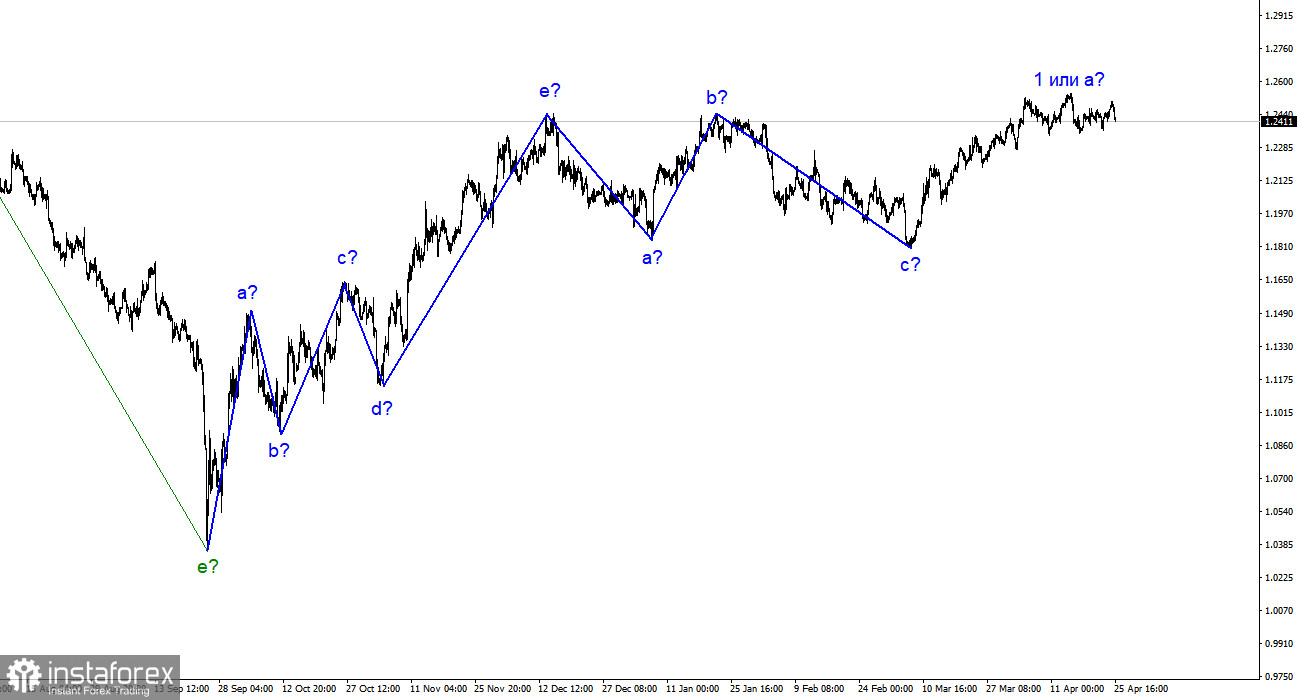

The wave markup for the pound/dollar pair still needs to be simplified. It does not look like a classic corrective or impulsive trend section. Since the current upward wave exceeded the peak of the last wave b, the entire downward trend section consisting of waves a-b-c can be considered complete. Although it is very weakly similar to the trend section for the same period in the euro currency's performance, it should be acknowledged that both pairs have built descending three-wave sets of waves. If this assumption is correct, a new upward trend has begun for the pound. Since I can only single out one wave starting on March 8, there is every reason to assume that forming a new trend section will take a long time. Both pairs should build similar wave formations. If this is indeed the case, then wave 2 or b for the pound may be extended, and at the same time, a downward three-wave structure may be built for the euro. Thus, I expect a deep wave b, as in the case of building the previous three-wave structure. Therefore, it is possible to expect a decline in the pair to the 1.1850 mark or slightly higher.

The British pound continues to swing between 24 and 25 figures.

The pound/dollar pair rate rose by 50 basis points by the end of Monday and fell by 70 today. Thus, the British pound continues to jump up and down, not paying too much attention to the background news. There is nothing to pay attention to now; it must be admitted. Nothing interesting happened in the UK or the European Union yesterday or today. Nevertheless, the British pound almost completely repeated all the movements of the euro. However, it also reacted quite strangely to the news background, which on Monday and Tuesday was practically the same. So, I don't know if we saw the market's reaction to the background news. Yesterday, this assumption had grounds, but today it does not.

