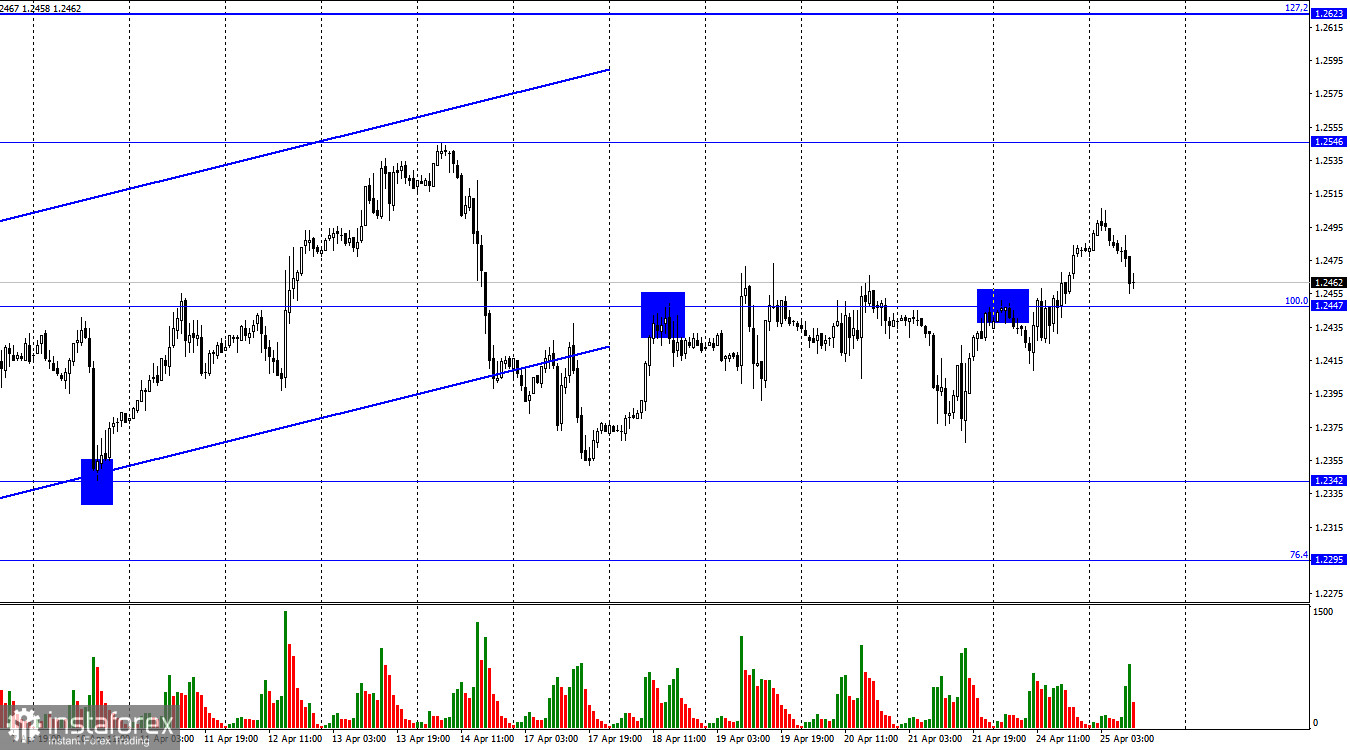

On the hourly chart, the GBP/USD pair made a new reversal in favor of the British currency on Monday and consolidated above the corrective level of 100.0% (1.2447). Thus, the growth process may continue toward the next level of 1.2546. Closing below the 1.2447 level will favor the US currency and cause some decline towards 1.2380 (1.2400). After traders left the ascending trend corridor, we did not see a significant decline in the pair. This is a rather ambiguous moment. Sometimes this happens, but in our case, it has started to happen too often. Bearish traders are stubbornly unwilling to enter the market, so the maximum the pair can reach is only small pullbacks downwards.

On Monday, there was no informational background for the British and American currencies. Nevertheless, the pound added value again. It may have followed the European currency, which happens very often, as these are two closely related currencies, and the economies of the UK and the EU are closely linked. However, even the European currency had a few reasons to show growth on Monday. Perhaps traders are already starting to prepare for central bank meetings, which will take place next week. However, only the Fed meeting will occur next week, and the Bank of England meeting is still a week away. It's strange if traders started buying pounds now, two weeks before the main event. After all, they know what to expect from the FOMC. A 0.25% interest rate hike and nothing more. The FOMC will not pause in May but will not raise rates more than 0.25%. This decision has long been known and taken into account. The Bank of England is more complicated, but the meeting is not soon either. There are still a few substantial reasons for the pound to grow.

