as we reckon the reinforcement of the bullish sentiment.

***

This technical analysis is based on the following ideas:

Larger timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Smaller timeframes - H1 – classic pivot points + 120-period Moving Average (weekly long-term trend line)