The U.S. dollar, which reigned supreme in 2021-2022, slipped and fell after the Federal Reserve slowed down the process of tightening monetary policy. In April, everyone seemed to be throwing stones at the American currency. It's still good when the end of the monetary restriction cycle, a "dovish" turn, or an imminent recession in the United States are cited as arguments. However, when the status of the dollar as the main reserve currency begins to raise doubts, one cannot help but wonder. Is everything really that bad?

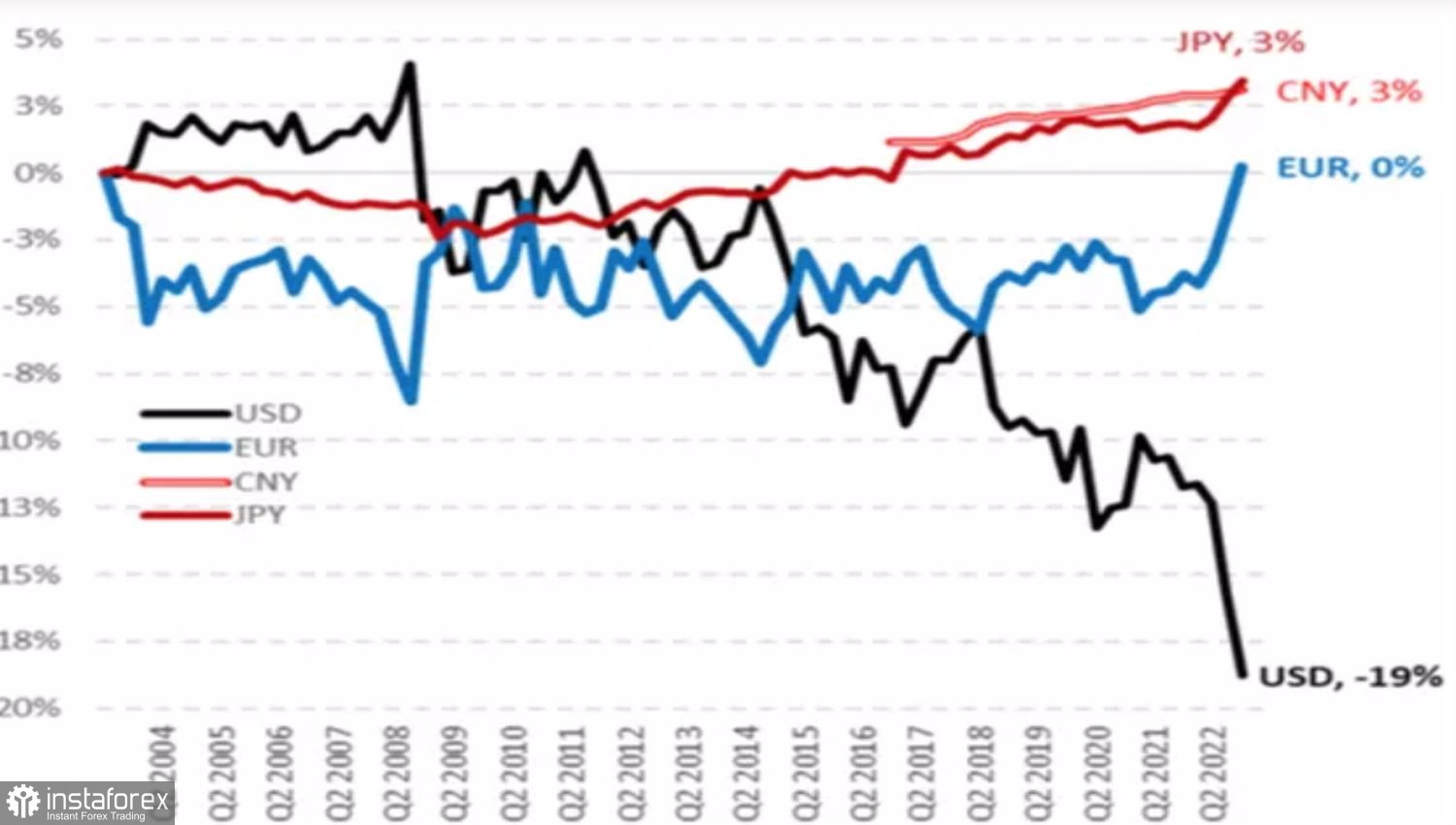

According to a study by Eurizon SLJ, the inflation-adjusted U.S. dollar's share of foreign reserves at central banks has declined from 73% in 2001 to 55% in 2021. In 2022, the figure fell to 47% against the background of the armed conflict in Ukraine and the intention of a number of countries to settle accounts in their own currencies. De-dollarization can provoke a sale of assets denominated in that currency and accelerate the fall of the USD index.

Changes in the structure of central banks' foreign exchange reserves in real terms

In my opinion, despite the credibility of the author of this idea, who came up with the dollar smile theory, it does not stand up to criticism. The current weakening of the U.S. dollar is a direct consequence of the outpacing cycles in the U.S. economy and the Fed's monetary policy. In 2021-2022 the U.S. GDP was expanding steadily and the Fed was aggressively raising rates. In 2023, it was time to pay the price. Cracks in the banking system, a cooling labor market, declining retail sales, and slowing business activity are direct consequences of tighter monetary policy. The USD index will likely continue to decline over the next 9-12 months due to the impending recession. However, in the longer term, the cyclical nature of the economy and monetary policy will play a role. The U.S. dollar will begin to strengthen.

