For the pound, the information background was also almost empty yesterday. The two reports I discussed in the euro/dollar article caused a slight market movement that quickly ended. In addition, on Wednesday evening, the Federal Reserve's "Beige Book" was released – a summary of regional economic reviews with the same significance for traders as the minutes of central bank meetings. That is very low. The "book" stated that inflation in the US remains high and economic activity has slightly decreased in recent weeks. Lending volumes have decreased, employment growth has slowed, and wage growth has slowed. Thus, almost all major indicators have decreased, but official statistics only indicate that the decline was insignificant. The latest economic data allowed traders and economists to raise the likelihood of an FOMC rate hike in May to 90%.

The last day of the week promises to be boring as well. Today, it isn't easy to highlight important events on the calendar. However, business activity indices and retail trade in the UK can at least slightly "push" traders so that we do not see a continuation of the horizontal movement today. I still support the pound's decline, as the latest statistics from the UK were weaker than the American ones. I am also waiting for the tightening of the DCP procedure in the UK to be completed soon.

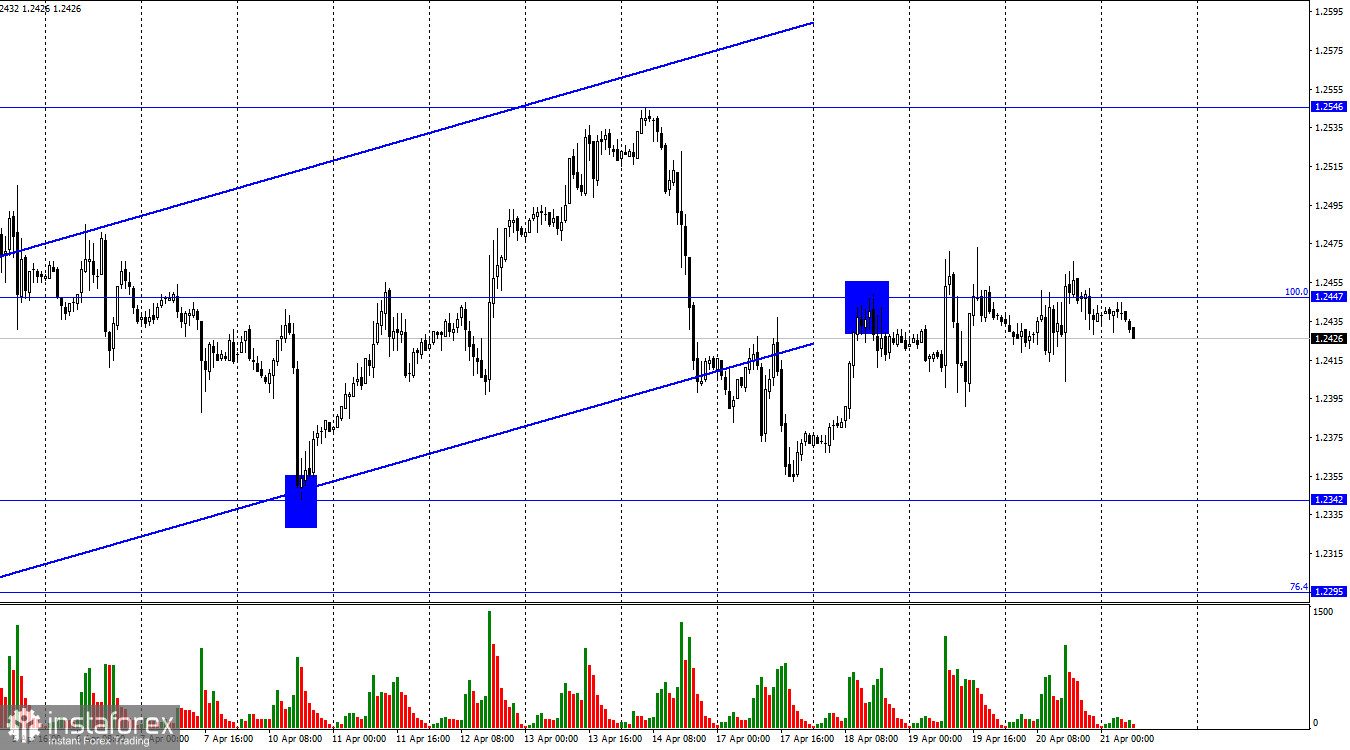

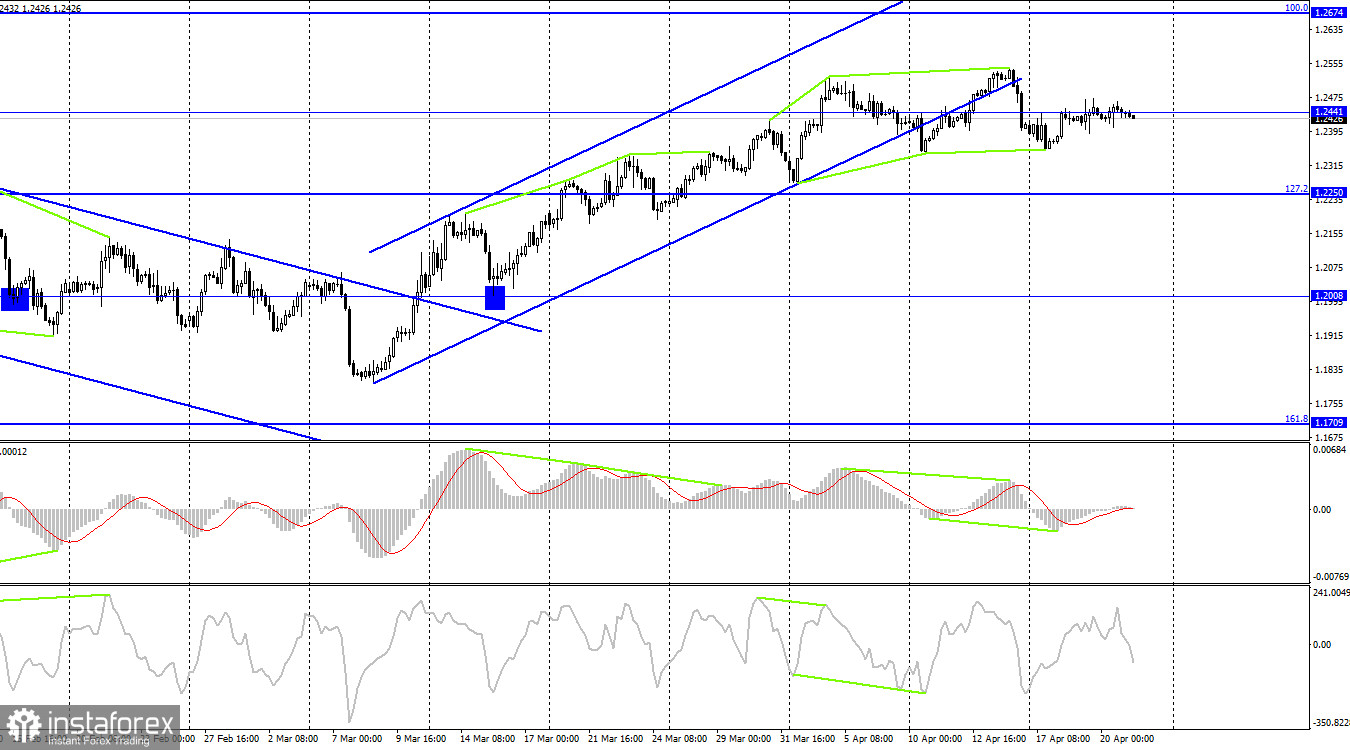

On the 4-hour chart, the pair completed a reversal in favor of the US dollar and consolidation below the ascending trend corridor and the 1.2441 level. I believe the exit from the corridor is a very important graphic signal, indicating a change in sentiment to "bearish." The "bullish" divergence allowed a return to the 1.2441 level, but a rebound from it will again work in favor of the US currency and the resumption of the fall toward the Fibonacci level of 127.2% (1.2250). Exiting two ascending corridors speaks volumes.

