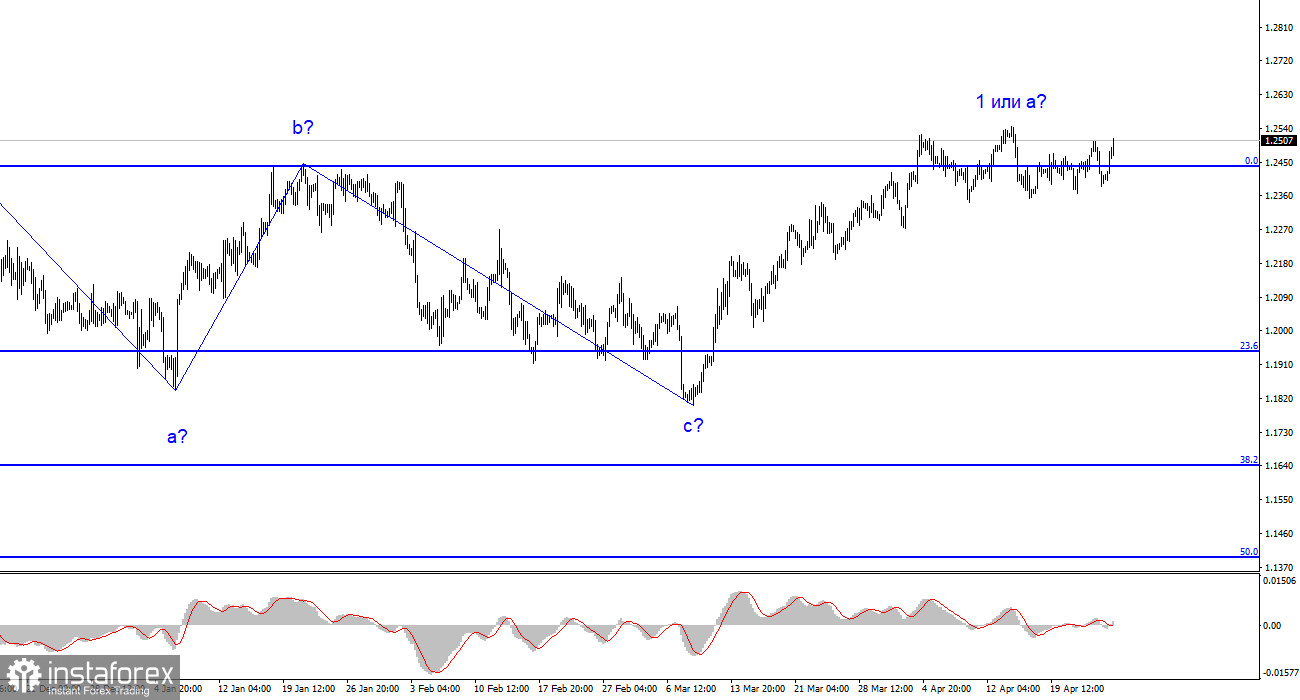

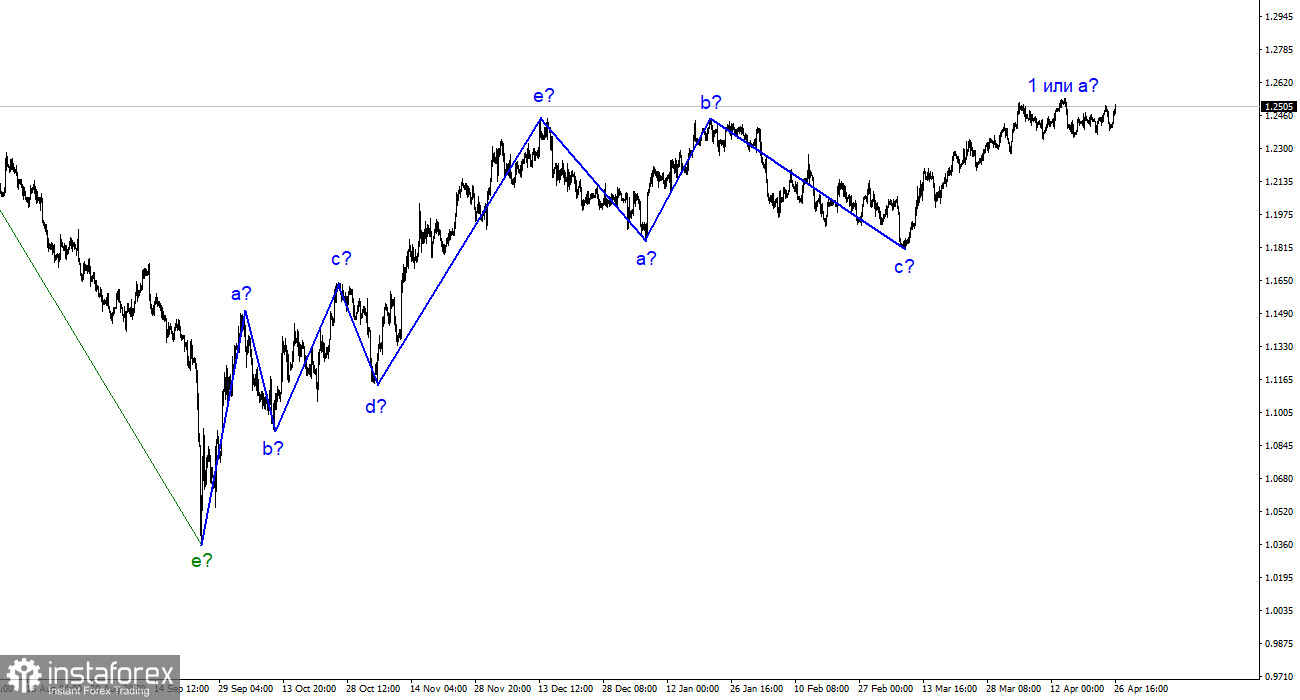

The wave analysis for the GBP/USD pair still needs to be simplified because it looks different from a classic corrective or impulse trend segment. Since the current upward wave exceeded the peak of the last wave b, the entire downward trend segment consisting of waves a-b-c can be considered complete. Although it is very weakly similar to the trend segment for the same period in the euro currency's performance, it should be acknowledged that both pairs have built downward three-wave sets of waves. If this assumption is true, a new upward trend segment has begun for the pound. Since I can single out only one wave starting on March 8, I believe that forming a new trend segment will take a long time. Both pairs should build similar wave formations. If this is indeed the case, wave 2 or b for the pound may be extended, and at the same time, a downward three-wave pattern can be built for the euro. Thus, I expect a deep wave b, as in the case of the formation of the previous three-wave pattern. Therefore, a decrease in the pair can be expected to the 1.1850 level or slightly higher.

The British currency continues to swing between 24 and 25 figures. The GBP/USD rate on Tuesday fell by 75 basis points, and today it rose by 90. The pendulum continues to swing from side to side, and that's all there is to say. Even inexperienced traders can see that the news background can stay the same daily. Especially in cases when it is practically absent. There have been no significant news or economic indicators in the UK this week. In the US, the first report of the week was released an hour ago. It turned out to be four times stronger than market expectations and caused a drop in demand for the US