Analysis of macroeconomic reports:

There are few important macro data on Thursday. For the second week in a row, we are sitting on a deficit of important data and events. I can only highlight the US GDP report for the fourth quarter. This will be the first estimate of the indicator, and it has the greatest chances of being worked out by the market. Forecasts suggest that the US economy will grow by 2.0-2.3% in quarterly terms. If the actual value differs significantly from the forecast, then the market may react. However, I want to remind you that the market currently does not react to any information, and when it does react, it seems to be illogical, so the essence of macro data and fundamental events is simply lost. We can also take note of the report on unemployment benefit claims in the US, which many consider important. However, in regards to this kind of report, deviations from forecast values are as rare as market reactions to it. Most likely, the pair will move according to its own rules on Thursday.

Fundamental events:

There is absolutely nothing to highlight among the fundamental events on Thursday. Of course, we may receive interesting information during the day (like earlier, Janet Yellen's speech, and those by Pierre Wunsch and Philip Lane from the ECB), as speeches can be unplanned, but chances of that are slim. In any case, it is impossible to predict in advance where and when a politician or central bank official will speak.

General conclusions:

Thursday promises to be another boring day, as there is not a single event capable of generating interest. However, both pairs this week are trading quite volatile and without fundamental information. Unfortunately, they are currently moving beyond our logic. Since we witnessed growth on Wednesday, we can assume a decline on Thursday, but most likely, it will be the opposite. However, for trading on a 5-minute chart, it doesn't matter which direction the pair will move. The main thing is to have a trend.

Basic rules of the trading system:

1) The strength of the signal is determined by the time it took the signal to form (a rebound or a breakout of the level). The quicker it is formed, the stronger the signal is.

2) If two or more positions were opened near a certain level based on a false signal (which did not trigger a Take Profit or test the nearest target level), then all subsequent signals at this level should be ignored.

3) When trading flat, a pair can form multiple false signals or not form them at all. In any case, it is better to stop trading at the first sign of a flat movement.

4) Trades should be opened in the period between the start of the European session and the middle of the US trading hours when all positions must be closed manually.

