Bitcoin has been in a consolidation phase for several weeks, which subsequently led to the formation of a "wedge" pattern. Just before the publication of deflationary reports, the cryptocurrency broke out of this range and reached the level of $30k.

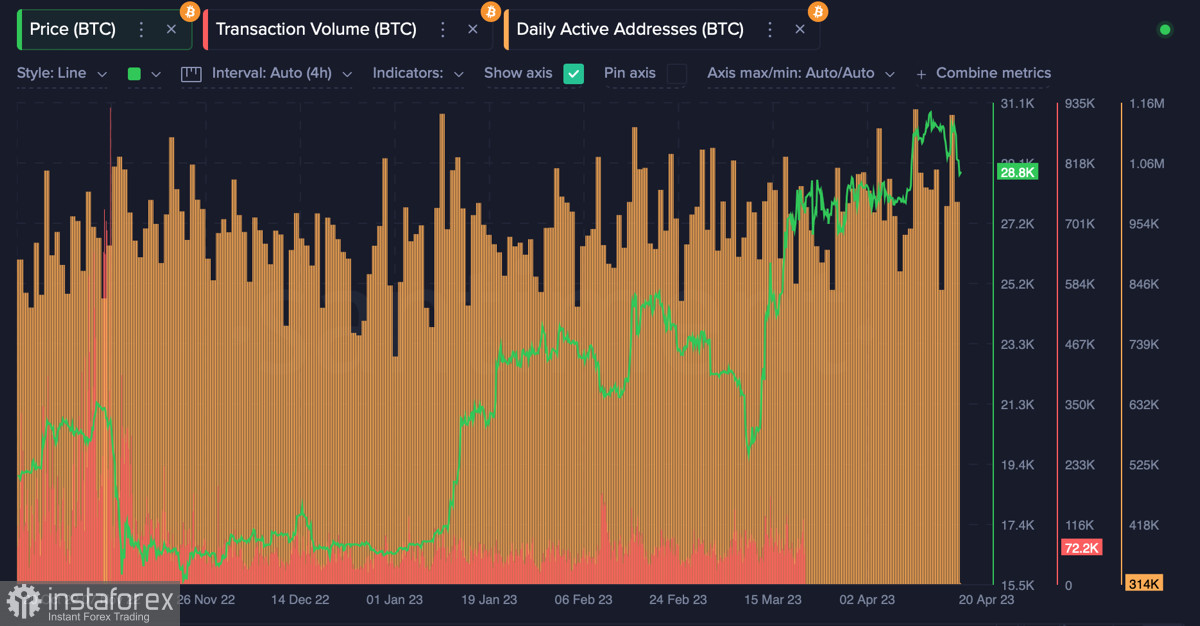

This week, the asset is trading near the psychological level of $30k, where consolidation is taking place. On April 14, Bitcoin set a local high, reaching the $31k level. At the same time, trading volumes and the activity of unique addresses in the BTC network remained unchanged.

This indicated low chances for Bitcoin to make a bullish breakout of the $31k level and continue its upward movement. Moreover, considering current events, the cryptocurrency is approaching a correction period, and as of April 20, the final breakout of the $30k level also raises questions.

False breakout of $30k?

An impulse move is characterized by a short-term spike in trading volumes. That is what helped Bitcoin break through the $30k level and start a consolidation with an attempt to continue the upward movement. However, upon reaching $31k, the asset faced increased selling volumes.

Over the last two days, the activity of the bulls remained roughly at the same level, around $20 billion. Bears continued to exert pressure and formed a "bearish engulfing" pattern, which buyers managed to absorb.

However, on April 19, sellers formed another bearish pattern, gradually updating local lows. If on Monday the BTC price dropped to the $29.5k level, on Wednesday, it updated the low at the $29k mark.

The situation is approaching its resolution, and given the growth of bearish volumes, we can assume that BTC made a false breakout of the $30k level. The asset had enough volume to break this level due to an impulsive reaction, but after that, Bitcoin was doomed

Is greed taking over the market?

