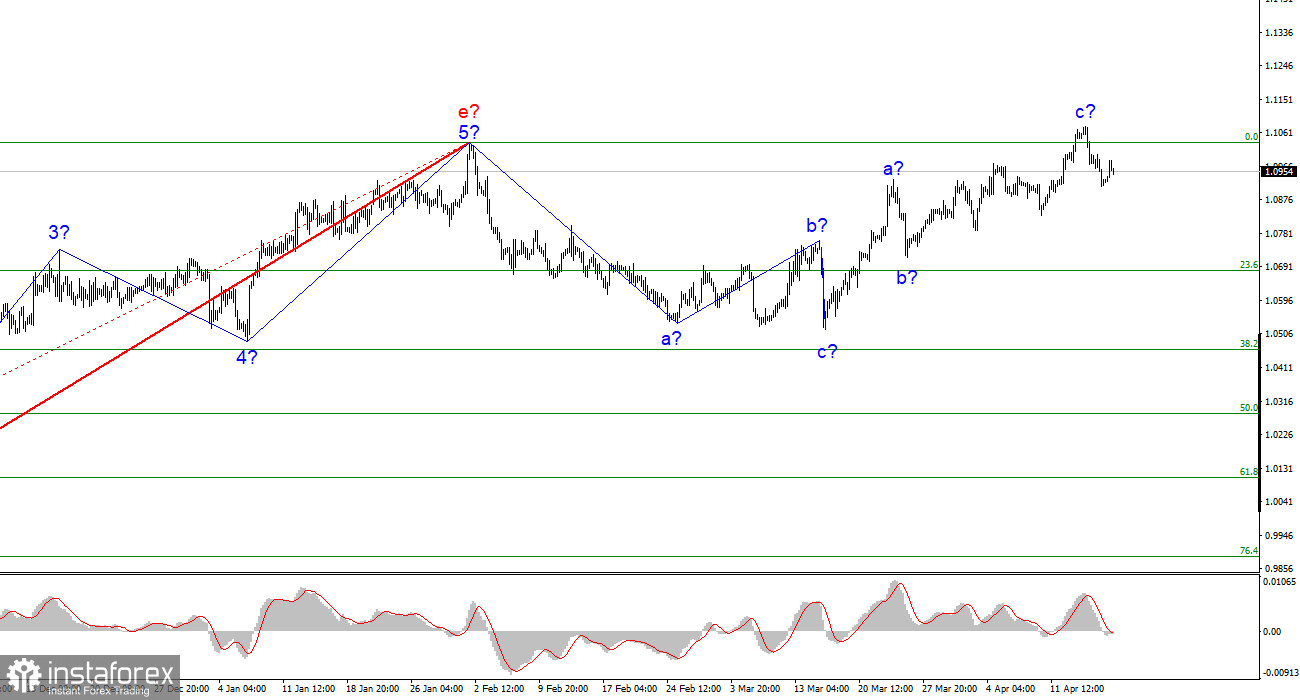

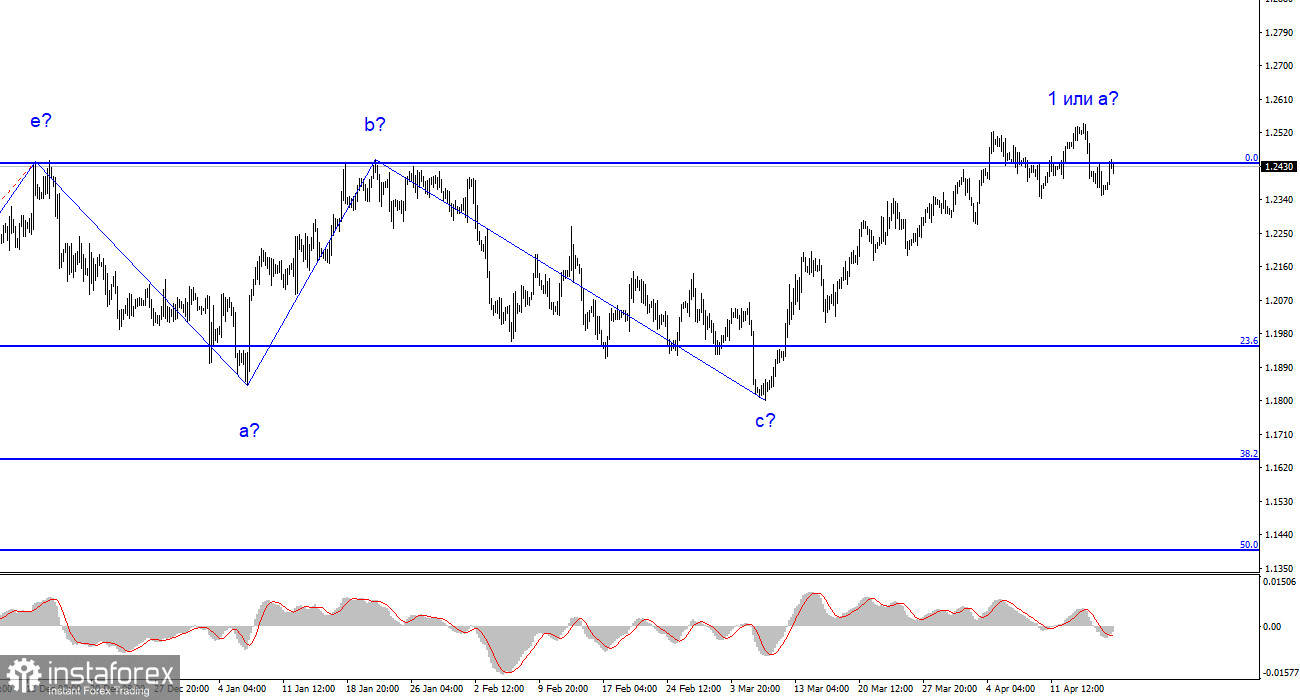

Both pairs are gradually and unhurriedly unfolding downward. The European currency has completed a three-wave upward movement. In contrast, the pound has completed the formation of the first ascending wave as part of a new three-wave upward movement. Thus, if the wave pattern continues to resemble each other, it is expected to build three waves down for the euro and one, but extended, for the pound. In any case, the euro and the pound will move similarly.

The background news this week still needs to be present. Christine Lagarde did not make any important statements on Monday, and British reports on Tuesday did not interest the market. Therefore, we should turn to more distant information. Recently, analysts have stopped panicking about a recession in the United States, as economic indicators reach a sufficiently high level every month. This primarily concerns GDP, inflation, nonfarm payrolls, and unemployment. These are the most important current indicators, and they do not give reason to believe that the US economy is slowing down or is close to a recession. In the European Union and the United Kingdom, GDP indicators have been around 0% for several quarters. That's where a recession should be expected, but ECB and Bank of England members also claim that a recession can be avoided.

On Friday, Chicago Fed President Austan Goolsbee said a soft recession in the United States is still possible. He believes that financial tightening has the same effect as raising interest rates. He refused to comment on what decision he plans to make at the May meeting, stating that it is necessary to wait for the next inflation, GDP, and labor market reports. He noted the good pace of inflation reduction, but according to him, some types of inflation