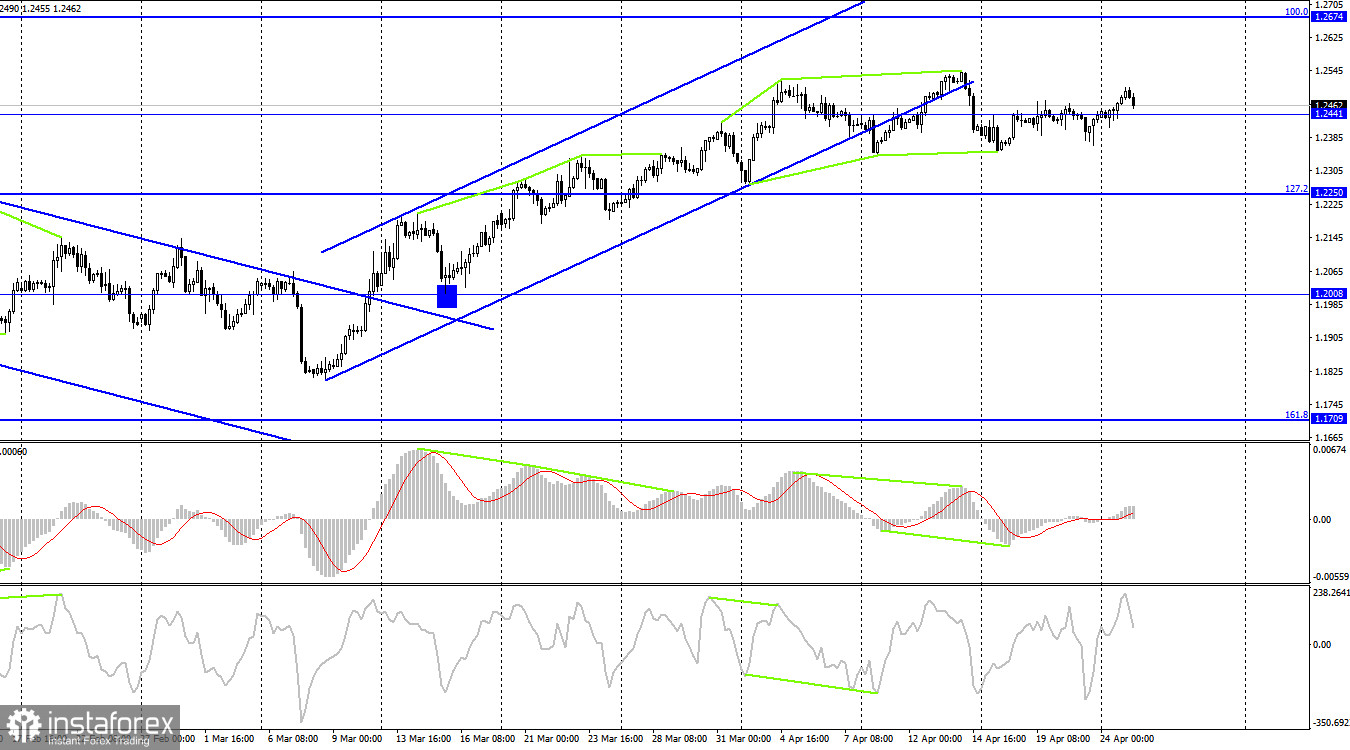

On the 4-hour chart, the pair reversed in favor of the US dollar and consolidated below the ascending trend corridor. I believe the exit from the corridor is a very important graphical signal, indicating a change in sentiment to "bearish." The "bullish" divergence allowed for some growth, but in recent weeks, the pair's movement can be characterized as "horizontal." Closing below 1.2441 will favor the US currency and a new decline toward the Fibonacci level of 127.2% (1.2250).