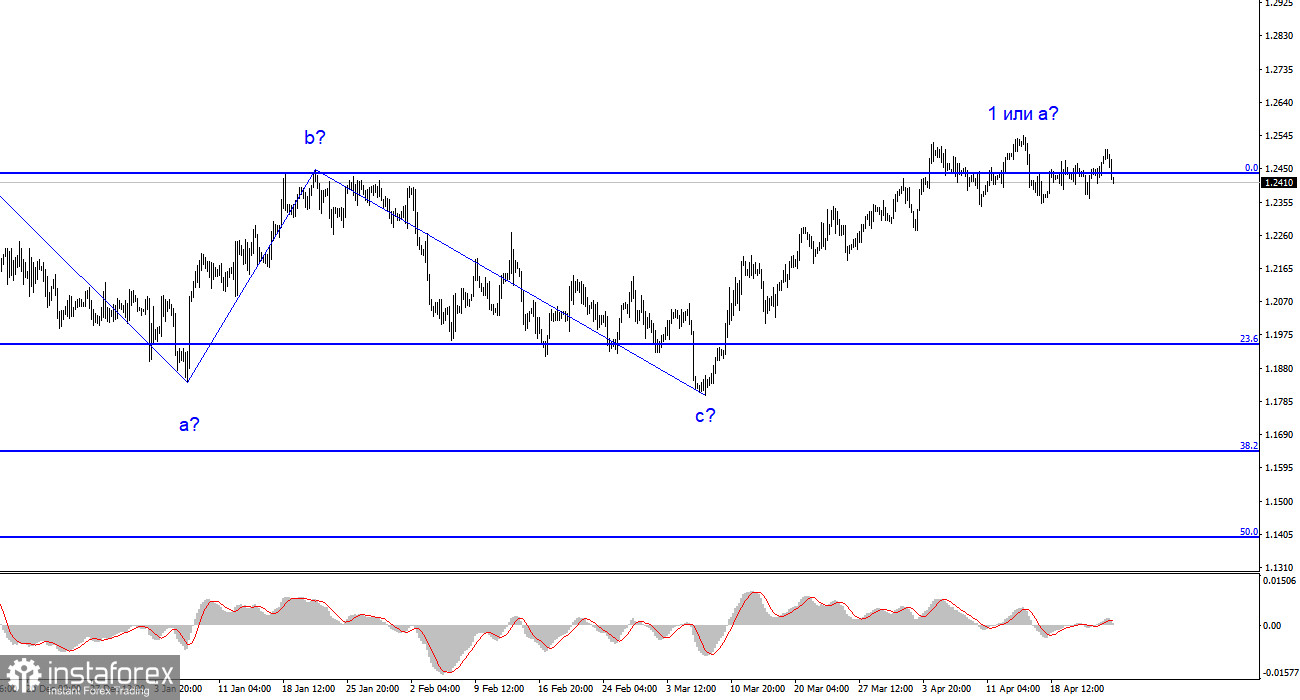

The pair has been swinging between the 1.2340 and 1.2550 marks for a long time, with a horizontal movement. It is also located very close to the assumed peak of wave 1 or a. The pair cannot start building a downward wave or a set of waves, but such a scenario looks most likely now. In recent weeks, both pairs have shown quite strange and complex movements. My readers have to wait for the horizontal movement to end. Or open short positions and wait, not paying attention to the MACD indicator. The background of the news needs to be clarified, and it is completely absent in the UK. In America this week, there are also a few important reports.

General conclusions.

The wave pattern of the pound/dollar pair suggests the construction of a new downward wave. The wave markup is now ambiguous, as is the news background. I do not see factors supporting the British pound in the long term, and wave b can be very deep. A decline in the pair is more likely now, as all the recent waves have been roughly the same size. Trading can be done from the 1.2440 mark, corresponding to 0.0% Fibonacci. Below it - we sell with targets 300-400 points lower; above it - we cautiously buy.

The picture is similar to the euro/dollar pair on the older wave scale, but there are still some differences. At this time, the ascending corrective trend section is complete. But the three-wave downward section may also be completed already. And the new ascending trend section can also be three-wave and horizontal.