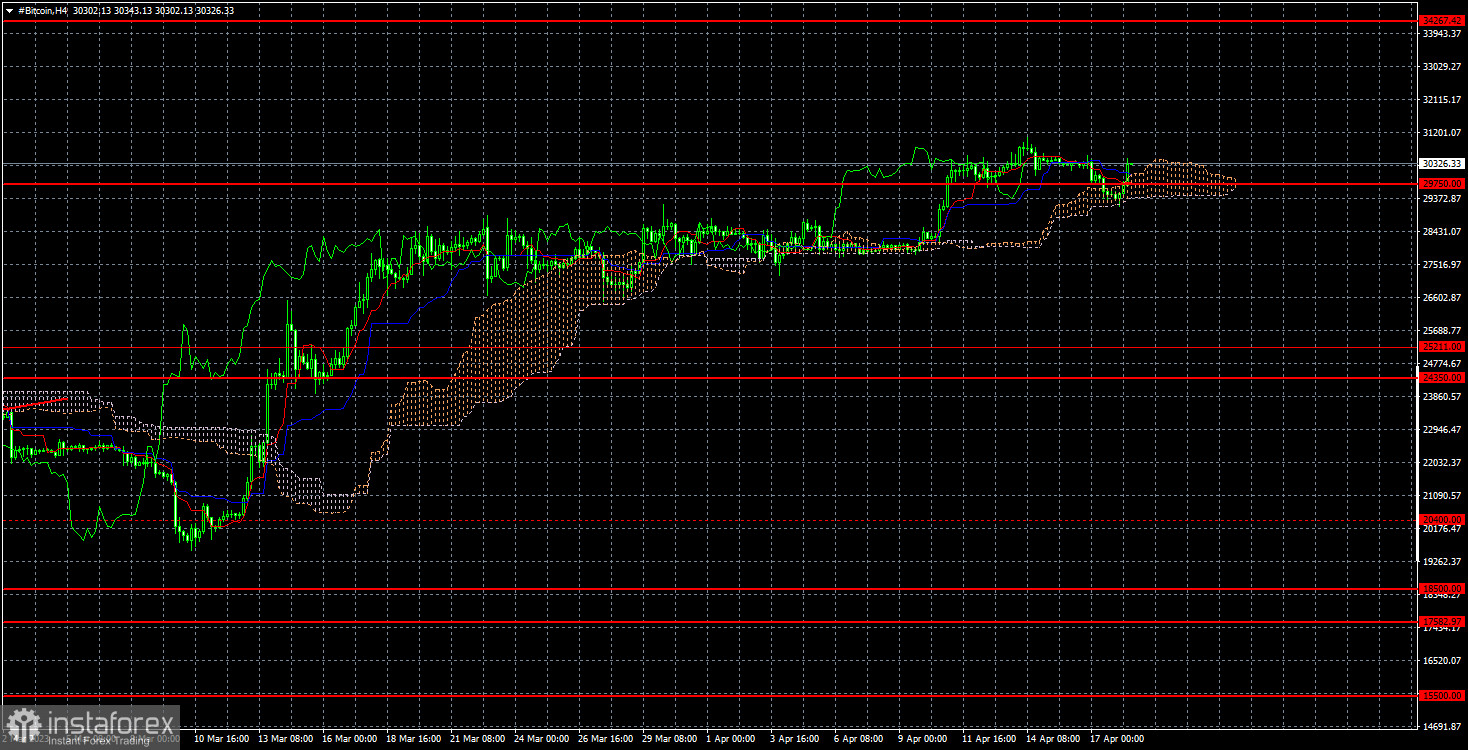

On the 4-hour TF, it is visible that Bitcoin attempted to start a downward correction but failed to properly overcome neither the $29,750 level nor the Senkou Span B line. These two supports did not allow the bears to take the initiative. Bitcoin can stay within the flat line or start a new growth phase. The flat will continue since the cryptocurrency has been moving this way for the past year: a few weeks/months of flat followed by a strong jump up or down. Since Bitcoin has come out of the previous flat, but no upward jump has occurred, we think the flat will continue above the $29,750 level.

At the same time, the best-selling author of "Rich Dad, Poor Dad," Robert Kiyosaki, took the microphone. As a reminder, Mr. Kiyosaki is among the biggest fans of gold, silver, and bitcoin. Over the past year, he has repeatedly predicted a global financial crisis and urged everyone to buy Bitcoin and precious metals. Last week, he again stated that a global economic crisis is inevitable, and he is increasing his capital in Bitcoin and gold. He also said that he does not trust the Fed or Joe Biden, calling them "liars" and accusing them of killing fiat money and trust in the banking system. Kiyosaki also noted that Bitcoin has grown by 100% over the past year, which allows us to conclude that the "crypto winter" has ended. The more difficult the situation in the global economy (and, in particular, in the American one) becomes, the higher Bitcoin will rise.

Meanwhile, lending volumes in the US are falling rapidly. On the one hand, this is good for inflation as it will continue to slow down. On the other hand, new shocks in the banking system are possible, as loans are reducing banks' profits. Due to the collapse of three large banks a month ago, deposit outflows from the banking system exceeded $100 billion. And deposit outflow means that banks' liquidity is decreasing, and they need something to issue new loans with. No loan issuance means less profit. The Fed promises to continue raising rates and hold them high for a long time. This is bad for the banking system, as loans will continue to get more expensive (lowering demand for them), and deposits will bring in more significant returns (which is disadvantageous for banks). The more intense the situation becomes, the stronger the outflow from banks will be. And the withdrawn money will be partially directed to the cryptocurrency market.

On the 4-hour timeframe, the cryptocurrency Bitcoin continues to move upwards, and we advised buying when the $25,211 level was surpassed. Thus, one can now stay in long positions with a target of $34,267. Sales on the "bullish" trend are irrelevant, but with a clear consolidation below $29,750, small shorts can be opened with a target of $2-3,000 lower.