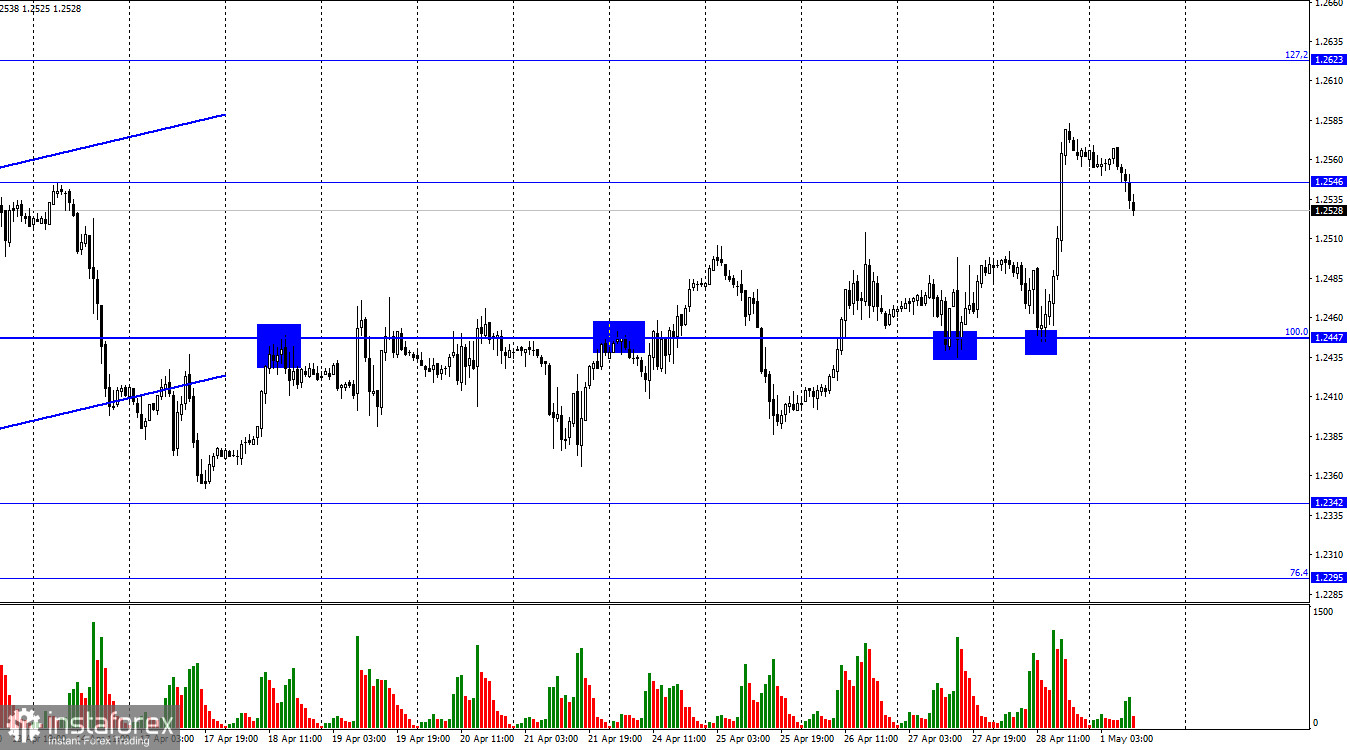

On the 1-hour chart on Friday, GBP/USD rebounded from the Fibonacci level of 100.0% at 1.2447 and reversed to the upside towards the level of 1.2546. On Monday, the pound retreated against the US dollar, and the pair settled below 1.2546. This indicates a further possible fall towards the level of 1.2447.

On Friday, the UK economic calendar was empty, resulting in most of the market movements happening in the second half of the day. At least three reports were released in the US, which could have supported bullish traders. Personal income in the US increased by 0.3%, personal spending remained unchanged at 0%, and the core personal consumption expenditures (PCE) price index recorded a 0.3% increase. Overall, all three reports were quite neutral and did not surprise traders.

