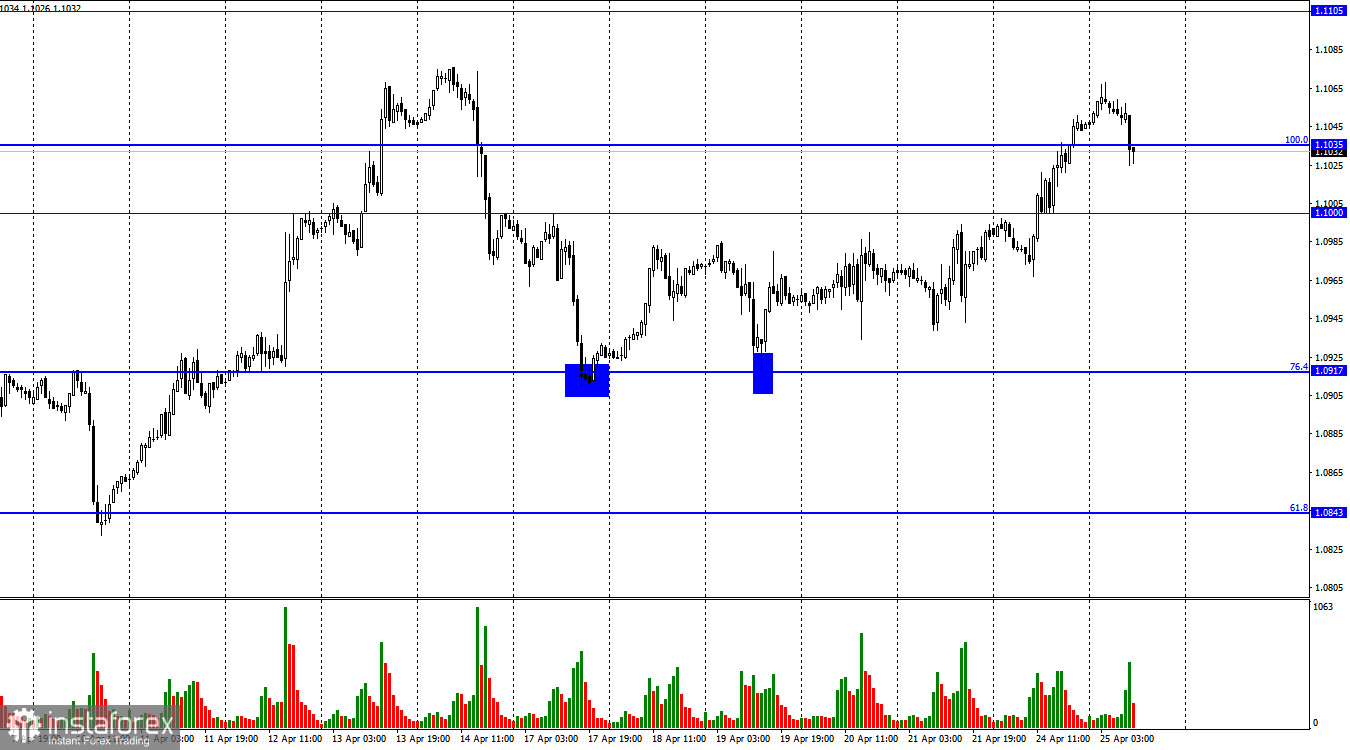

Hi everyone! The EUR/USD pair rose on Monday, closing above the levels of 1.1000 and 1.1035. Today, it returned to 1.1035, the Fibonacci correction level of 100.0%. If the price breaks through this level, it may hit 1.1105. If it declines below 1.1035, a slight fall may occur.

On Monday, there were no market-driving events. Only the comments of ECB policymakers helped the euro rise higher. In particular, one of the ECB governors, Francois de Galo, said that the main priority of all central banks remains price stability. At the same time, another member of the Board of Governors, Pierre Wunsch, said that the ECB would continue raising the key rate rise until core inflation and wages fall. Traders deemed these statements as bullish and opened new positions on the European currency. Some analysts believe that the upward movement of the euro and the pound sterling is not justified. There is a grain of truth in it. However, the euro still has strong drivers for further growth.

The next ECB meeting is scheduled for next week. The central bank is expected to raise the interest rate by 0.50%, while the Fed is likely to hike the rate by only 0.25%. The ECB may raise the key rate several more times in 2023. However, the Fed may take a pause in monetary tightening. Thus, the euro is probably in the final stage of an uptrend. It is likely to maintain its bull run for some time. Next week the situation will become a little clearer. This week, the economic calendar is uneventful.

