Long positions on GBP/USD:

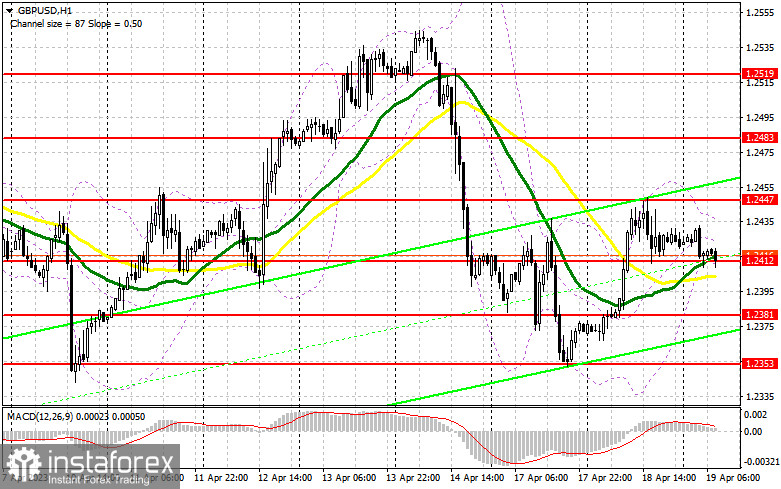

The growth in UK wages will undoubtedly affect UK inflation, which will be the main event today. It is crucial for prices to stop rising and for the annual consumer price index to fall below double-digit levels. If this does not happen, demand for the British pound will strengthen. The core inflation will also be of great importance and should be closely monitored. Bank of England Monetary Policy Committee member Catherine L. Mann's speech and her aggressive position will favor the pound's buyers. If the pair corrects downwards in the first half of the day, a good strength test will be the support test at 1.2412, which may occur after the UK reports are released. A false breakout at this level will provide an entry point into long positions with the prospect of returning to 1.2447. Controlling these levels will be quite an important task, as breaking through and securing above this range will form an additional buying signal with a surge to 1.2483. The next target is 1.2519 but it is unlikely to be reached in the first half of the day. Traders may fix profits at this level. In case of a decline to 1.2412 and no bullish activity, it is better not to rush with purchases. In such a scenario, one may open long positions on a false breakout of the support level of 1.2381. You may also buy GBP on a rebound from the low of 1.2353, allowing an intraday correction of 30-35 pips.

Short positions on GBP/USD:

Bears need to increase their activity in the area of 1.2447, as allowing the price to reach above this level could lead buyers to enter the market in anticipation of compensating for Friday's decline. If bulls fail to break above this level, even against the backdrop of data on a high inflation level along with a false breakout, the downward correction may continue with the prospect of testing 1.2412, where the moving averages are supporting bulls. If the price breaks through and tests this level amid dovish rhetoric from the Bank of England, the pressure on the pound may increase, forming a sell signal with a drop to 1.2381. The next target remains at the low of 1.2353, where traders may lock in profits. If the GBP/USD pair grows and we see a lack of activity at 1.2447, which is also quite likely, it is better to postpone sales until the pair reaches the resistance of 1.2483. Only a false breakout at this level will provide an entry point into short positions. If there is no downward movement there either, one may sell GBP on a rebound from the high of 1.2519, expecting an intraday correction of 30-35 pips.

Signals of indicators:

