After the rapid rally of Brent, traders seem to be ready to be cautious, but the gaping hole of 2 million barrels per day between supply and demand does not give them peace of mind. The IEA warns of its emergence by the third quarter. In this case, the gap, which oil producers are unable or unwilling to fill, will lead to higher prices and accelerate inflation, which is bad news for consumers and the global economy. However, charity begins at home.

The IMF estimates that Saudi Arabia's economy will not lose anything from the additional 1.1 million bpd announced by OPEC+. On the contrary, budget revenues will grow amid higher oil prices. Riyadh receives preferences due to Western sanctions against the Russian Federation: it not only stores Russian oil but also buys it for the purpose of further resale. Thus, Moscow's oil supplies to Saudi Arabia are estimated at 100,000 barrels per day, although there were none before the armed conflict in Ukraine.

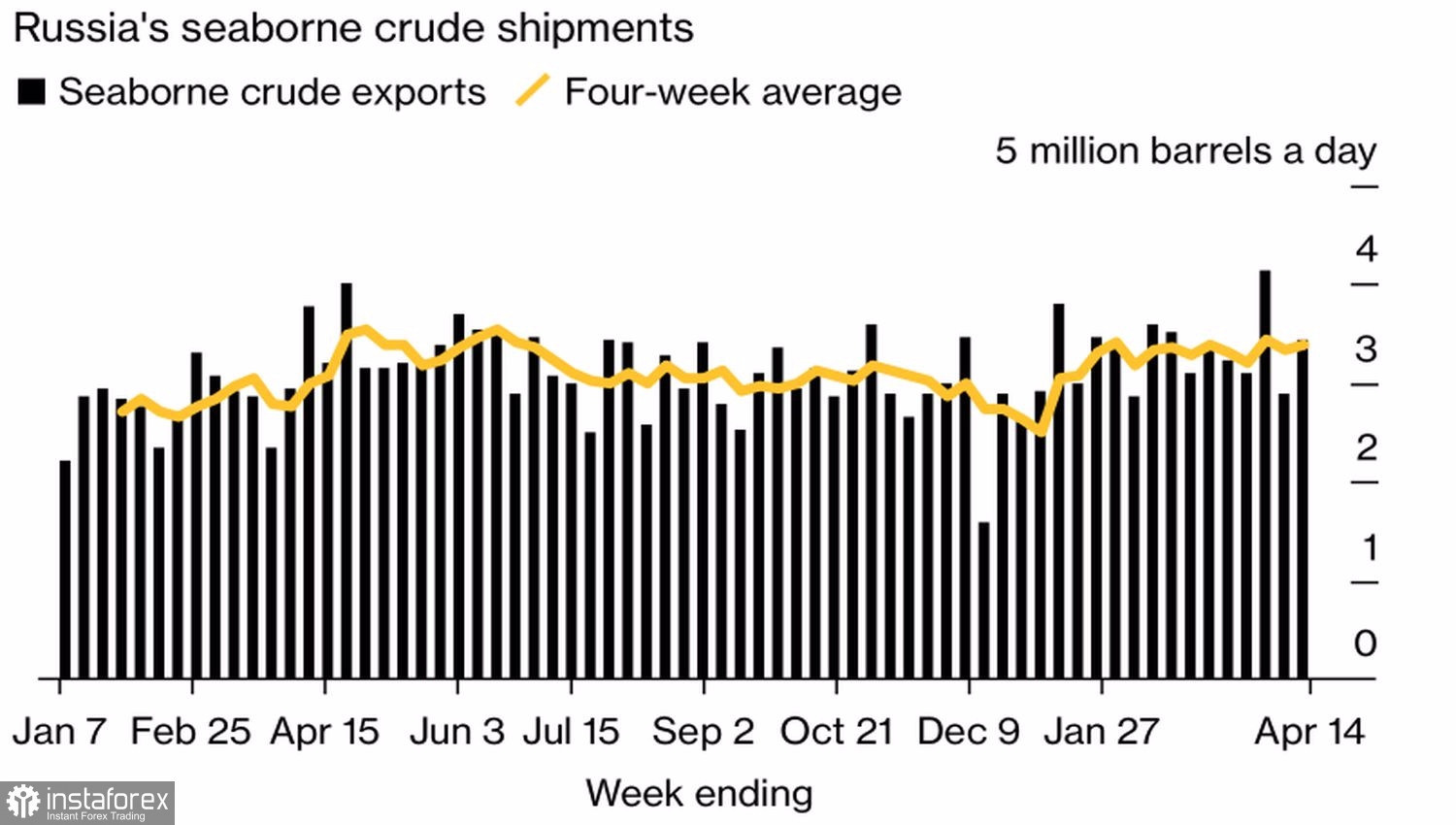

As for Russia, there are certain doubts about its statement on reducing production by 500,000 bpd. Oil export by sea has increased by 540,000 bpd and again exceeds 3 million bpd.