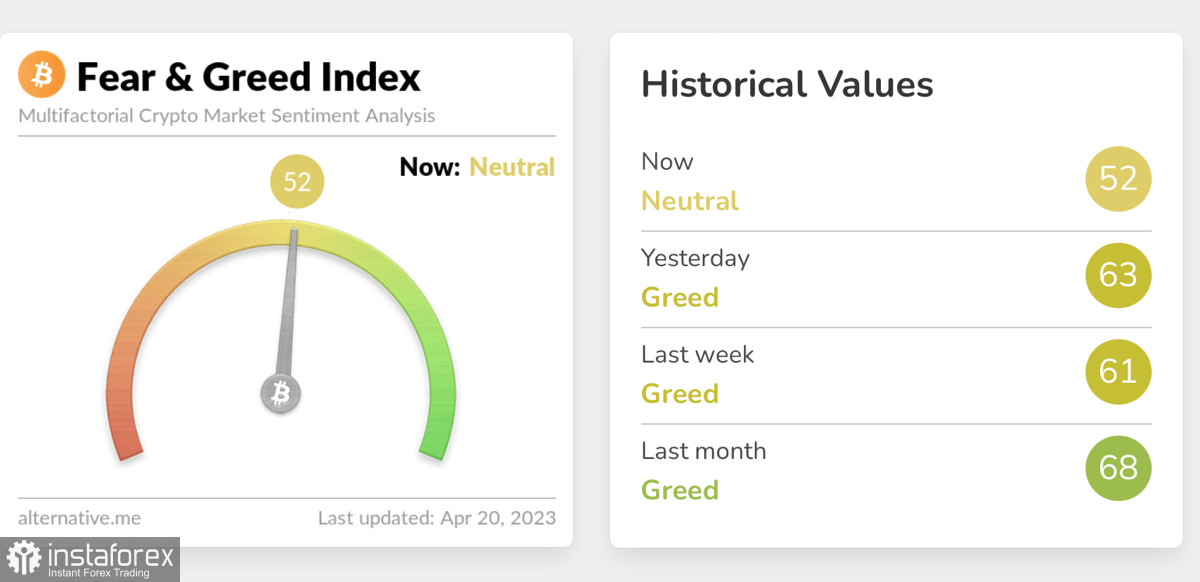

In addition to the obvious passivity of buyers and the lack of volumes necessary to consolidate above $30k, growing greed played an important role in the decline of BTC. The fear and greed index was at 63 when the asset formed a bearish engulfing pattern.

As a result, in just a few hours, after the fall of BTC price, the volume of liquidated long positions amounted to $160 million. Recall that during the last upward movement, the bears lost a little over $140 million.

Greed gradually prevails in the market, forming large volumes of liquidity harvesting. It is also important to remember that in recent weeks, the cryptocurrency's technical indicators were above the 60 level, which is typical for an overheated asset.

Is Bitcoin on a correction?

Despite the sellers' unconditional dominance in the current market phase, it is too early to talk about the beginning of a full-fledged correction. First of all, the asset needs to break through the powerful accumulation zone of $28.5k–$29.1k, where more than 500,000 BTC were purchased.

The technical metrics of the asset also stabilized: the RSI declined to the level of 50 and bounced off this mark in an upward direction. Stochastic declined to 25 and also made a rebound. At the same time, the MACD continues its downward movement, which may indicate a likely retest of $28.5k–$29.1k.

Considering this, we may see Bitcoin rebound locally and attempt to consolidate above the $29.5k key bullish trend level within today's session. The opening of the American markets will play an important role in this process, setting the BTC trend for the rest of the day.

Results

There is no doubt that bears have managed to seize the initiative over the past week. At the same time, the asset continues to move within the fluctuation range of $28.5k–$30k, so it is too early to talk about the beginning of a corrective movement. A full-fledged downward trend in BTC will start at the break of $28.5k level, but until then, the asset has all chances to rebound above $29.5k.