Over the past few days, Bitcoin finally moved into a corrective movement phase. An unsuccessful breakout of $31k and the subsequent decline beyond the $30k level provoked a rather rapid price decline to the $27k level.

However, the $27k level proved to be a solid support zone, where bulls accumulated large volumes of BTC in early spring. As a result, the cryptocurrency managed to defend this milestone and locally recover above $27.5k. For the last four days, the price of BTC has been trading above this area, which may indicate a decrease in bearish activity.

Does the stock market help?

The stock market is making contrarian predictions and statements on a daily basis. On the one hand, investors are expecting a massive 400-point drop in the SPX main index. At the same time, more than 75% of the companies that have already reported for the first quarter of 2023 have showed encouraging earnings.

Wells Fargo is confident that a recession awaits the U.S. economy in the second half of 2023. It also noted that the Fed does not plan to lower the key rate until early 2024, which may exacerbate liquidity problems.

In the short term, the situation also remains negative, as Fedwatch reports that markets are pricing in an 89% chance of a key rate hike in May. Investors believe that the figure will be raised by another 0.25%.

Despite three months of "thickening clouds" over the stock market, the SPX has held steady at the $4,000 mark and continues to rise to the $4,100 mark. The correlation between BTC and SPX persists, and therefore the importance of the stock index in the cryptocurrency's stability cannot be denied.

Investment climate around the crypto market

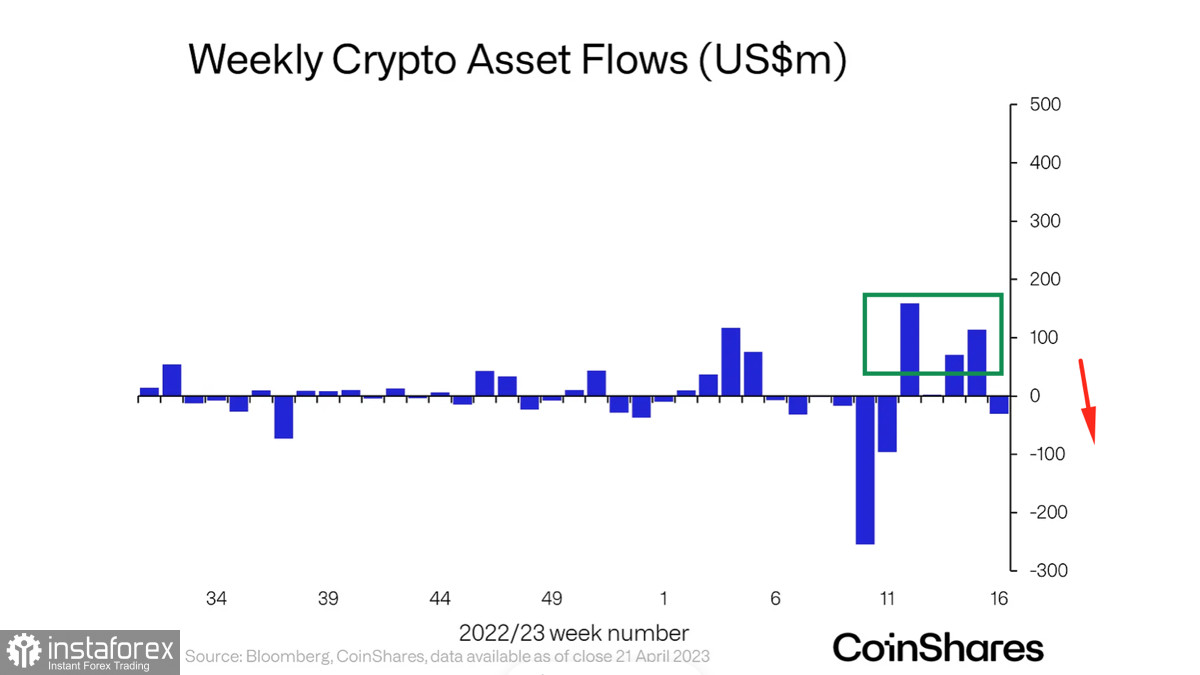

For the first time in 4 weeks, CoinShares records $30 million in outflows from crypto products. At the same time, for the last 4 weeks, the inflow of funds was more than $300 million, and during this period, BTC showed a significant increase and updated the high by $32k.

Glassnode notes a bearish trend in the BTC market. Investors continue to massively bring cryptocurrency to exchanges. Usually, this process precedes profit taking and the subsequent decline in cryptocurrency quotes

Analysts at Santiment also point to a resumption of activity by short-term traders who have sold BTC at a loss three times more often than at a profit over the past two weeks. This is also evidence of local overheating of the market and the need to clear out manipulative capital.

BTC/USD Analysis

Considering BTC, let's focus on the $27.4k level, where at the end of yesterday's trading day, a weak doji candlestick formed. It is likely that under the current market conditions, the formation of such a pattern indicates a pause or exhaustion of the current downward movement.

Bitcoin has chances to make a local reversal if the asset finishes the current trading day above the $28k level. However, BTC/USD looks bearish on the 1D timeframe, and all the main metrics indicate a further decline.

At the same time, the similarity of the current situation with the pattern of early 2019 indicates the imminent resumption of the upward movement of the cryptocurrency. BTC completely repeats the period of local bottom formation and accumulation, after which there is a local decline and further bullish movement.

Results

Fundamentally, the situation remains unchanged until BTC makes a bearish breakout of the $25k level. The bulls stubbornly keep the bears below $27k, and the bears lack the strength to make a powerful breakout. At the same time, there is no need to talk about the completion of the corrective movement yet.