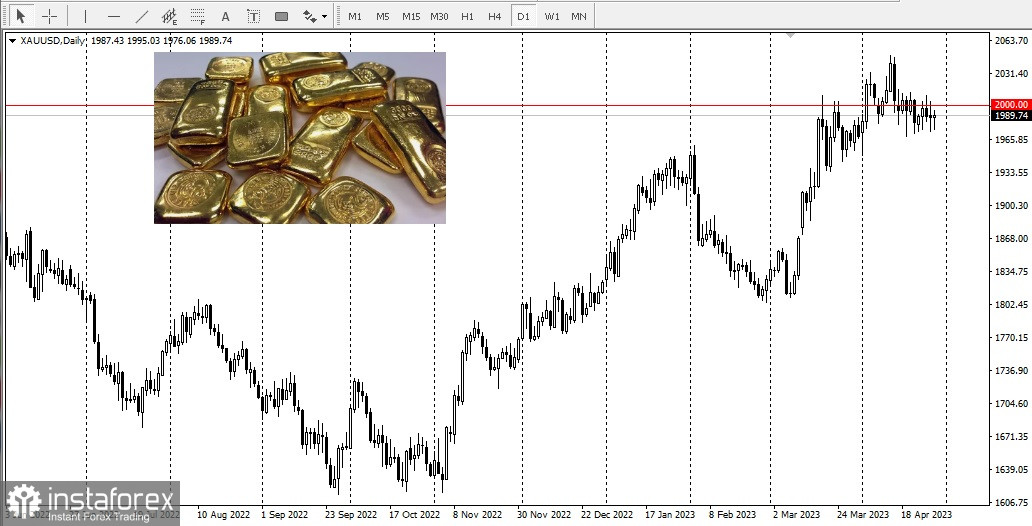

In the latest gold review, most analysts stated that gold prices would continue to decline this week as the Federal Reserve prepares to raise interest rates by another 25 basis points, reiterating its hawkish stance as inflation continues to rise and the threat that inflation could take hold in the economy.

The Fed meeting, which begins on Tuesday and ends on Wednesday, will be a key factor determining the short-term direction of gold movement. But the risk remains on the downside.

Until today, markets have fully priced in a 25 basis point rate hike to take place on Wednesday, but gold will be sensitive to any forecasts suggesting further rate hikes throughout the year. And even to the fact that the central bank may maintain its aggressive monetary policy longer than expected.

According to the CME FedWatch tool, it is clear that the market expects a rate hike in June and throughout the summer as well.

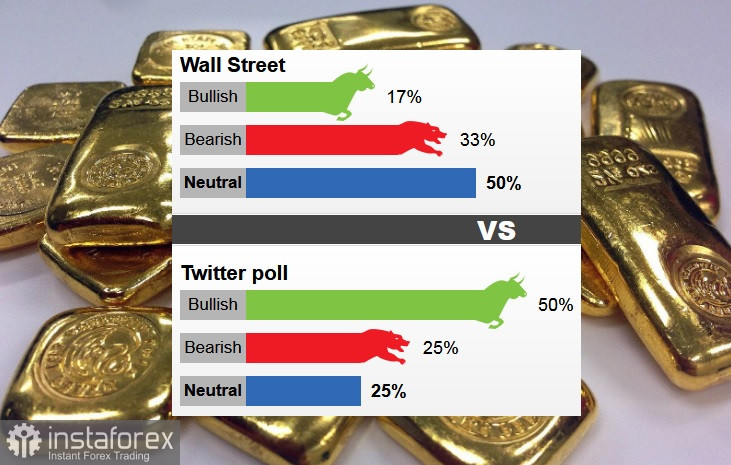

Last week, 18 Wall Street analysts participated in the survey. Among the participants, only three analysts, or 17%, were optimistic about gold prices for the current week. Six analysts, or 33%, predicted bearish sentiment. And nine analysts, or 50%, believe that prices are trading in a sideways range.

As gold prices have fluctuated in the range of $1980 to $1930 per ounce for two weeks, investors have maintained a firm neutral stance for the second straight week.

However, a Twitter poll showed that most retail investors remain optimistic.

The Twitter poll received 160 votes. Of those, 80 respondents, or 50%, expect gold to rise this week. At the same time, bearish and neutral positions received 40 votes each, or 25%.

Despite a solid neutral bias among those surveyed, many analysts believe that gold remains in an uptrend. Some even believe that if the Fed continues to raise interest rates, it will push the economy into recession. Such a movement in the global economy leads to a neutral price movement for gold.