On Tuesday, the EUR/USD pair completed a reversal in favor of the US currency and a 100-point drop. A reversal in favor of the EU currency and a rise of 80-90 pips were executed overnight. On Monday, let me remind you the pair also showed growth. Thus, we have witnessed complete chaos in the market over the last three days. Bulls and bears are pulling the rope, and the pair is dancing in all directions almost simultaneously. There is no background information of the usual nature. This week's first report will be released only today in the second half of the day. The current market situation is unstable, and movements can be expected in any direction with any force.

Of course, if desired, one can find news or events that could cause a particular movement. For example, Janet Yellen spoke overnight, stating that the US debt ceiling needs to be raised. Otherwise, a technical default may occur. For those who have recently been following the market, let me inform you that such a problem arises in America once every six months. Each time, it starts with a speech by the finance minister or other high-ranking officials who demand that Congress raise the national debt limit. Then monthly bargaining and debates begin. Both houses of Congress must approve this decision by a majority, so one side (the Republicans) tries to win as much as possible if it approves the other side's proposal (Democrats). Ultimately, the national debt limit will still be raised, as there is no other way, and a technical default is not beneficial to either Republicans or Democrats. Thus, there is no problem here, and the dollar is not falling due to this event. Yesterday, it showed strong growth, although there was no information background for this. In today's second half, we may see the pair fall.

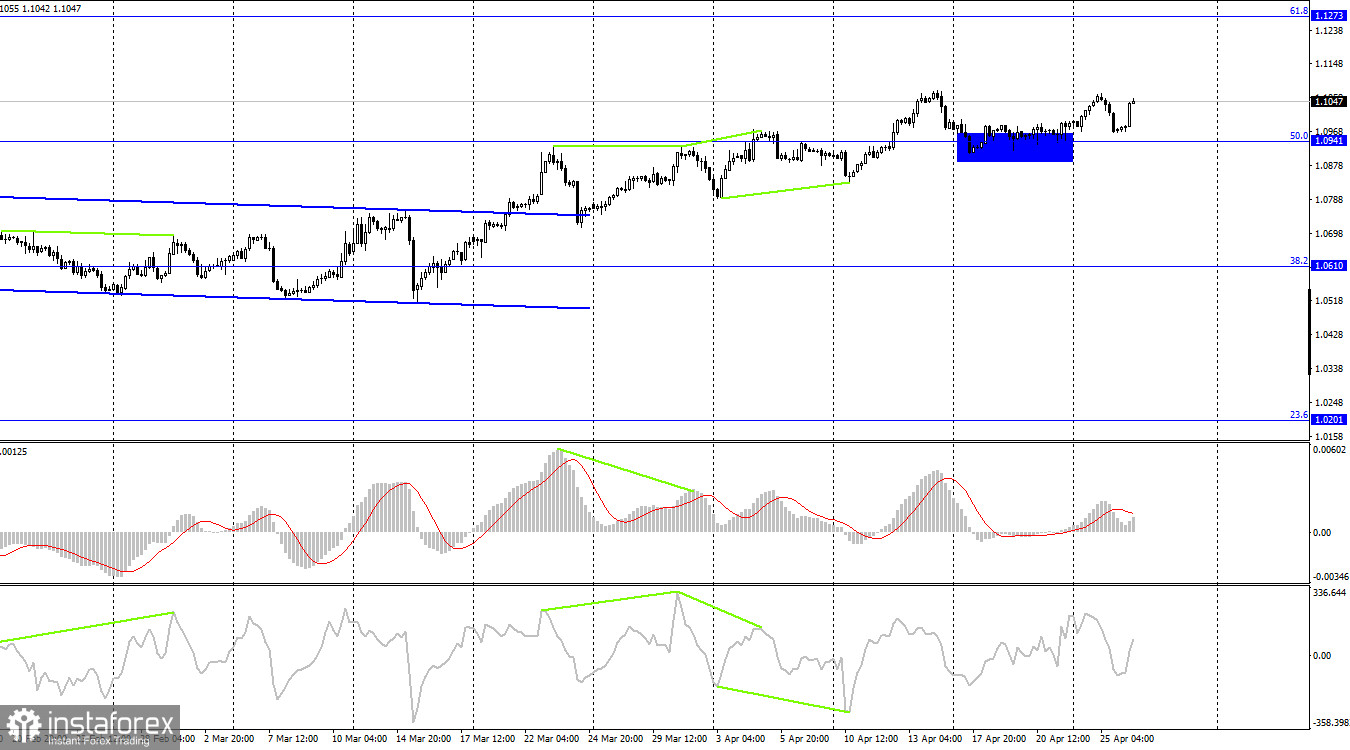

On the 4-hour chart, the pair completed a consolidation above the sideways corridor, which allows for the continuation of growth toward the corrective level of 61.8% (1.1273). Consolidation above the corrective level of 50.0% (1.0941) was also completed, increasing the chances of further growth. The "bullish" divergence of the CCI indicator similarly favored the euro. No new emerging divergences have been observed yet.

