The USD/CAD pair is trading in the red at 1.3470 at the time of writing and it seems very heavy. The Dollar Index's massive drop forced the USD to depreciate versus its rivals. The currency pair signaled exhausted buyers, so a downward movement is in the cards.

Fundamentally, the greenback took a hit from the Final GDP, Pending Home Sales, and Final GDP Price Index data. Today, the economic figures should be decisive. The Canadian GDP may report a 0.1% growth versus the 0.2% drop in the previous reporting period.

On the other hand, the US Revised UoM Consumer Sentiment could remain steady at 67.7, Chicago PMI may drop from 48.7 points to 47.5 points, while Core PCE Price Index could report a 0.2% growth again. The US is to release the Goods Trade Balance, Personal Income, Personal Spending, and Prelim Wholesale Inventories data as well. Poor US figures could punish the USD.

USD/CAD Trading In Red!

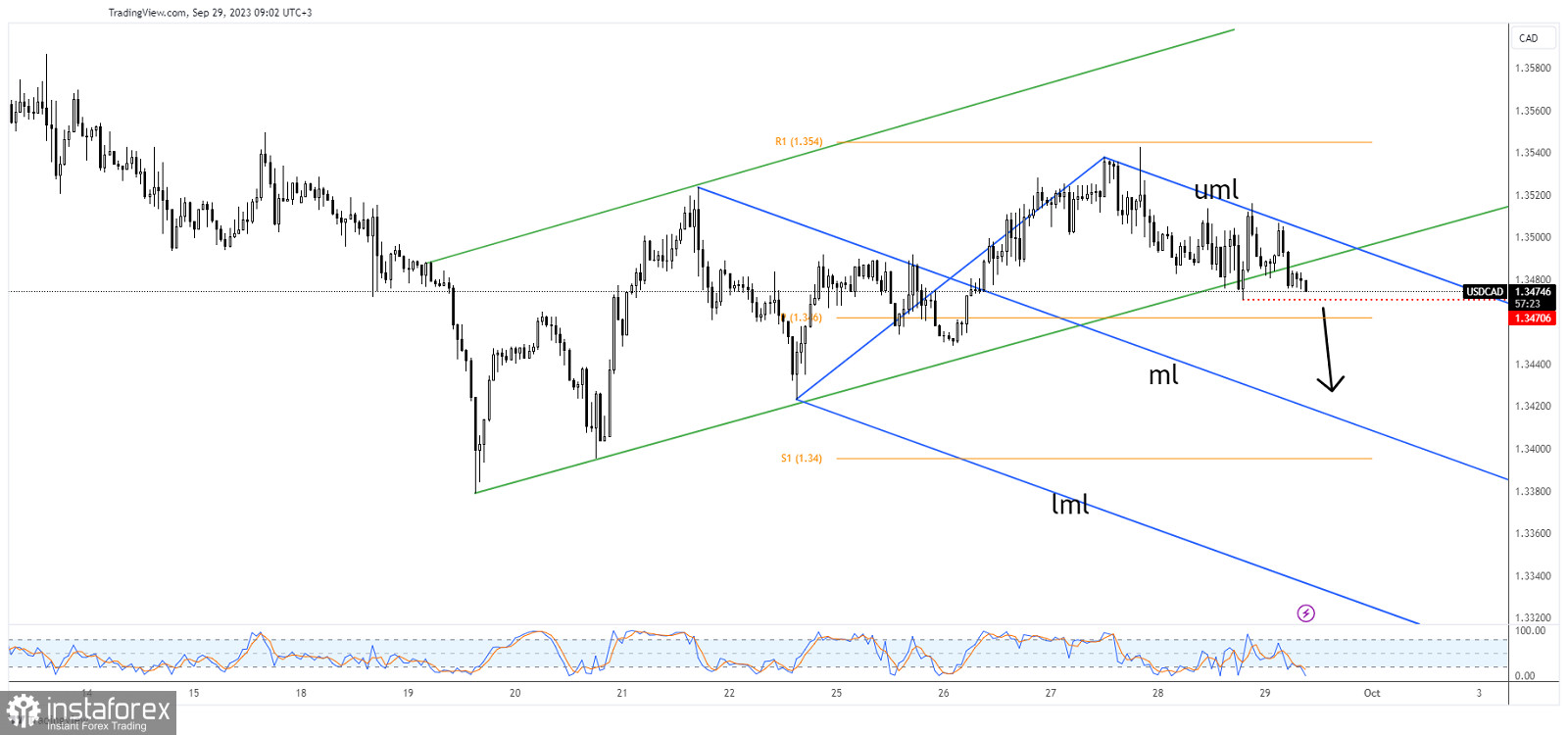

As you can see on the H1 chart, the rate increased within an up channel. Its failure to reach and retest the channel's upside line signaled exhausted buyers.

Staying near the uptrend line announced a potential breakdown and a deeper drop. Personally, I've drawn a descending pitchfork, hoping that I'll catch a downward movement. The rate tested and retested the upper median line (uml), registering only false breakouts.

USD/CAD Forecast!

Dropping and closing below 1.3470 and below the weekly pivot point of 1.3460 activates more declines. This is seen as a bearish signal.