Dynamics of offshore deliveries of Russian oil

The increase in the deficit in the world oil market is due not only to the intention of OPEC+ to reduce production volumes. Brent is supported by growing demand. According to the latest Wall Street Journal survey, the likelihood of a recession in the U.S. economy in the next 12 months is still 61%. Everyone has long forgotten about the recession in the eurozone, and China is beginning to please the eye. Its GDP expanded by 4.5% in the first quarter, beating the Bloomberg consensus estimate of 4%. Even if the figure falls short of the government's +5% target, the economy will likely continue to accelerate throughout the rest of the year, thanks in part to additional stimulus.

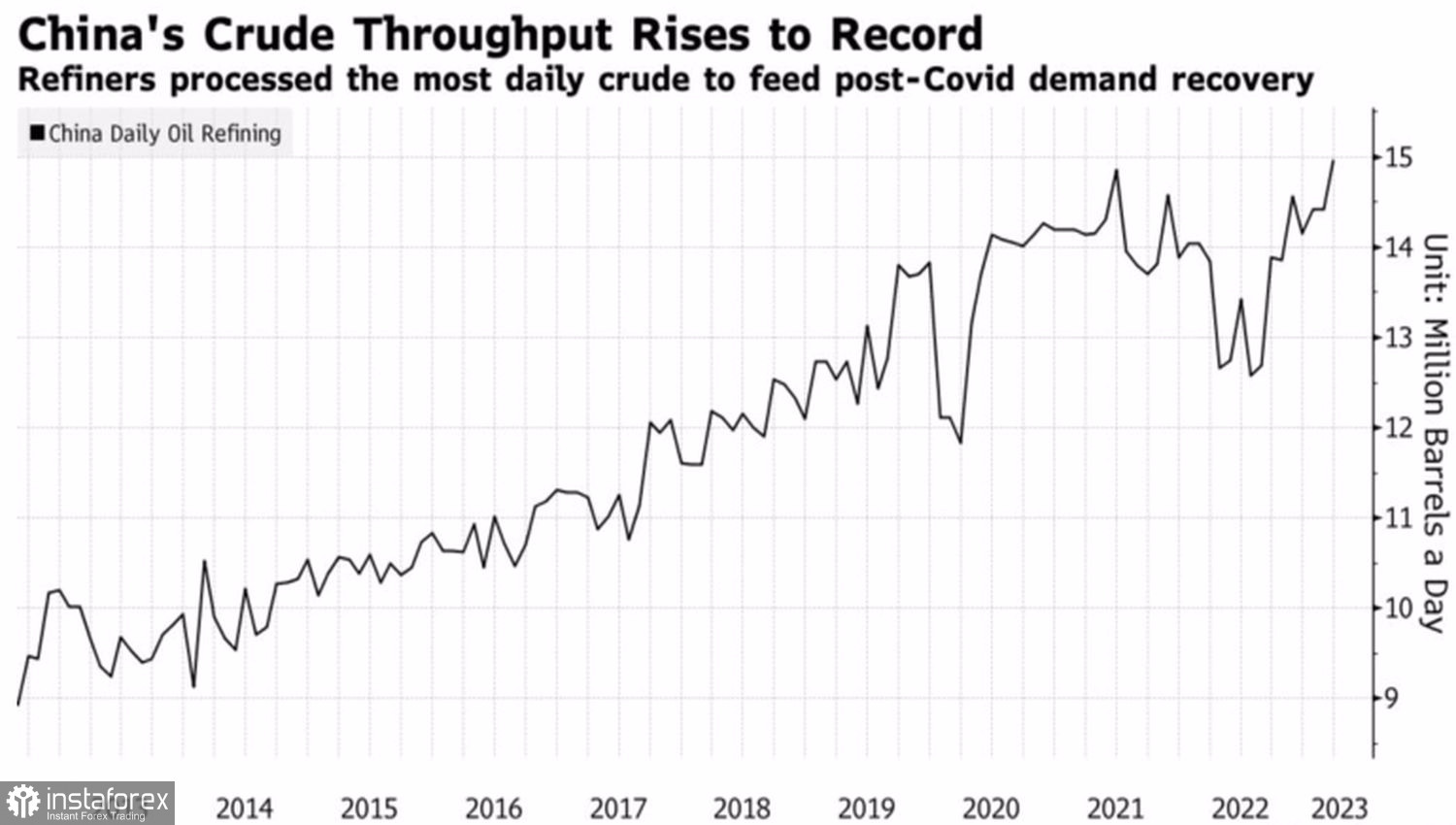

For oil, the record growth in oil refining by Chinese refineries is important, which indicates increased demand. In March, the figure reached 63.29 million tons, which is 8.8% more than a year ago. We are talking about 14.97 million bpd, the highest figure for March in the history of observations.