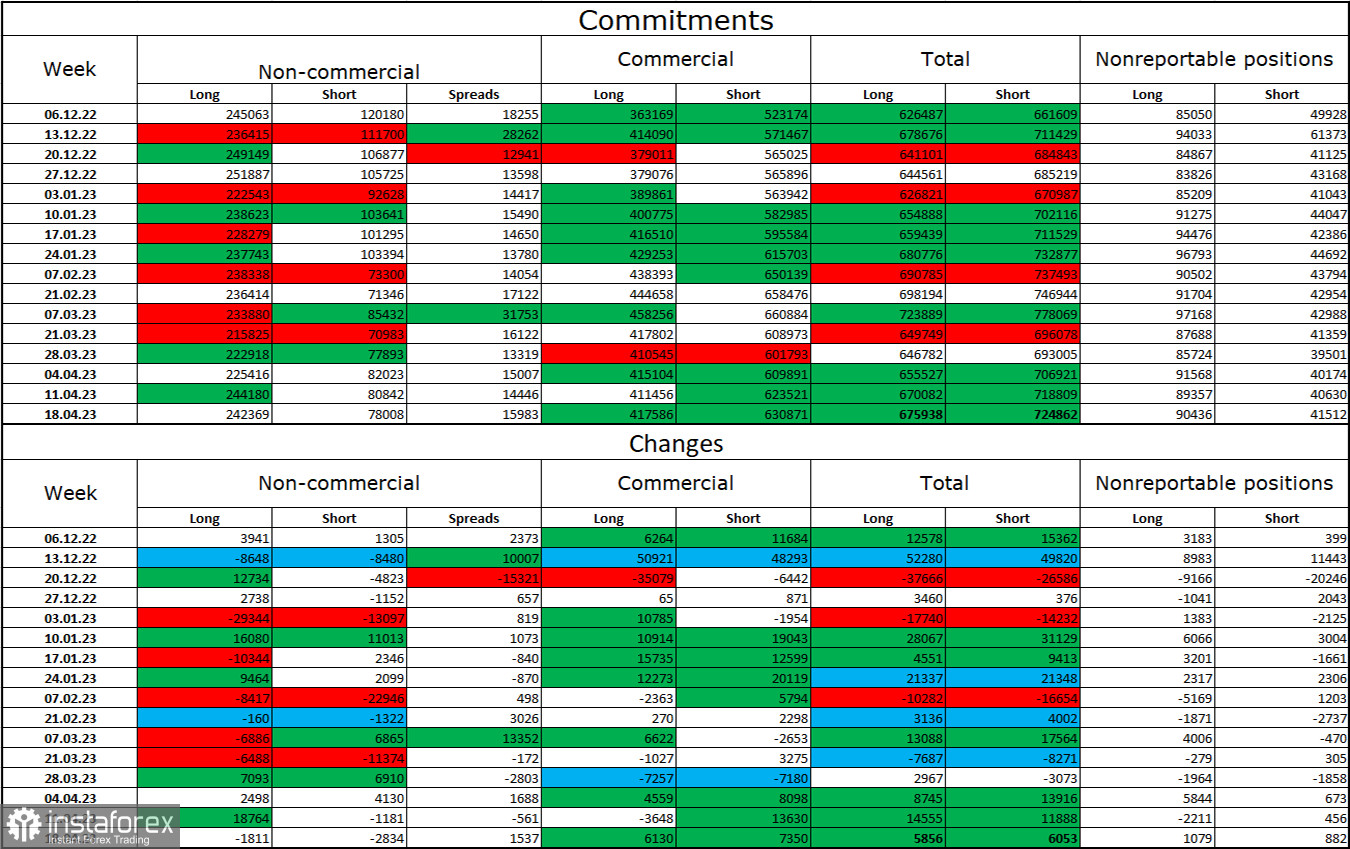

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 1,811 long contracts and 2,834 short contracts. The sentiment of major traders remains "bullish" and continues to strengthen overall. The total number of long contracts concentrated in the hands of speculators now stands at 242 thousand, while short contracts amount to 78 thousand. The European currency has been growing for more than half a year, but the information background is starting to change, which may lead to a decline in the EU currency. At its next meeting, the ECB may reduce the pace of rate hikes to 0.25%, which is unlikely to please buyers. The difference between the number of long and short contracts is threefold, which speaks to the proximity of the moment when bears will become more active. For now, a strong "bullish" sentiment persists, but I think the situation will change soon.

