Dollar rose at the end of Monday's trading, continuing to hold above 101.00 on the ICE index. At the same time, stock markets show moderate optimism, demonstrating an upward trend.

The reason why dollar surged yesterday is the possibility of at least one more rate hike from the Fed, most likely at the upcoming meeting in May. Forecast assumes an 85.2% chance of seeing a 0.25% to 5.25% increase, which will prevent dollar from resuming a large-scale decline.

The Fed meeting will take place on May 3, during which a noticeable decline will be seen. However, it will be followed by an increase, which will stimulate a sideways trend.

The upcoming comments from Fed representatives are also likely to be interesting as they may insist that rates should continue to increase despite the economic slowdown. Such statements will be decisive as to what the market sentiment will be.

Meanwhile, the rally in stock markets can be explained by the growing hopes that the Chinese economy may become the locomotive of the world, even if the US plunges into recession and supports the demand for risky assets. Strong GDP data due out today also fueled risk appetite not only in the Asia-Pacific region, but also in Europe and the US.

In a nutshell, it is the uncertainty over interest rates that is holding dollar back from both falling and rising against other major currencies. In the meantime, demand for stocks and commodity assets may stimulate a local rally, thanks to strong data from China.

Forecasts for today:

AUD/USD

The pair rose above 0.6730 due to the latest RBA minutes, which revealed a high probability of rate hikes at the next meeting. Positive GDP data from China also contributed to its growth. Staying above the level may lead to a further price increase to 0.6800.

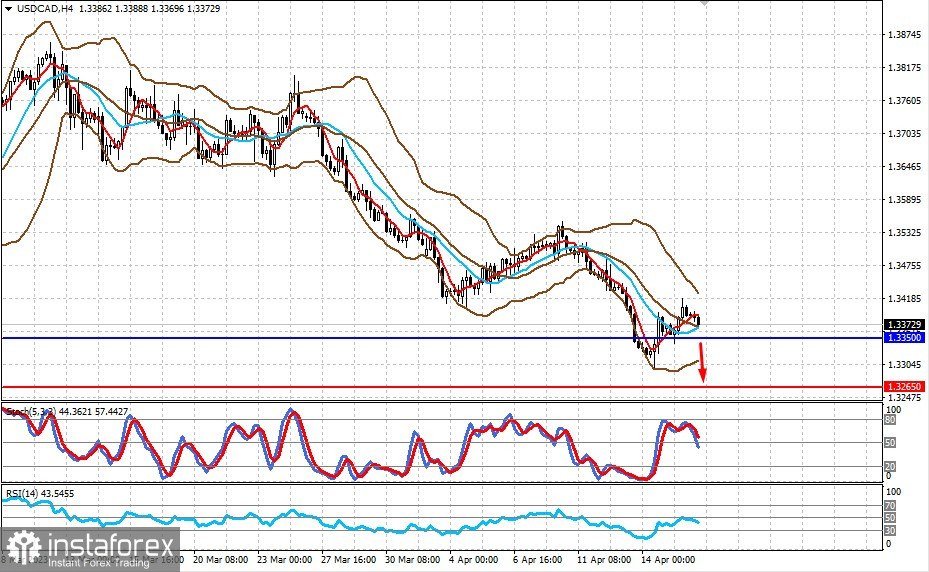

USD/CAD

The pair is trading above 1.3350. A further rise in oil prices and a decline below the level may prompt a fall towards 1.3265.