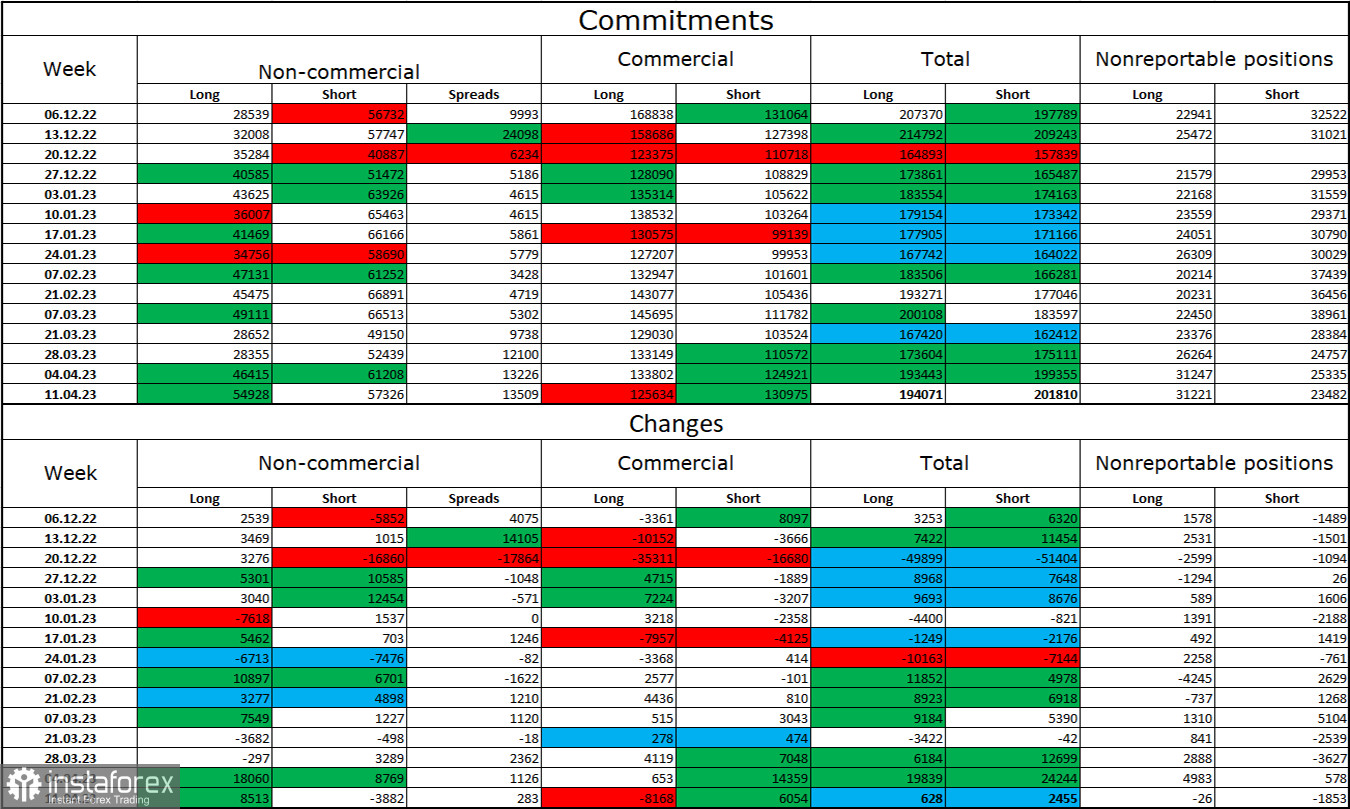

The Commitments of Traders (COT) report:

The sentiment of the "non-commercial" trader category has changed significantly over the last reporting week. The number of long contracts held by speculators increased by 8,513 units, and the number of short contracts increased by 3,882. The overall sentiment of major players remains "bearish," and the number of short contracts still exceeds that of long contracts. But only slightly. Ironically, at this time, the market sentiment may change to "bearish" as there are quite specific sell signals. Over the past few months, the situation has constantly changed in favor of the pound, but nothing lasts forever. Thus, the prospects for the pound remain good, but in the near future, a decline should be expected.

News calendar for the US and the UK:

UK - retail sales volume (06:00 UTC).

UK - business activity index in the manufacturing sector (PMI) (08:30 UTC).

UK - business activity index in the services sector (08:30 UTC).

US - business activity index in the manufacturing sector (PMI) (13:45 UTC).

US - business activity index in the services sector (13:45 UTC).

On Friday, the economic event calendars contain quite a few entries, but the reaction will depend on the values of these reports. The more neutral they are, the higher the chances that traders will not mark them. The information background's influence on traders' sentiment today may be weak.

GBP/USD forecast and advice for traders:

I advise selling the pound with targets of 1.2342 and 1.2295 in case of a rebound from the 1.2441–1.2447 levels. Purchases of the pound will be possible upon closing above the 1.2447 level on the hourly chart, with a target of 1.2546.