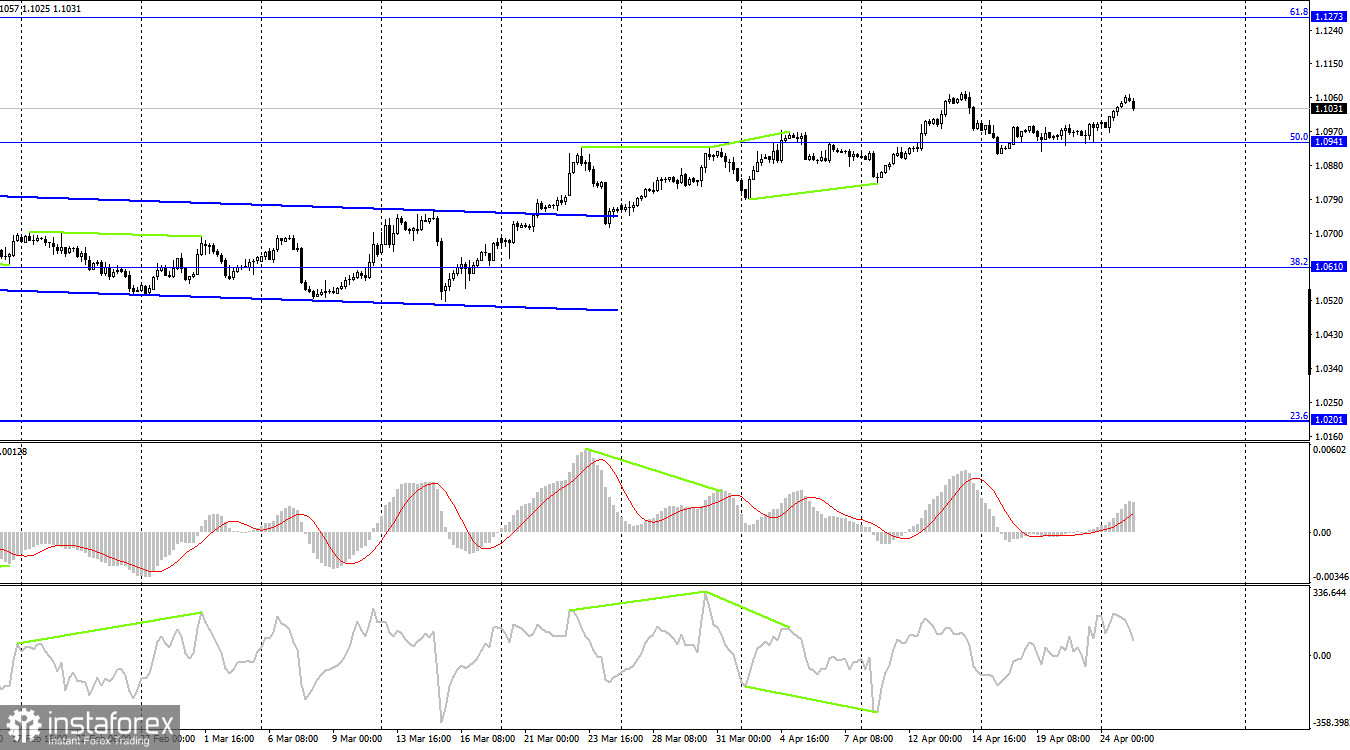

On the 4-hour chart, the pair consolidated above the sideways corridor. It may reach 1.1273, the Fibonacci correction level of 61.8%. The euro also rose above 1.0941, the Fibonacci correction level of 50.0%. It increases the chances of further growth. The bullish divergence of the CCI indicator also facilitated its upward movement. There are no new divergences yet.