Dynamics of oil refining by Chinese refineries

The upward trend in refining is likely to continue, as May is the peak month for travels in China, and as it approaches, refinery activity will increase.

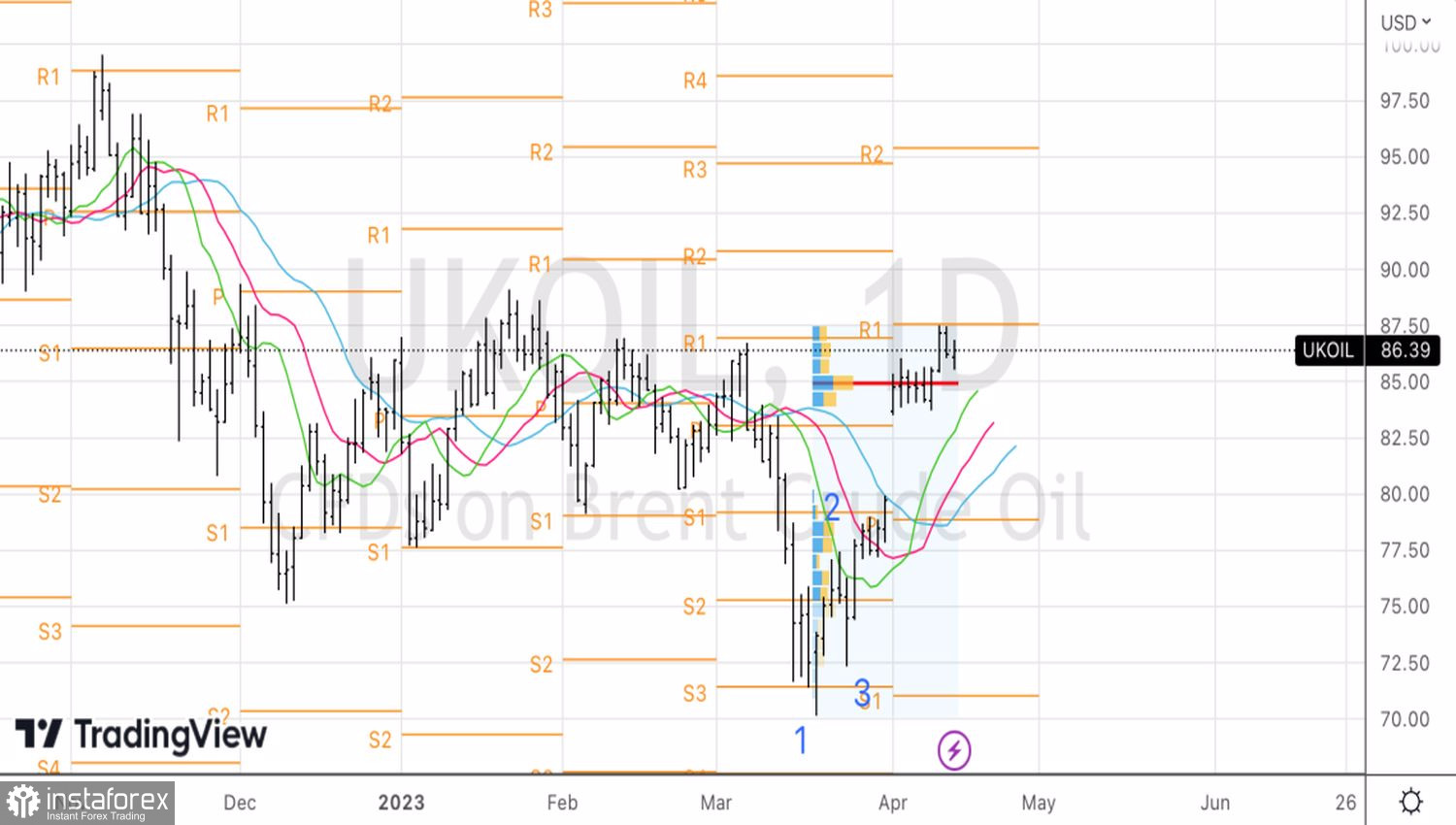

Thus, the medium-term "bullish" prospects for Brent due to the gap in demand and supply are not in doubt, but in the short term, a strong U.S. dollar creates an obstacle for oil on its way up. The increase in the probability of a 25 bps rate hike on federal funds rate to 5.25% in May to 86% and the reduction in the risks of the Fed's "dovish" reversal in 2023 allow the USD index to raise its head after a prolonged collapse.

Technically, the Brent rally continues, and the targets for longs at $90 and $95 per barrel remain in force. Buying oil on a rebound from supports at $85 and $83.75, as well as on breaking resistance at $87.5, is relevant.