AUD/USD continues to trade in a bearish market, and investor uncertainty and lack of confidence are weighing on commodity currency quotes, particularly the Australian dollar.

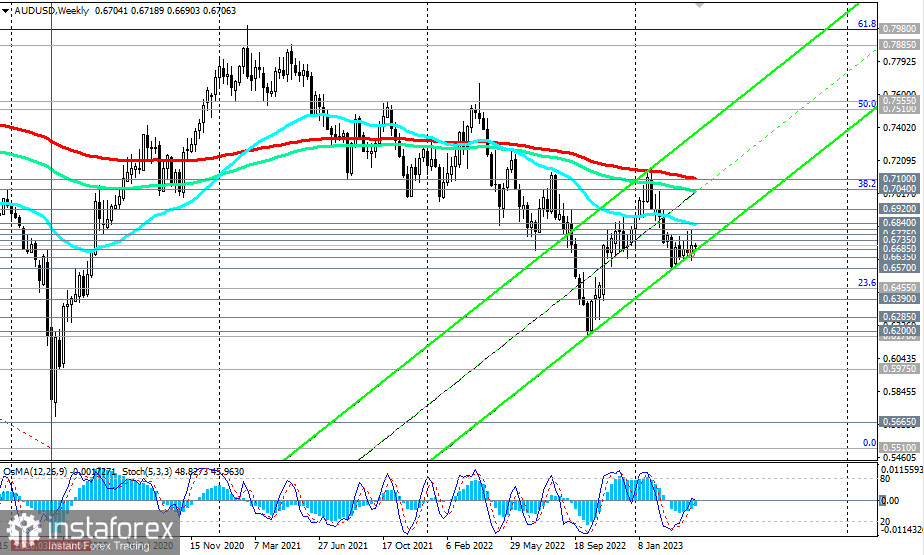

As of writing, AUD/USD was trading near the 0.6706 mark, at an important short-term support level (200 EMA on the 1-hour chart). Breaking through this level and breaking the local support level 0.6685 would signal a resumption of short positions on the pair with the nearest target at the local support level 0.6635. Breaking through the local support level 0.6570 will finally revive bearish sentiment on AUD/USD.

In an alternative scenario, breaking through the 0.6735 resistance level (50 EMA on the daily chart) may trigger further growth in AUD/USD towards the key resistance level 0.6805 (200 EMA on the daily chart). Meanwhile, breaking through the resistance at 0.6840 (50 EMA on the weekly chart) could open the way towards key resistance levels 0.7040 (144 EMA on the weekly chart), 0.7100 (200 EMA on the weekly chart), separating the long-term bull market from the bear market.

Support levels: 0.6700, 0.6685, 0.6635, 0.6600, 0.6570, 0.6500, 0.6455, 0.6390, 0.6285, 0.6200, 0.6170

Resistance levels: 0.6735, 0.6775, 0.6805, 0.6840, 0.6900, 0.6920, 0.7040, 0.7110