One should not underestimate the Federal Reserve. You should not underestimate the US dollar. FOMC members in their latest forecasts insisted on maintaining the federal funds rate at its peak for an extended period. The market did not believe them, but it gradually came to understand that the central bank was right. Hedge funds are selling US 10-year Treasury futures at a record pace. This means that their current yield is underestimated and will grow, creating a favorable environment for EURUSD bears.

Dynamics of bond yields and hedge fund rates

In fact, several positive factors are already accounted for in the main currency pair's quotes. Falling gas prices, the energy crisis and recession in the eurozone fading into the background, and an increase in deposit rates to a peak of 3.75%. What will drive the euro higher? The increase in business activity in the currency bloc to 11-month highs did not particularly inspire investors.

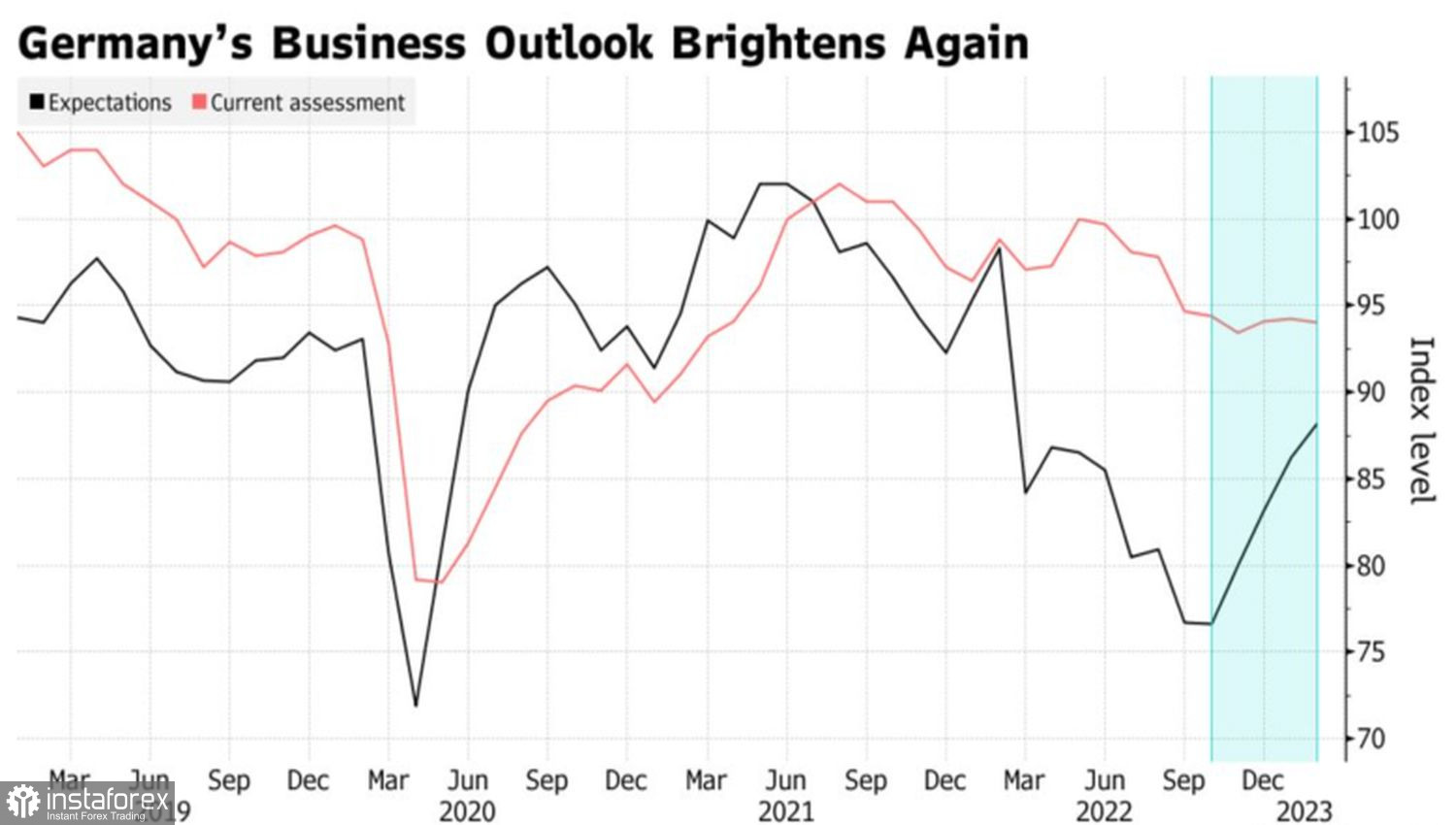

Neither did positive data on the German business expectations index from the IFO Institute act as a catalyst for a rapid rally. The indicator unexpectedly rose from 91 to 92.2, pleasantly surprising Bloomberg experts. However, the current business conditions index decreased. Germany remains an economy that is not collapsing under the influence of the European Central Bank's tightening monetary policy and high inflation, but it is also not growing rapidly. This is a kind of stagnant economy. The question is, what can get it out of such a state? Improving supply chains? Or positive shifts in the armed conflict in Ukraine?

