Bitcoin

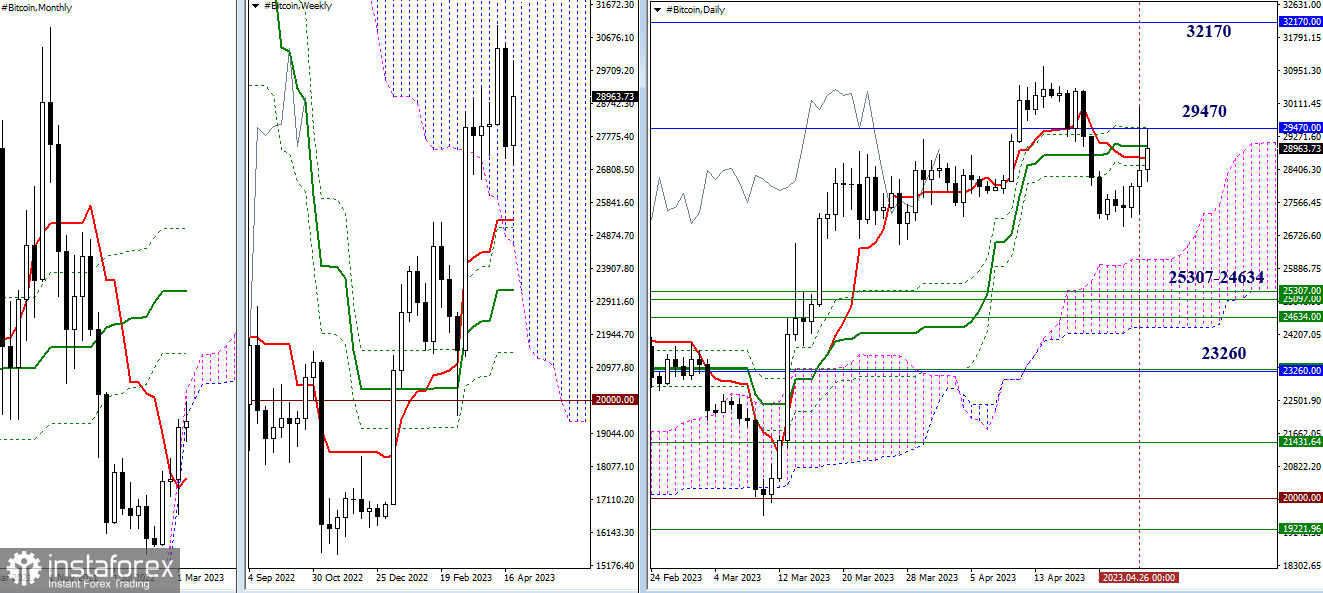

Not long ago, Bitcoin managed to recover to 30,000, seizing the support of the monthly short-term trend and forming the appearance of upward prerequisites on the weekly timeframe in the form of a golden cross. The monthly Ichimoku cloud is currently located around 30,000, and as a result of testing which, a slowdown and some consolidation occurred. The monthly cloud in this area is expanding and rising, so the struggle with it can be protracted.

At the moment, the cloud boundaries are located at the marks of 29,470 and 32,170. These are the main bullish targets in the near future, and further bullish prospects will appear only after a confirmed breakout and a reliable consolidation above. In case of a return of bearish sentiment to the market and a decline develops, the interests of bears will be directed to the daily cloud supports (26,110 - 24,378), the accumulation of weekly levels (25,307 - 25,097 - 24,634), and the monthly short-term trend (23,260).

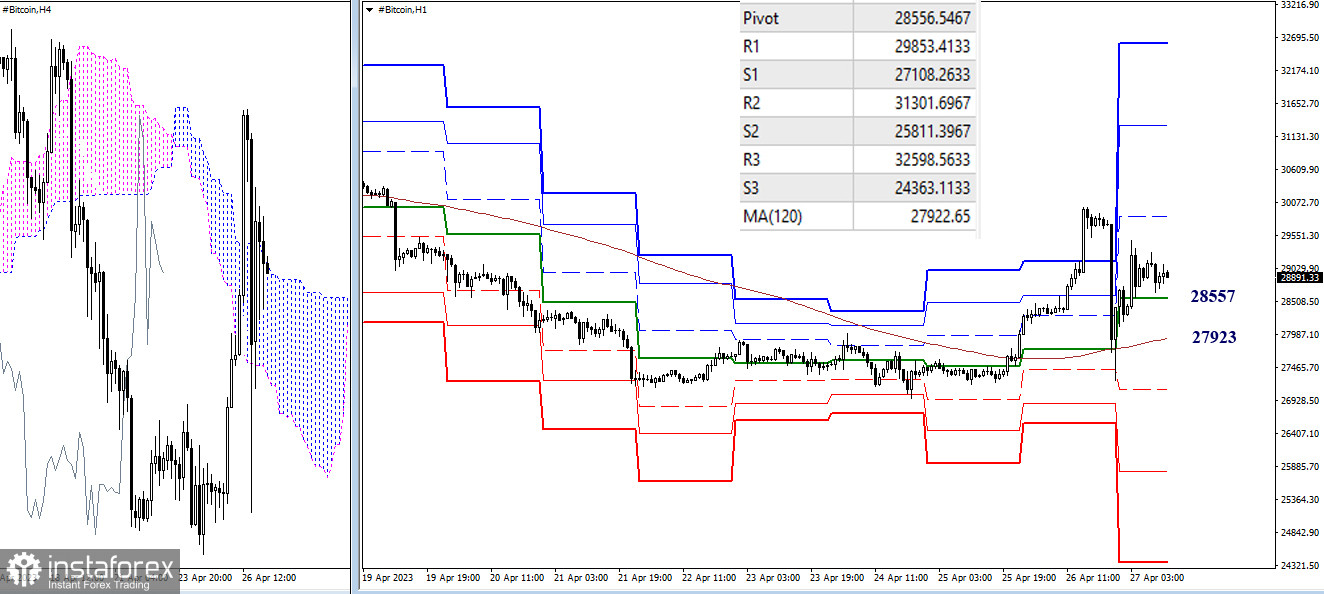

On the lower timeframes, the main advantage now belongs to the bulls, as the market works above the key levels. The resistance levels of the classic pivot points (29,853 - 31,302 - 32,599) serve as benchmarks for the continuation of the upward trend today. The breakout of the key levels 28,557 (central pivot point of the day) - 27,923 (weekly long-term trend) will change the current balance of power, handing the initiative over to the bears. If the bears take advantage of this, the downward targets 27,108 - 25,811 - 24,363 (supports of the classical pivot points) will become relevant within the day.

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)