The EUR/USD currency pair showed a new downward movement on Thursday, albeit quite weak. As we have repeatedly said, there is no logic in the pair's movements. In the medium term, an upward trend persists, which raises no doubts. In the short term, the pair jumps up and down, changing the direction of movement every day. Both the first and second tendencies are illogical. The European currency has been growing for almost two months now and, in total – for about 9. During this time, it has managed to appreciate by 2100 points, but we have not seen a significant downward correction after such strong growth. This is the first thing that raises questions. Over the last one and a half to two months, the pair has retreated several times and has overcome the moving average several times but has never managed to continue the decline. That is, all sell signals were ignored. And if, during this period, the macroeconomic and fundamental backgrounds were clearly on the side of the euro currency, there would be no questions. However, the market practically interprets any news in favor of the euro.

Even analysts are confused about the current situation. The fact is that some of them try to explain every movement of the pair logically. For example, yesterday, the dollar rose by 30–40 points on important statistics from across the ocean. Questions immediately arise. Why did the dollar grow at all if the statistics were disastrous? If the market somehow interpreted the next report in its way, why did the dollar rise so weakly? Analysts now try to explain any movement by increasing or decreasing the probability of the Fed raising rates in early May. Macroeconomic events can now be interesting only at the time of their publication, nothing more.

GDP growth rates are falling in the United States.

Frankly, we did not expect any market reaction to the GDP report. Let's assume that the market is always right and that the strengthening of the dollar is logical. In the first quarter, the US economy grew by 1.1% quarterly. Forecasts spoke of a growth of 2.0-2.3%. That is, the actual value was twice as low as market expectations. And the GDP report is considered important. With such initial data, how do we get a 40-point movement? We assumed that the deviation of the actual value from the forecast would be minimal, so we did not expect any reaction, but in reality, the deviation was large! We believe the market proves its indifference to important events and reports daily.

In any case, no matter how the market's expectations for the Fed's rates grow, a negative GDP report should cause a decline in the national currency and a positive one – growth, which we did not see yesterday. As for the probability of raising the key Fed rate in May, it has long been around 80%, and yesterday's GDP report could only lower this figure, not raise it. The worse the economy, the less likely monetary policy will tighten further. At the same time, European GDP is on the verge of "negative growth," but this fact does not bother traders who refuse to sell the euro currency. Therefore, there has been no logical reaction to the fundamental and macroeconomic background for several weeks at least.