dollar. Each new day gives me more and more confidence that the news background currently has no impact on what is happening in the foreign exchange market. If this is indeed the case, we can observe any movement of the pair in the near future. And in the past few weeks, the movement has been mostly horizontal. The situation is now extremely confusing.

Tomorrow in the US, the second important report of this week will be released: the GDP for the fourth quarter. Something tells me that the market will "ignore it." It is expected that the growth rate of the US economy will decrease to 2-2.3%, but with the current interest rate level, this is normal. The main thing is that there is growth, not a recession. If the pendulum swings down tomorrow (which would be logical, given the nature of the pendulum), then demand for the US currency will grow in any case, no matter what the GDP report is.

General conclusions.

The wave pattern of the GBP/USD pair implies the formation of a new downward wave. The wave analysis is now ambiguous, as is the news background. I do not see factors supporting the British currency in the long term, and wave b could be very deep, but it has yet to start. A decline in the pair is more likely now, as all the recent waves have been roughly the same size. Trading can now be done from the 1.2440 mark, corresponding to 0.0% Fibonacci. Below it – we sell with targets 300-400 points lower; above it – we cautiously buy or wait.

The picture is similar to the EUR/USD pair on the older wave scale, but there are still some differences. At this time, the ascending corrective trend segment has been completed. But the three-wave downward segment may have already been completed as well. And the new ascending trend segment can also be three-wave and horizontal.