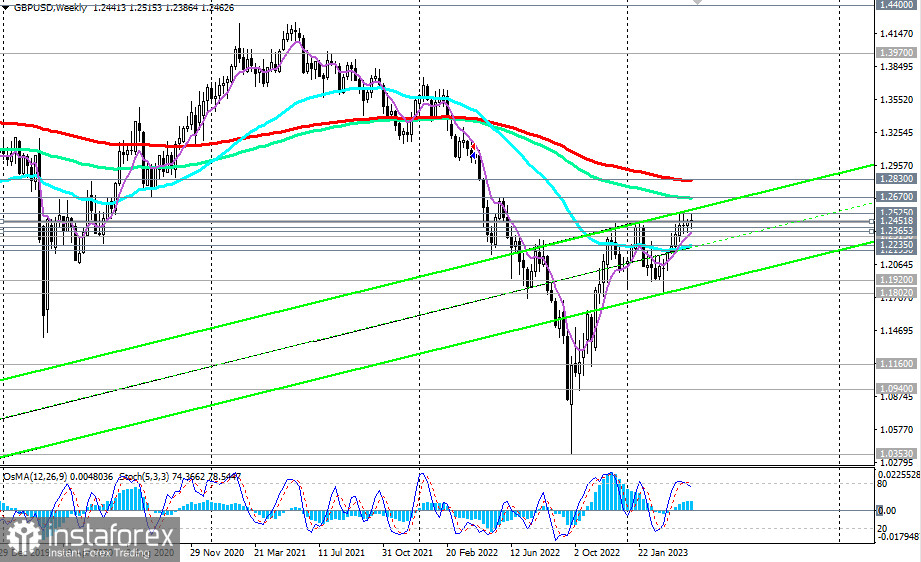

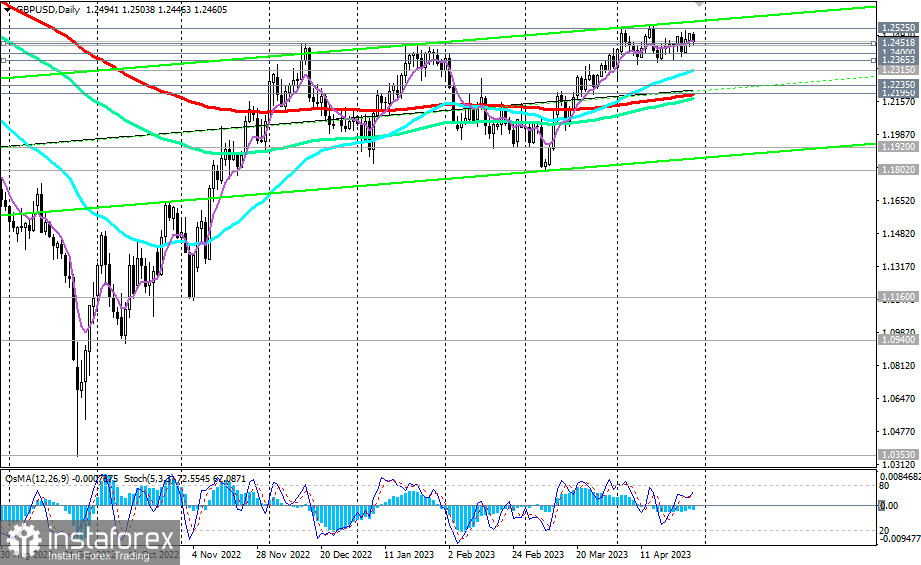

GBP/USD is developing an upward correction, moving towards key resistance levels at 1.2670 (144 EMA on the weekly chart), 1.2830 (200 EMA on the weekly chart), separating the long-term bullish market from the bearish one.

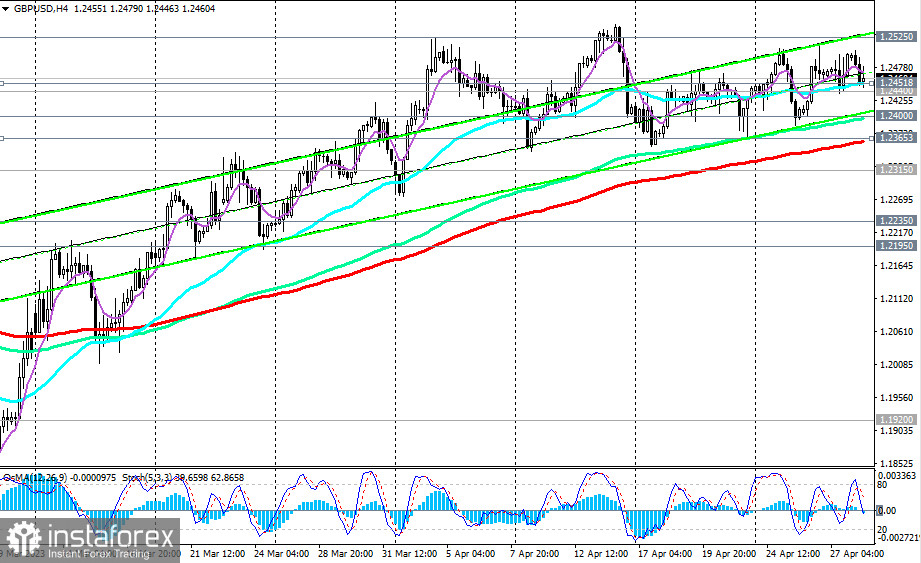

Above the support levels of 1.2451 (200 EMA on the 1-hour chart), 1.2400 (144 EMA on the 4-hour chart), long positions are not threatened. However, a break of the support level at 1.2365 (200 EMA on the 4-hour chart and local support level) may trigger a deeper decline. Breaking the key support level of 1.2195 (200 EMA on the daily chart) will return GBP/USD to the long-term bearish market zone.

In the main scenario, a rebound from the support levels of 1.2451 and 1.2440 will occur, and the pair's growth will continue. A breakout of the local resistance level at 1.2525 will confirm our main scenario of the pair's growth, and the earliest signal could be the breakout of the local resistance level at 1.2475.

Support levels: 1.2451 1.2440 1.2400 1.2365 1.2315 1.2235 1.2195 1.2100 1.2070 1.2000 1.1920 1.1900 1.1800 1.1160 1.09 40

Resistance levels: 1.2475, 1.2500, 1.2525, 1.2600, 1.2670, 1.2700, 1.2800, 1.2830