Dynamics of business expectations and current business conditions in Germany

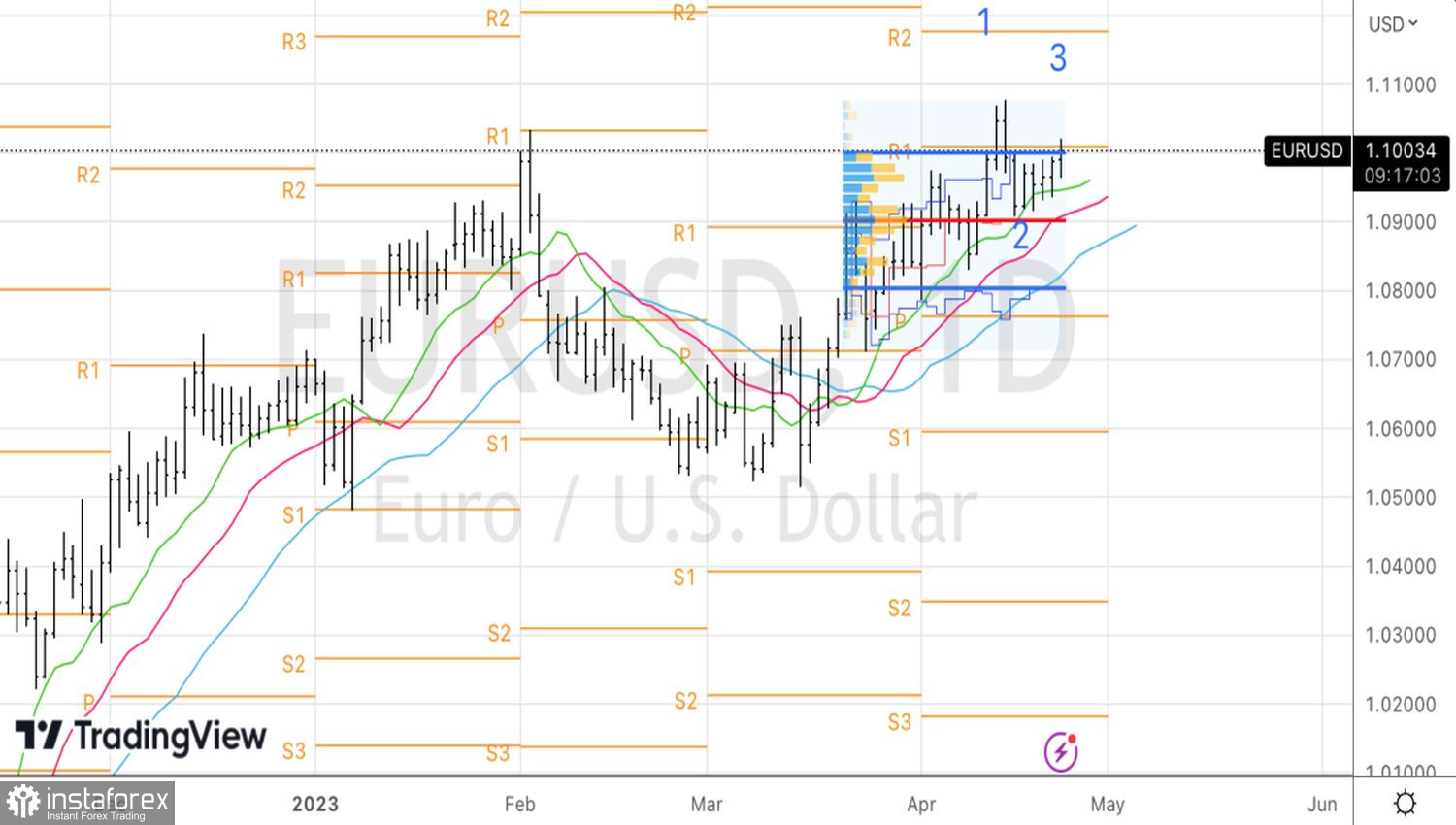

So far, the EURUSD rally has been supported not only by the eye-catching euro but also by a weak US dollar. However, towards the end of April, the dollar seems to have found some ground. It has come to terms with the increase in the federal funds rate by 25 basis points to 5.25% in May and is beginning to doubt the Fed's dovish turn. This would require very disappointing US data, which we have yet to receive.

Yes, employment in the non-agricultural sector is growing at its slowest pace in more than a year, but judging by historical records, the indicator shows very decent results. The same applies to inflation, which, despite the slowdown, is still significantly above the 2% target. The US economy remains strong for now, so what kind of monetary easing are we talking about in 2023?

Undoubtedly, everything can change in the next couple of months. The Personal Consumption Expenditures Index can significantly slow down, and the labor market may cool down considerably, but until that happens, there's no smell of recession. This means it's too early to get rid of the US dollar.

Technically, on the daily chart, a reversal pattern 1-2-3 can be formed for EURUSD. At the same time, failure to push the pair's quotes beyond the upper limit of the fair value range of 1.08-1.1 is a sign of the bulls' weakness and a reason to establish short positions on the euro against the US dollar.