Looking at the British macro data, one might question the adequacy of the pound's decline observed during the European trading session. Of course, retail sales continue to decline, but their rate of decline has slowed from -3.3% to -3.1%. It is true that a slightly sharper slowdown was expected, somewhere around -2.9%. Nevertheless, we are talking about a slowdown in the rate of decline, which is a positive factor. Moreover, the manufacturing PMI fell from 47.9 points to 46.6 points, instead of rising to 48.5 points. But the much more significant services PMI jumped from 52.9 points to 54.9 points, whereas it was expected to decline to 52.7 points. As a result, the composite business activity index, instead of increasing from 52.2 points to 52.4 points, rose to 53.9 points. In other words, the data itself should have contributed to the strengthening of the British currency, but instead, it declined.

No less interesting was the pair's behavior after the opening of the US trading session. Preliminary estimates of PMIs were also released in the United States, which turned out to be noticeably better than forecasts. In particular, the manufacturing PMI rose from 49.2 points to 50.4 points, with a forecast of 51.8 points. The services PMI, which was expected to decline from 52.6 points to 51.8 points, rose to 53.7 points. So, the composite business activity index managed to rise from 52.3 points to 53.5 points, while it was predicted to drop to 51.4 points. Against this backdrop, the pound rose, returning to the values at the beginning of the trading day.

Of course, such strange behavior could be explained by the euro's movement, which, through the dollar index, influenced the pound. However, it behaved completely differently. Most importantly, it reacted adequately to the data, both in the eurozone and in the United States. It turns out that the pound became a victim of trivial speculation. Overall, this is quite possible and has happened more than once. The main conclusion of such situations in the past is that they are of an exclusively short-term nature, and the market quickly returns to its original positions. Moreover, if we judge by the data, at the end of the day, the pound should have returned to the values it was at the beginning of the trading day. It should have risen first and then declined, not the other way around.

In any case, all these movements took place against the backdrop of at least some macro data. Whereas today, the calendar is completely empty. Therefore, the market is most likely to stagnate. Even for speculative movements, some formal reason is needed. And there are problems with that today, unless, of course, some unexpected news appears.

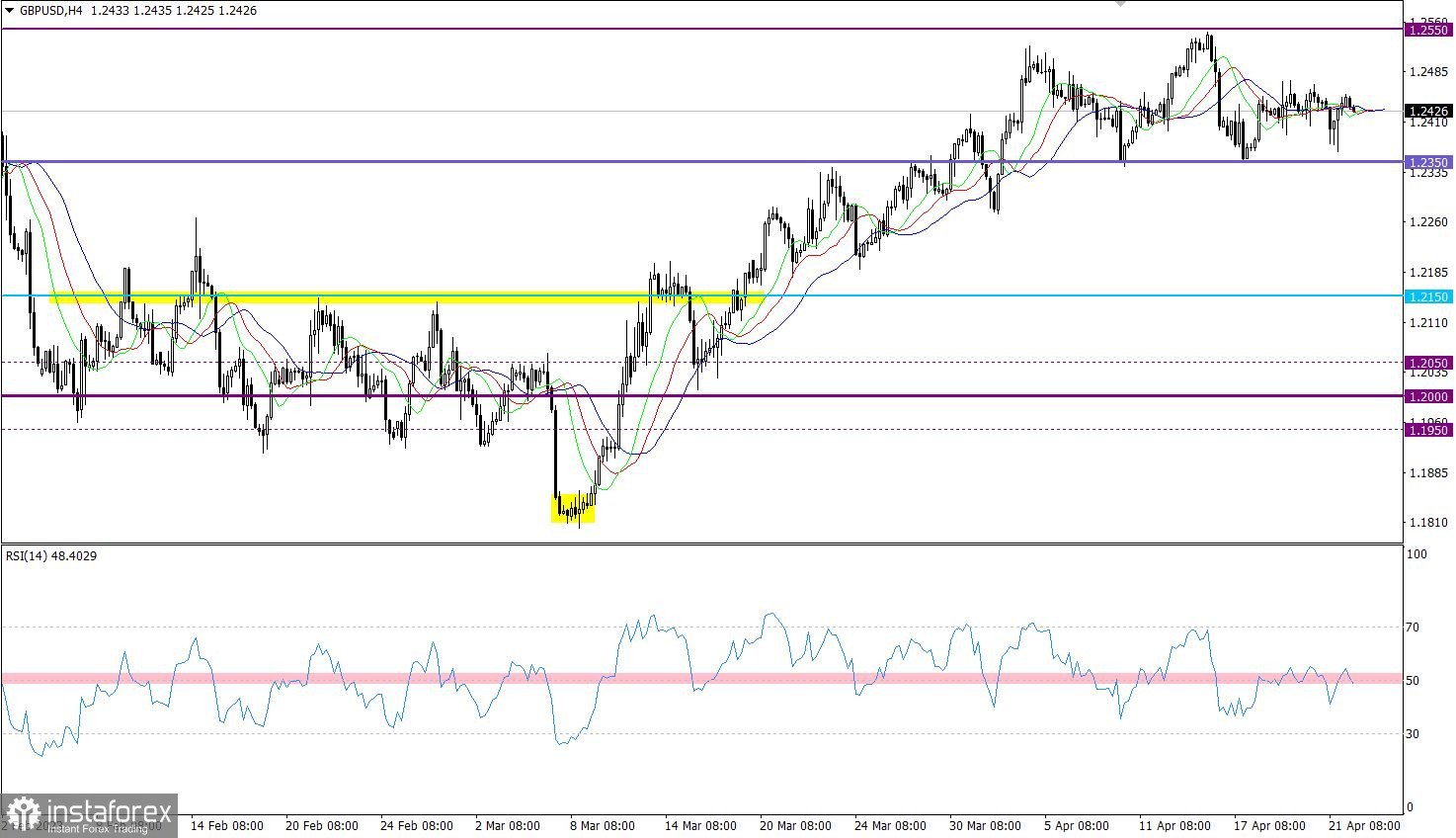

The GBP/USD pair showed interest in moving downward, but it did not lead to anything radical. The quote continued to move within the sideways range of 1.2350/1.2550, ultimately reaching the lower limit.

On the four-hour chart, the RSI technical indicator is moving along the midline 50, indicating stagnation. In the daily period, the RSI is moving in the upper area, indicating an uptrend in the mid-term.

On the four-hour chart, the Alligator's MAs have multiple intersections with each other, which corresponds to a signal of stagnation. In the mid-term, it reflects a bullish cycle.

Outlook

Market participants still focus on two main strategies: the tactic of a breakout relative to the established limits.

In terms of the complex indicator analysis, we see that in the short-term and intraday periods, technical indicators are pointing towards different directions due to the stagnation. Meanwhile, in the mid-term period, the indicators are reflecting an upward cycle.