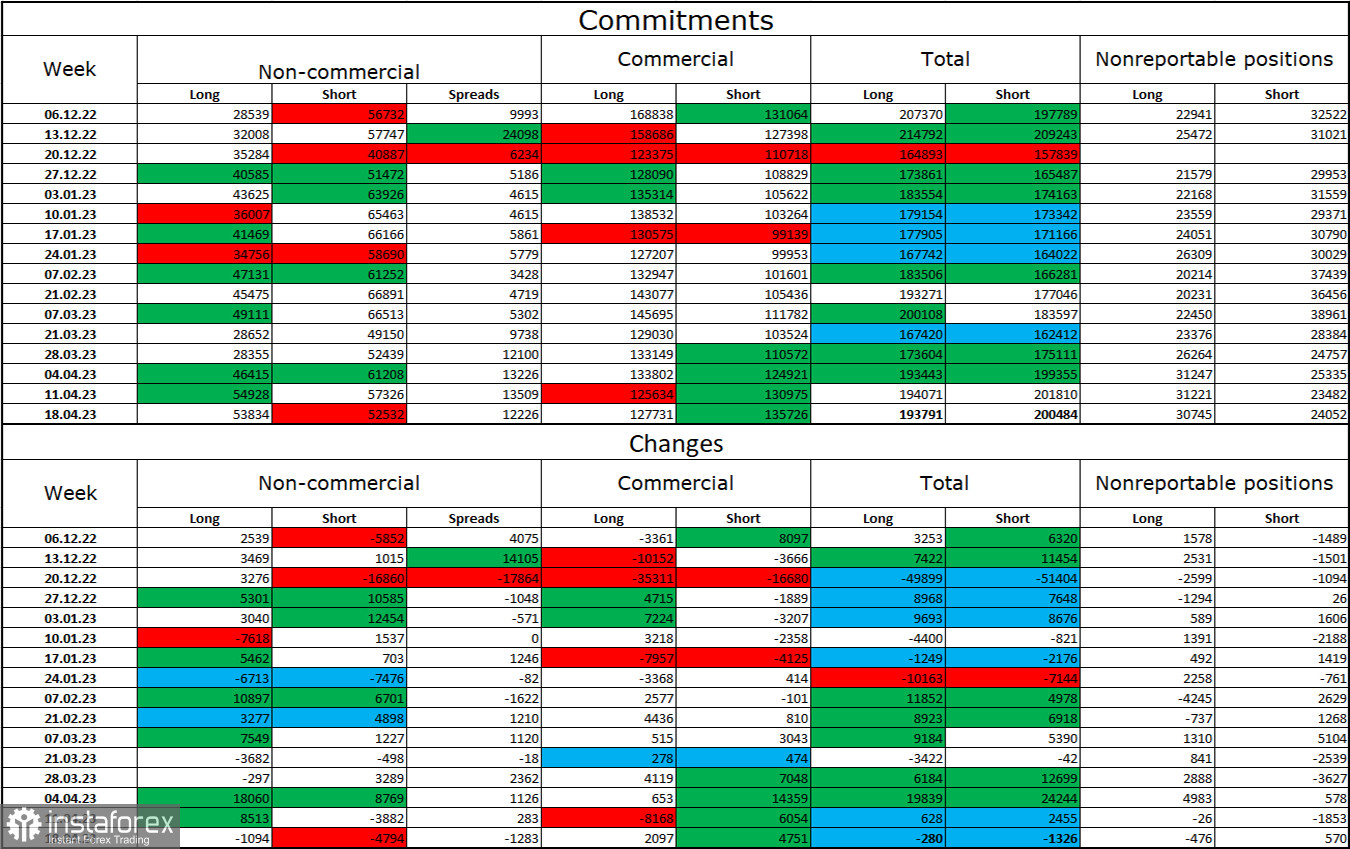

Commitments of Traders (COT) report:

During the last reporting week, the sentiment of the "non-commercial" category of traders changed to a more "bullish" stance. The number of long contracts held by speculators decreased by 1,094 units, while the number of short contracts decreased by 4,794. The overall sentiment of major players changed to "bullish," but the number of long and short contracts is now almost equal - 54,000 and 52,000, respectively. The sentiment in the market for the British currency remained "bearish" for a long time, but all this time, the bulls strengthened their positions, and the British currency actively grew. At this time, graphical analysis indicates a possible decline, but it may be short-lived. Thus, the prospects for the pound remain good, but soon, a decline can be expected.

Economic news calendar for the US and the UK:

US - number of building permits issued (13:30 UTC).

US - new home sales (14:00 UTC).

On Tuesday, the economic event calendars contained only two entries for the US, but they are insignificant. The influence of the informational background on traders' sentiment today will be weak or absent.

GBP/USD forecast and advice for traders:

I recommend selling the British currency with targets of 1.2380 and 1.2342 if it consolidates below the 1.2441–1.2447 zone. Buying the British currency was possible upon closing above the 1.2447 level on the hourly chart with a target of 1.2546. Until closing below 1.2447, they can be held open.