News calendar for the US and the European Union:

US - core durable goods orders (12:30 UTC).

On April 26th, the US economic events calendar contained only one entry of medium significance. The influence of the information background on traders' sentiment today will be weak.

EUR/USD forecast and advice for traders:

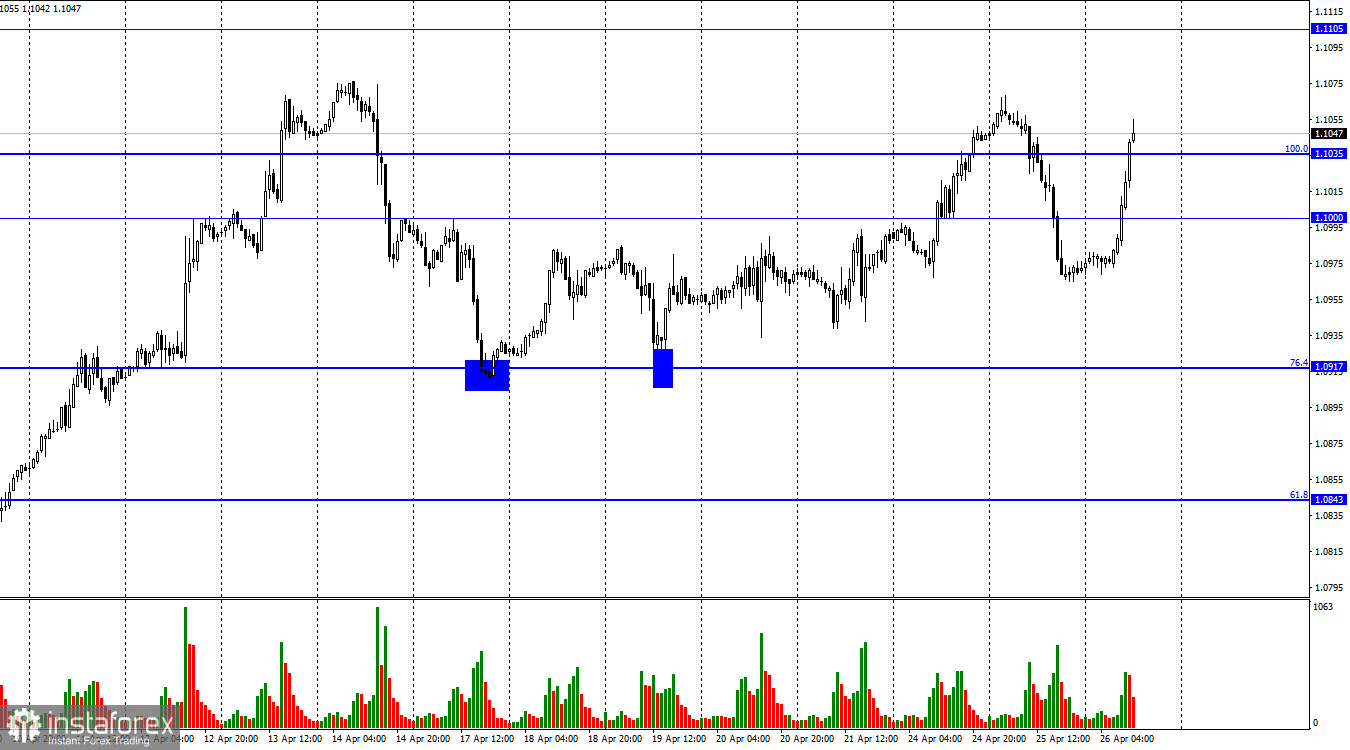

Sell trades can be opened when closing below the level of 1.1035 on the hourly chart, with targets at 1.1000 and 1.0917. Purchases were possible when closing above the level of 1.1000 on the hourly chart with a target of 1.1105, but I doubt that the bulls will be able to reach this target.