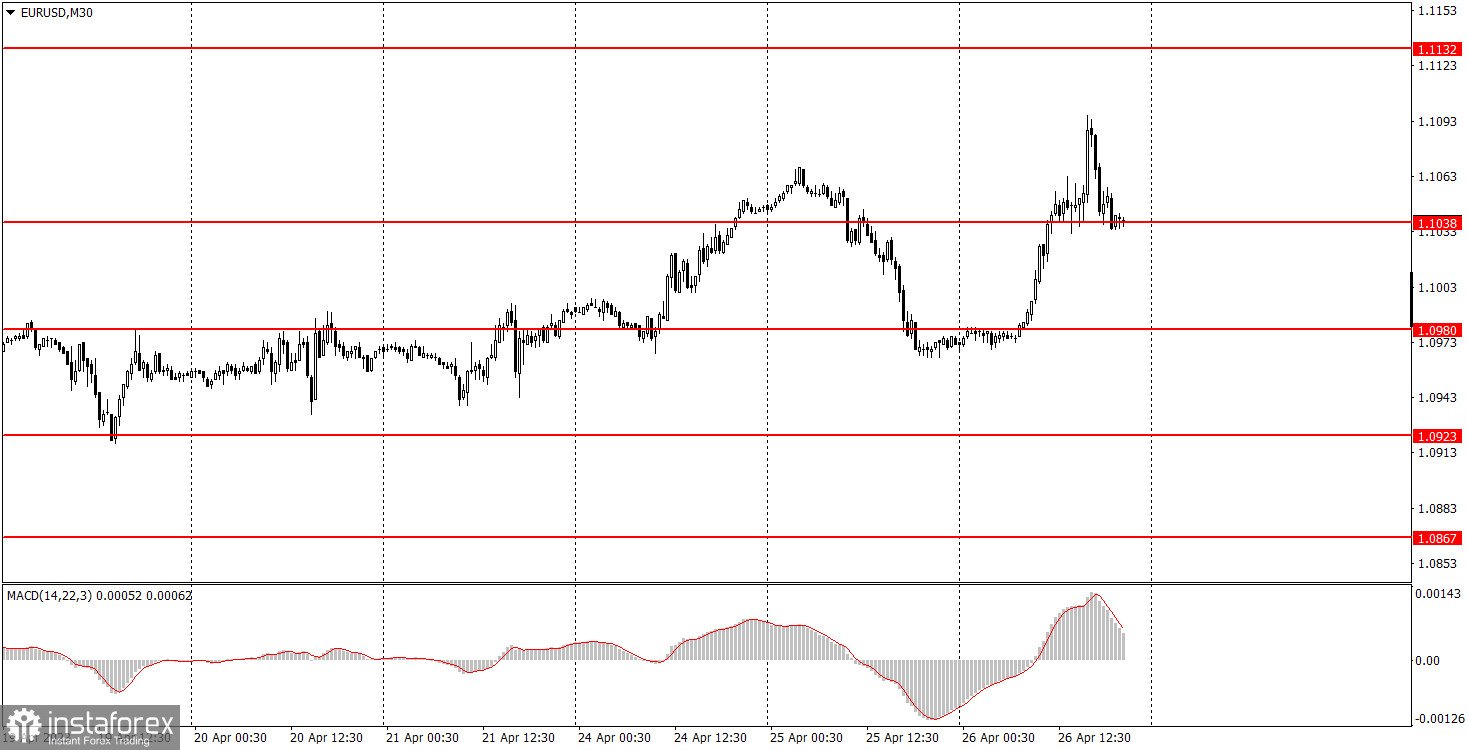

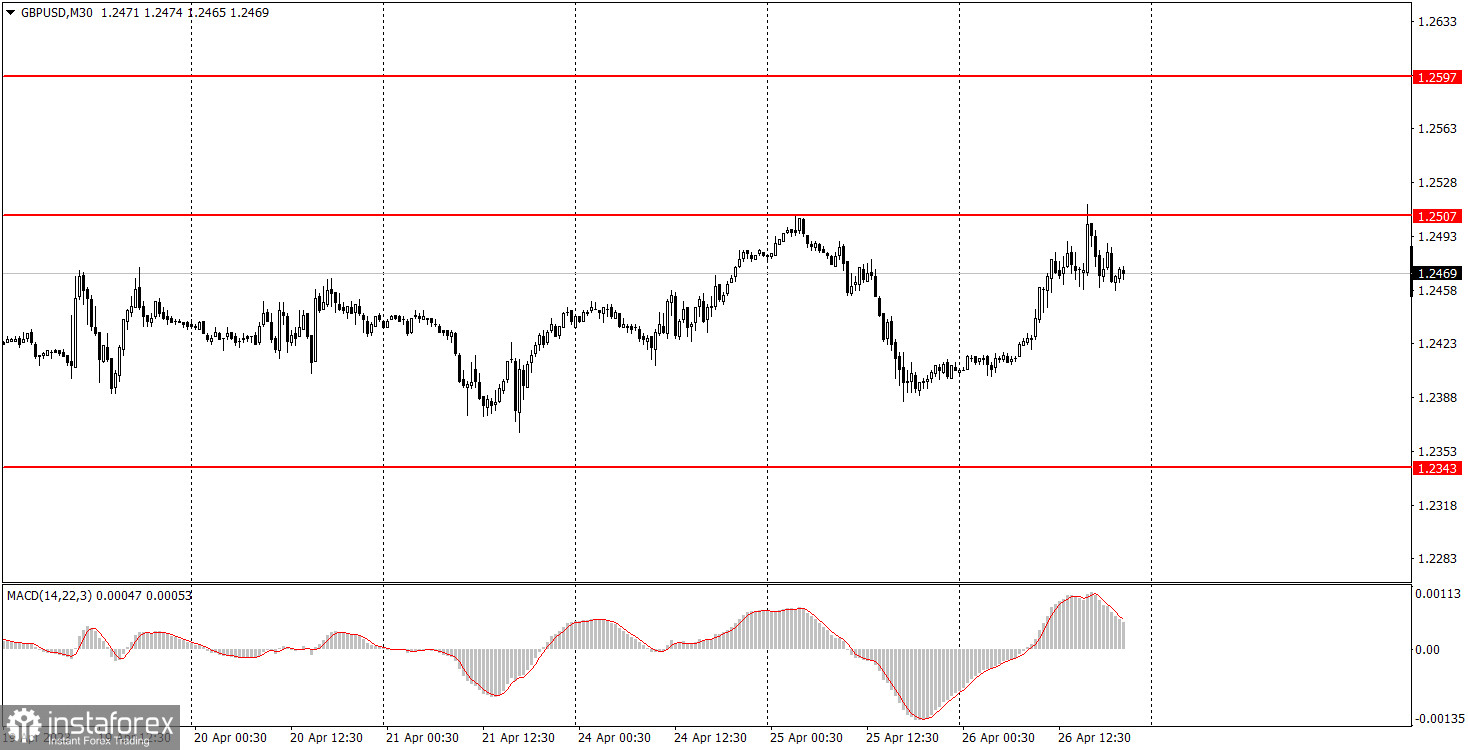

5) You can trade using signals from the MACD indicator on the 30-minute time frame only amid strong volatility and a clear trend that should be confirmed by a trendline or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 pips), they should be considered support and resistance levels.

On the chart:

Support and Resistance levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines).

Important announcements and economic reports that can be found on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exiting the market in order to avoid sharp price fluctuations.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management is the key to success in trading over a long period of time.