need to catch up to the main indicator. The producer price index and retail sales are declining, which will positively impact overall price growth. Goolsbee also warned against paying too much attention to wages, which are not a "leading indicator of inflation." "The Fed needs to monitor prices for various categories of goods, trying to respond and control everything, not just wage growth," believes the Chicago Fed President. He also noted that credit conditions have tightened, and a detailed analysis of how they can affect the economy and inflation is required. There is a risk that the pressure on the economy will be too strong, which will cause a small recession. However, the Fed is doing everything possible to prevent this. Goolsbee's speech shows it is too early to worry about the American economy. Inflation is falling at a high rate, and if necessary, the Fed can ease monetary policy earlier than currently expected.

Based on the conducted analysis, the upward trend segment is constructed. Therefore, it is advisable to sell now, as the pair has ample room for decline. The target of 1.0600 can be considered quite realistic. With this goal in mind, I advise selling the pair on MACD indicator reversals "downward" until the quotes successfully attempt to break through the 1.1030 mark, which may not happen.

The wave pattern of the pound/dollar pair implies the formation of a new downward wave. The wave analysis is now ambiguous, as is the news background. I do not see factors supporting the British currency in the long term, and wave b could be very deep. A decline in the pair is more likely now, as all the recent waves have been roughly the same size. It is possible to trade from the 1.2440 mark now, which corresponds to 0.0% Fibonacci. Below it – sell with targets 300-400 points lower; above it – cautiously buy.