Thus, it does not make sense for central banks to change the structure of foreign exchange reserves. We are talking about long-term investments, and it's hard to think of a better currency than the U.S. dollar.

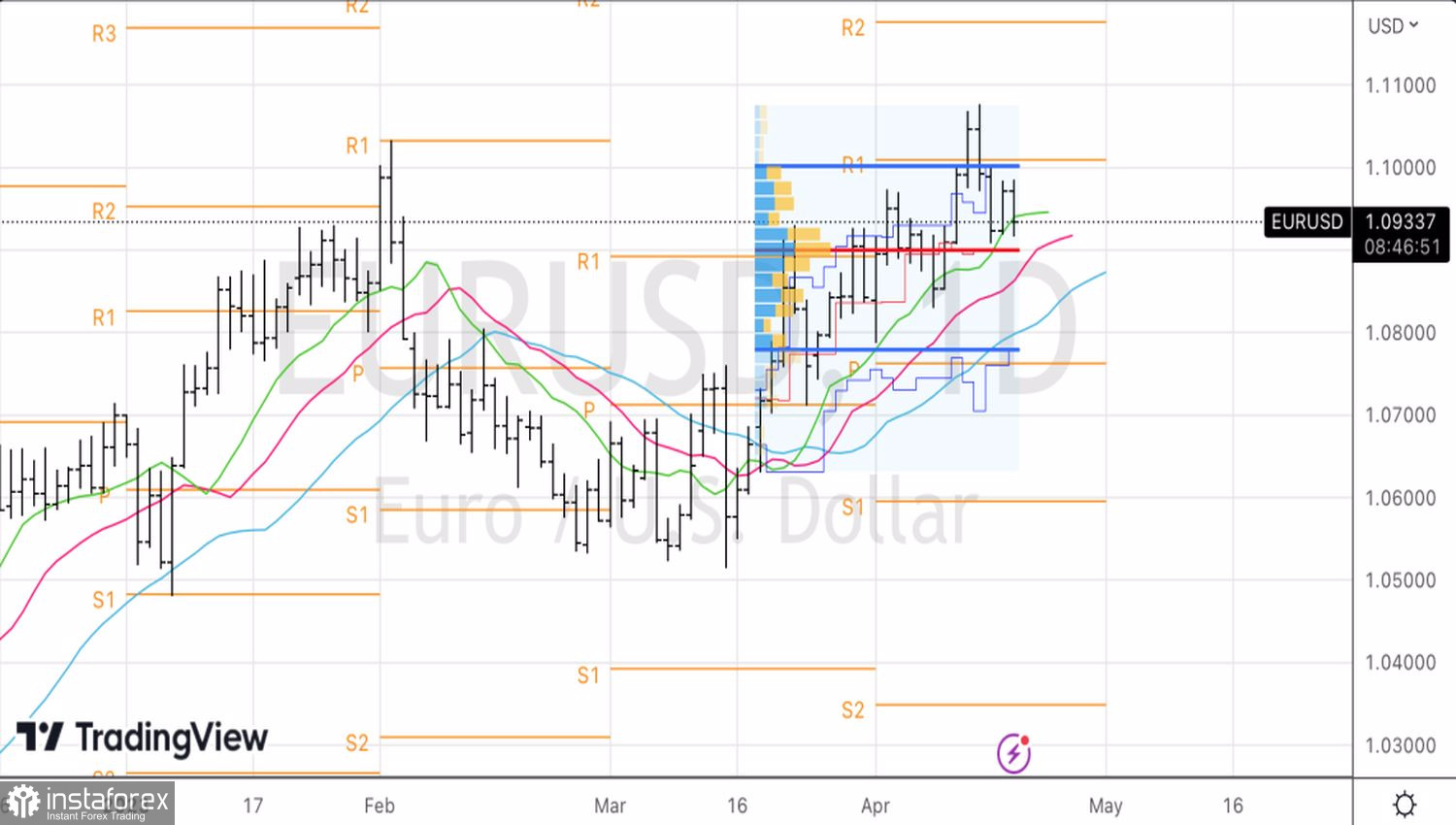

Speaking of medium-term prospects, the slowdown in the U.S. economy and the imminent end of the Fed rate hike cycle paint a bright future for EURUSD. Especially since the ECB intends to raise the deposit rate by another 75 basis points to 3.75% and doubts the size of the step in May. It chooses between 25 and 50 basis points, which also gives optimism to euro fans.

Nevertheless, the risks of keeping the federal funds rate at 5.25% through the end of 2023 amid elevated inflation and an unwilling slide into recession are underestimated. And the return of fears about it is holding back the rally in the main currency pair.

Technically, the inability of the EURUSD bulls to win back the inside bar was the first sign of their weakness. If the market does not go in the direction where it is expected to go, it is more likely to go in the opposite direction. In this regard, breaking the lower border of the inside bar near 1.092 is a reason for short-term sales.