When to open long positions on EUR/USD:

Given that today traders are anticipating only Germany's Consumer Confidence Index and speeches of ECB policymakers Andrea Enria and Luis De Guindos, the euro may recoup losses after a sell-off yesterday. I will go short as it could help me see whether there are large bears in the market.

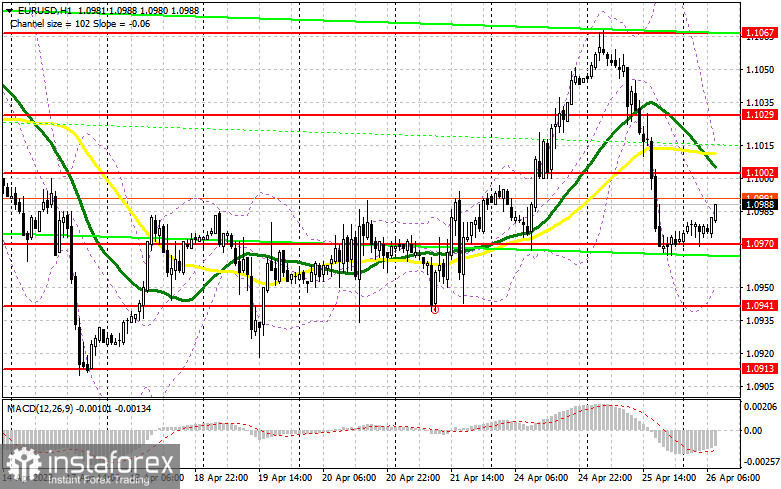

A false breakout of 1.0970 that occurred yesterday may give a buy signal. In this case, the pair could rise to the resistance level of 1.1002 where the moving averages are benefiting bears. A breakout and a downward retest of this level will boost bullish sentiment. Thus, an uptrend may start, providing new entry points into long positions. The pair could climb to the resistance level of 1.1029. A more distant target will be the 1.1067 level where I recommend locking in profits.

If EUR/USD declines and buyers show no activity at 1.0970, which is quite likely as yesterday's sell-off may continue today, the pressure on the pair will only increase. Only a false breakout near the lower border of 1.0941 will give a buy signal. You could buy EUR/USD at a bounce from the low of 1.0913, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Sellers took control of the market, not allowing the euro to reach a monthly high. Today, they need to protect the resistance level of 1.1002. The euro is unable to consolidate above this level. A negative market reaction to Germany's economic data as well as a false breakout of this level could generate a sell signal. The pair is likely to decrease to 1.0970. If it drops below this level and there is an upward retest, the pair may take a nosedive to 1.0941. A more distant target will be the 1.0913 level - the low of last week. At this level, I recommend locking in profits.

If EUR/USD rises during the European session and bears show no energy at 1.1002, which is also likely due to the lack of important economic reports, I would advise you to postpone short positions until a false breakout of 1.1029. You could sell EUR/USD at a bounce from 1.1067, keeping in mind a downward intraday correction of 30-35 pips.

COT report:

The COT report (Commitment of Traders) for April 11 logged a rise in long positions and a drop in short ones. The latest US economic reports signaled a gradual overheating of the labor market as well as a decline in retail sales. It is likely to ease inflationary pressure in the United States, allowing the Fed to end the tightening cycle. However, according to the meeting minutes for March, Fed policymakers are not planning to abandon aggressive tightening. At the May meeting, the regulator could raise the key rate by 0.25%. It will help the US dollar maintain its lead against the euro, trading below 1.1000. This week, there will be no crucial economic reports, excluding PMI data. So, the bears could facilitate the downward correction. The COT report showed that long non-commercial positions increased by 18,764 to 244,180, while short non-commercial positions declined by 1,181 to 80,842. At the end of the week, the total non-commercial net position amounted to 162,496 against 143,393. The weekly closing price fell to 1.0950 against 1.1.

Indicators' signals:

Trading is carried out below the 30 and 50 daily moving averages, which indicates a bearish bias.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 1.0950 will serve as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.