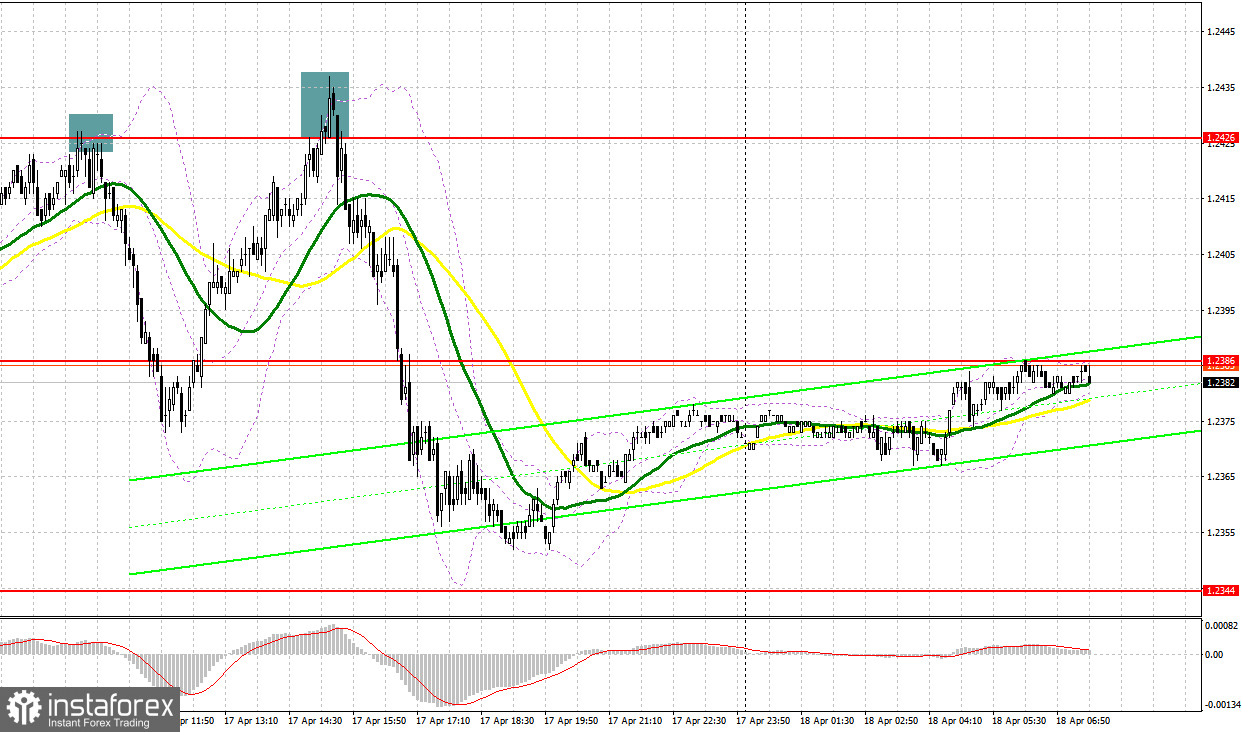

Yesterday, several strong signals to enter the market were generated. Let's take a look at the 5-minute chart and figure out what happened. In my morning forecast, I drew attention to the level of 1.2426 and recommended making decisions to enter the market from it. A rise followed by a false breakout at 1.2426 created a strong sell signal, which allowed the pound sterling to fall by more than 50 pips. In the second half of the day, after another unsuccessful attempt by bulls to break above 1.2426, another sell signal was generated. As a result, the pair dipped by more than 70 pips.

To go long on GBP/USD:

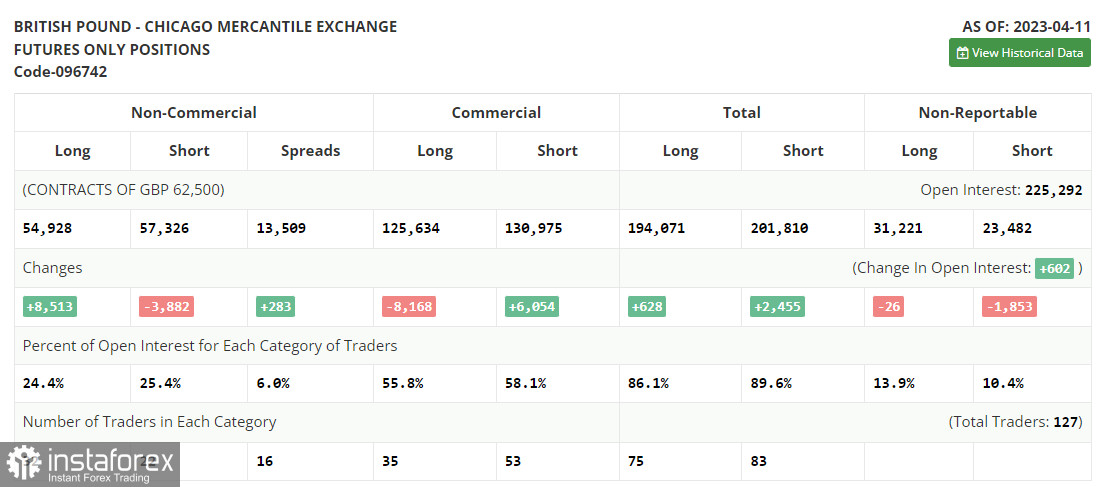

Before getting into technical analysis, let's see what happened in the futures market. The COT report (Commitment of Traders) for April 11th recorded an increase in long positions and a decrease in short ones. UK GDP growth data was rather upbeat, so demand for the pound sterling persisted despite the pair's downward correction, which had been long overdue. Considering that the Fed's aggressive policy is coming to an end, and the Bank of England has no choice but to continue raising interest rates to fight double-digit inflation, the British pound is expected to continue gaining value. A correction will be a good reason to go long. The latest COT report states that short non-commercial positions decreased by 3,882 to 57,326, while long positions of the non-commercial group of traders jumped by 8,513 to 54,928. This led to a sharp decline in the negative delta of the non-commercial net position to -2,398 compared to -14,793 a week earlier. The indicator has been falling for the third week in a row, which also confirms that market sentiment is bullish. The weekly closing price dropped to 1.2440 against 1.2519.

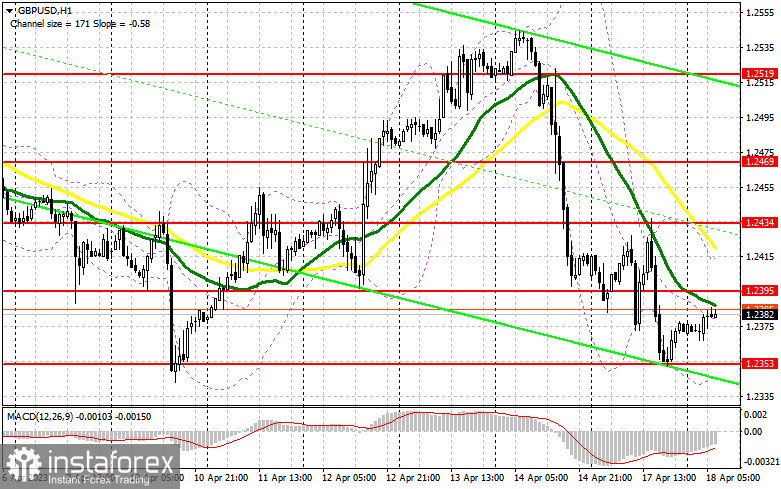

Today's data on the UK labor market will be decisive in the first half of the day. The number of people claiming for unemployment benefits in the UK is estimated to have increased in March, while UK median earnings are expected to decrease. If data turns out to be even worse than economists' forecasts, the British pound will come under pressure again. In this case, buyers will have every chance to take the lead around the nearest support level of 1.2553 formed on April 7th after a similar correction earlier in the month. A false breakout at this mark will make it possible to buy the pair. Thus, the pound sterling will most likely reach 1.2395. Its breakout and a top-down test will create an additional buy signal, allowing the pair to advance to 1.2434. In this scenario, buyers will be able to regain control of the market. If the price rises above this level, it will probably head toward 1.2469, where I recommend locking in profits. Alternatively, in the event of a decline and bulls' subdued activity at 1.2353, pressure on the pound sterling will persist. In this case, traders are recommended to hold off long positions until the price reaches 1.2310. Going long at this level will be relevant only amid a false breakout. Long positions on a rebound can be opened at 1.2275 with a view to catching an intraday correction of 30-35 pips.

To go short on GBP/USD:

Given that the price hit a new low at the beginning of the week, bears are in control of the market. In the first half of the day, bulls will most likely try to break above the resistance level of 1.2395. Only a false breakout at this level following the release of labor market statistics will create a sell signal. In this case, one can count on a decline to the nearest support level of 1.2353. Its breakout and bottom-to-top test will make it possible to sell the pair, trying to drag the price below the low of 1.2310. The next target will be 1.2275, where I recommend locking in profits. In the event of a rise and bears' subdued trading activity at 1.2395, the market is expected to stabilize. Thus, bears will lose control of the market. In this case, only a false breakout at the resistance level of 1.2434 will form an entry point for short positions, and the British pound will slide. If there is no trading activity in this area, it would be a wise decision to sell GBP/USD at 1.2469 in the hope of an intraday decline of 30-35 pips.

Indicators' signals:

Moving averages

Trading is carried out below the 30 and 50 daily moving averages, which indicates a downtrend.

Note: The period and prices of moving averages are considered by the author on the H1 chart and differ from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD gains value, the indicator's upper boundary at 1.2410 will act as resistance. In case of a decline, the indicator's lower boundary at 1.2350 will serve as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.