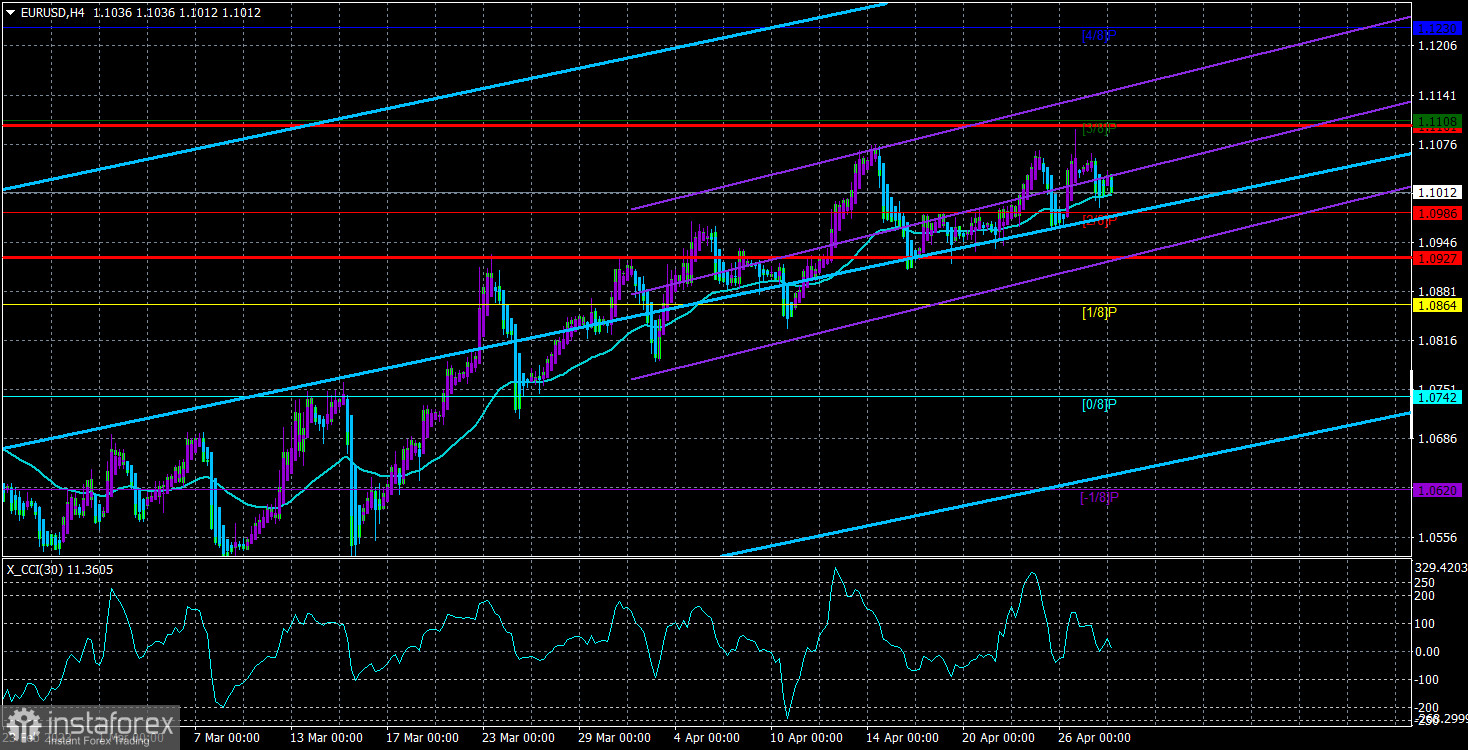

From a technical point of view, the pair did not try to consolidate below the moving average this time. The upward trend continues, and what will happen today is very difficult to say again. The macroeconomic background today will be extensive but not too strong. And the market showed that a reaction to an important report of 40 points, even in the wrong direction, is the best it can show now. Therefore, we expect a new portion of random movements today.

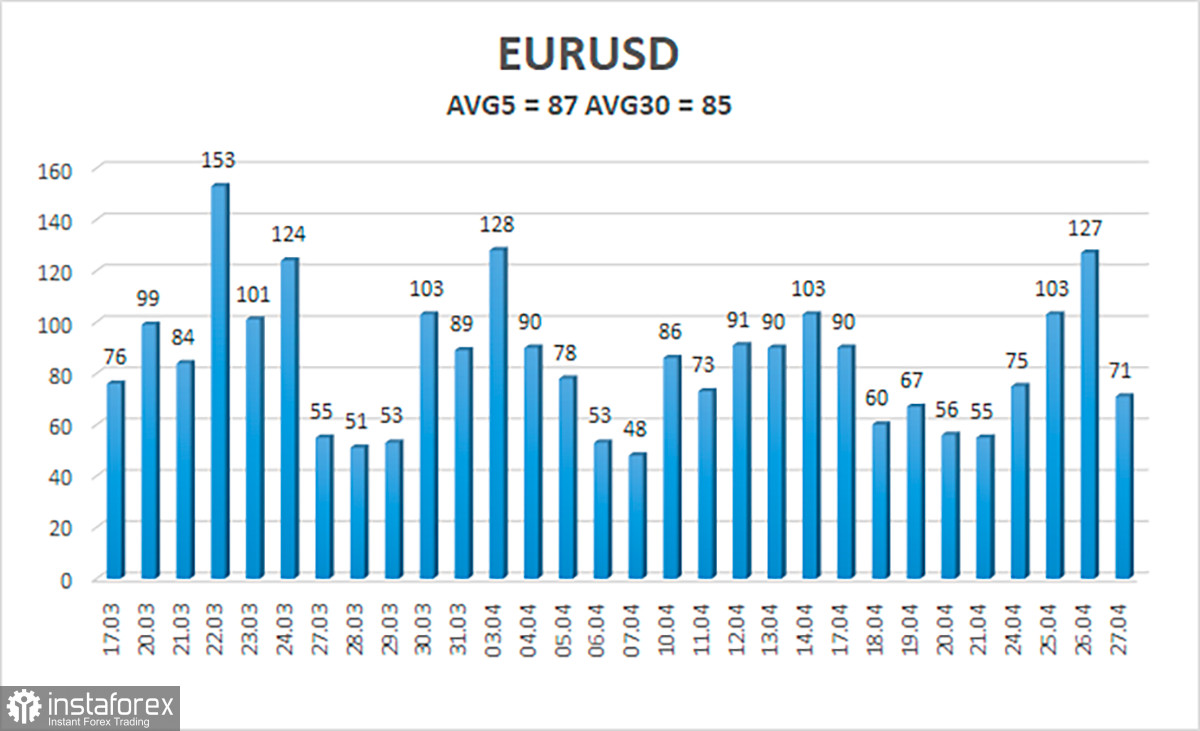

The average volatility of the euro/dollar currency pair over the last five trading days as of April 28 is 87 points and is characterized as "average." Thus, we expect the pair to move between levels 1.0927 and 1.1101 on Friday. The reversal of the Heiken Ashi indicator back up will indicate a resumption of the upward movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair has once again tried to correct but failed. You can stay in long positions with targets of 1.1101 and 1.1108 until the price is consolidated below the moving average. Short positions (but what's the point?) can be opened after the price is consolidated below the moving average with targets of 1.0927 and 1.0864.

Explanation of illustrations:

Linear regression channels – help determine the current trend. If both point in the same direction, the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term tendency and the direction in which trading should be conducted now.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day, based on the current volatility indicators.

The CCI indicator – its entry into the area of oversold (below -250) or overbought (above +250) means that a trend reversal is approaching in the opposite direction.