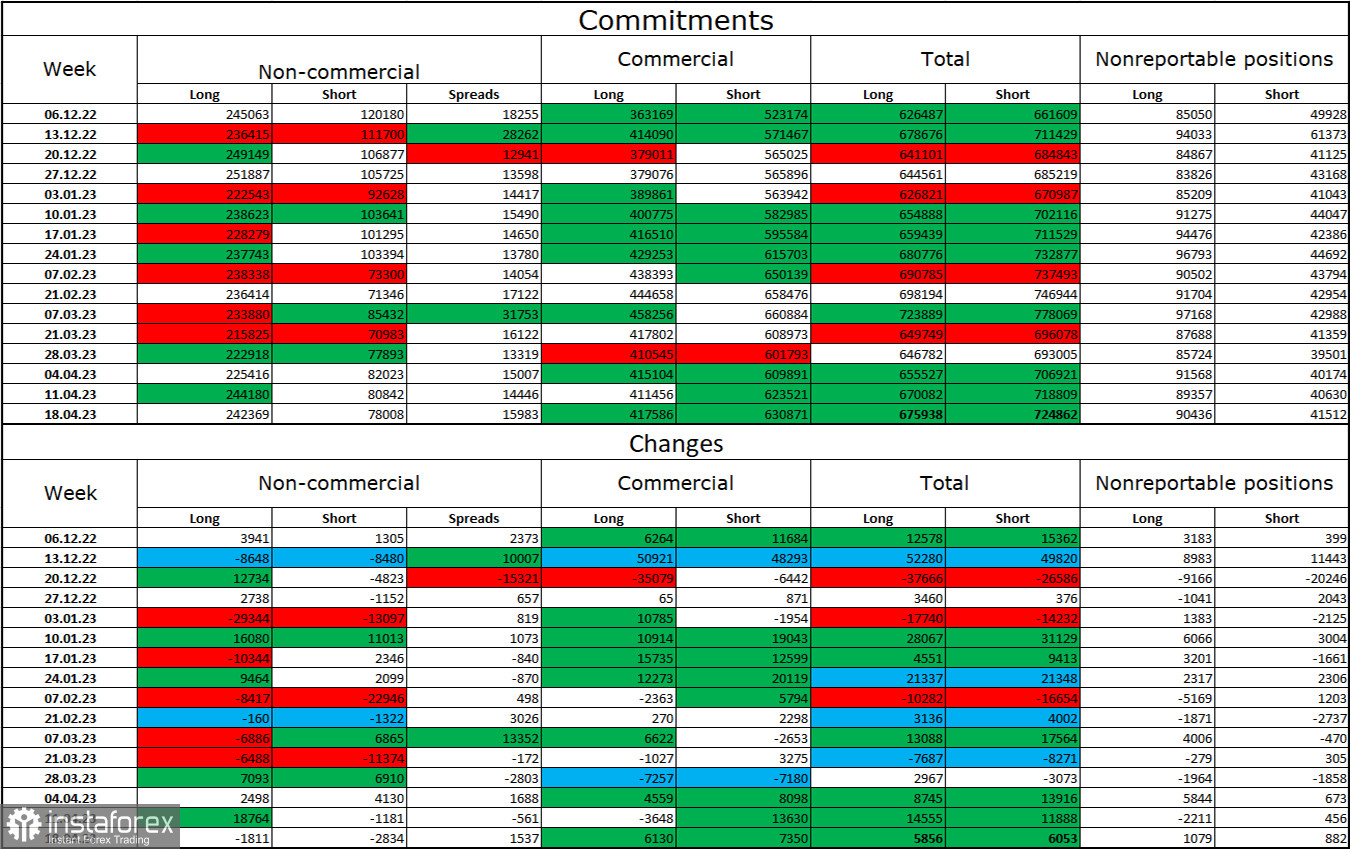

Commitments of Traders (COT):

In the last reporting week, speculators closed 1,811 long positions and 2,834 short ones. The sentiment of large traders remains bullish. The total number of long contracts now amounts to 242,000 and short contracts – 78,000. The European currency has been growing for more than six months but the fundamental background has started to change. It may lead to a fall. The ECB may hike the key rate by 0.25 basis points at the next meeting, which is bearish for the euro. The difference between the number of long and short positions is threefold, which indicates the likelihood of a trend reversal. Now, bulls are still in control. However, I think that the situation may change in the near future.

Economic calendar for US and EU:

US – Building permits (13:30 UTC).

US – New home sales (14:00 UTC).

On April 25, the US will unveil only two economic reports. However, traders are likely to ignore them. The influence of macroeconomic data on sentiment today will be weak.

Outlook for EUR/USD and trading recommendations:

It is recommended to open short positions if the pair closes below 1.1035 on the hourly chart with target levels of 1.1000 and 1.0917. One may go long if the pair rebounds from the level of 1.1035 with the target level of 1.1105.