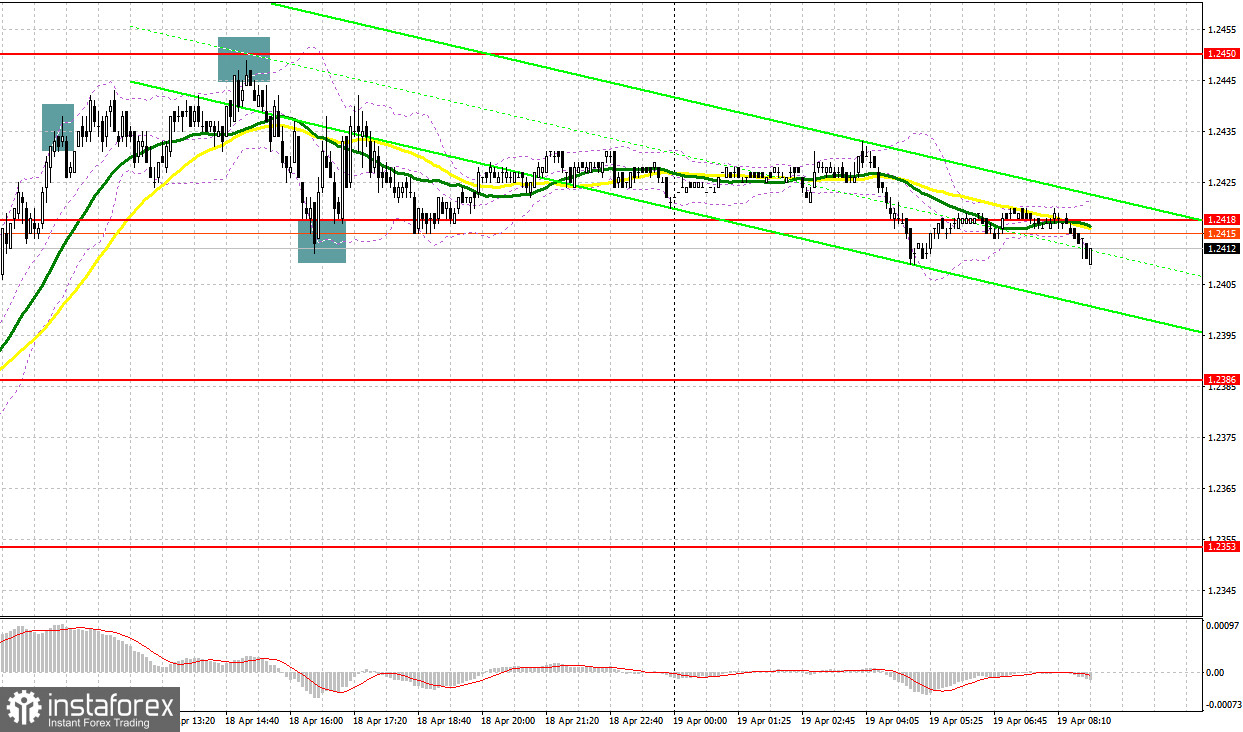

Moving Averages

The pair is trading above the 30- and 50-day moving averages, indicating that bulls are trying to enter the market again.

Note: The moving average period and prices are considered by the author on an hourly H1 chart and differ from the general definition of classical daily moving averages on the daily D1 chart.

Bollinger Bands

If the pair declines, the lower boundary of the indicator near 1.2412 will offer support.

Description of indicators

- Moving average determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20.

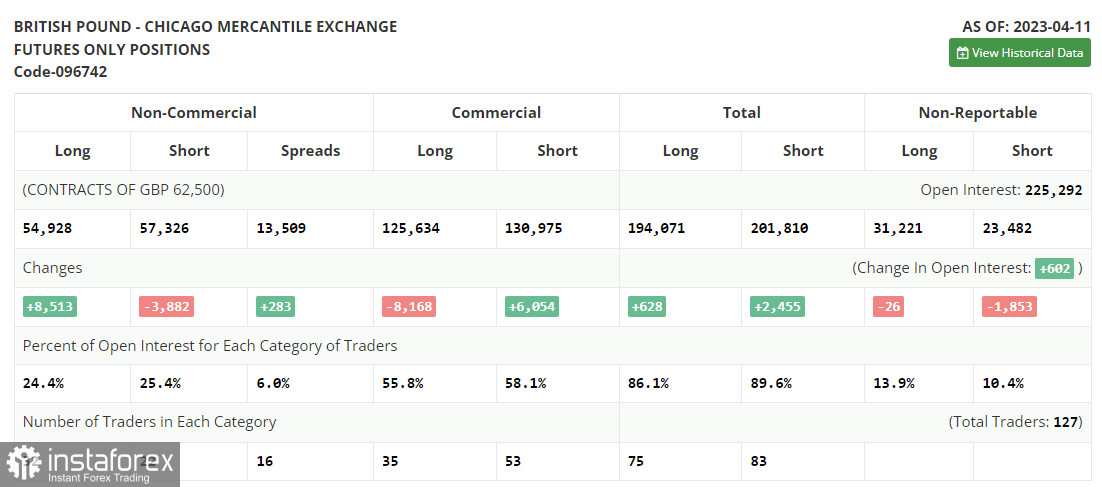

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Non-commercial long positions represent the total long open position of non-commercial traders.

- Non-commercial short positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.