However, there was another report that typically receives less attention. The non-core PCE price index decreased to 4.2% from 5.1% in annual terms. The PCE serves as a leading indicator of overall inflation. As a result, the likelihood that the main inflation indicator will continue to decline in the coming months has increased. Along with that, the chances that the FOMC will hike the rate more than once in 2023 have decreased. It might be due to these expectations that the US dollar depreciated on Friday. Apparently, traders are well aware that inflation in the US will continue to decline. Therefore, there is no sense in expecting the Federal Reserve to tighten its monetary policy. So, the reason for the dollar's decline was too obvious and did not come as a surprise to anyone.

The Bank of England's meeting is scheduled for next week, and in my view, the British regulator may pause the tightening cycle. I believe it is time for both the British pound and the euro to decline.

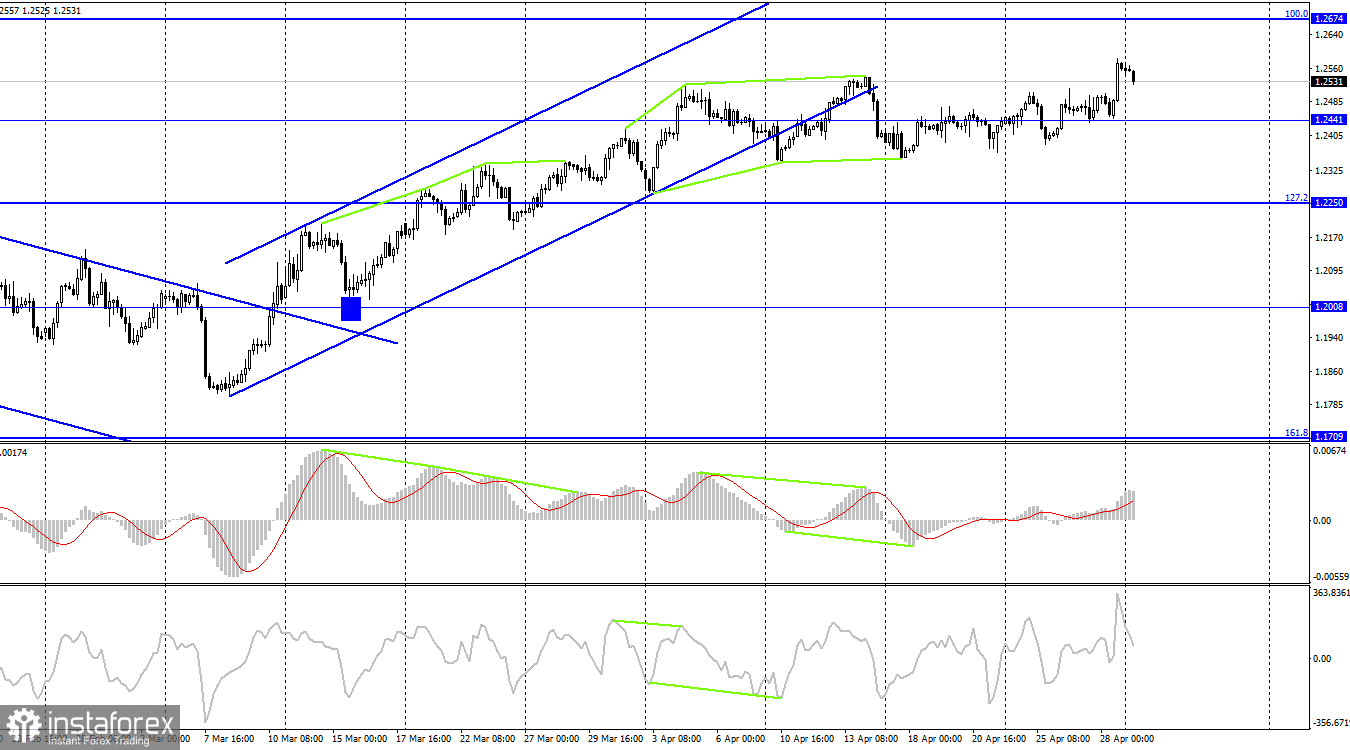

On the 4-hour chart, the pound/dollar pair settled below the ascending trend channel. A breakout of this channel will indicate a change in the market sentiment to bearish. Thanks to the bullish divergence, the pair developed some growth and retested the recent high. The price may continue to rise toward the retracement level of 100.0% at 1.2674. The level of 1.2441 is weak at the moment but every closure below this mark may indicate the start of a decline towards the retracement area of 127.2% at 1.2250.

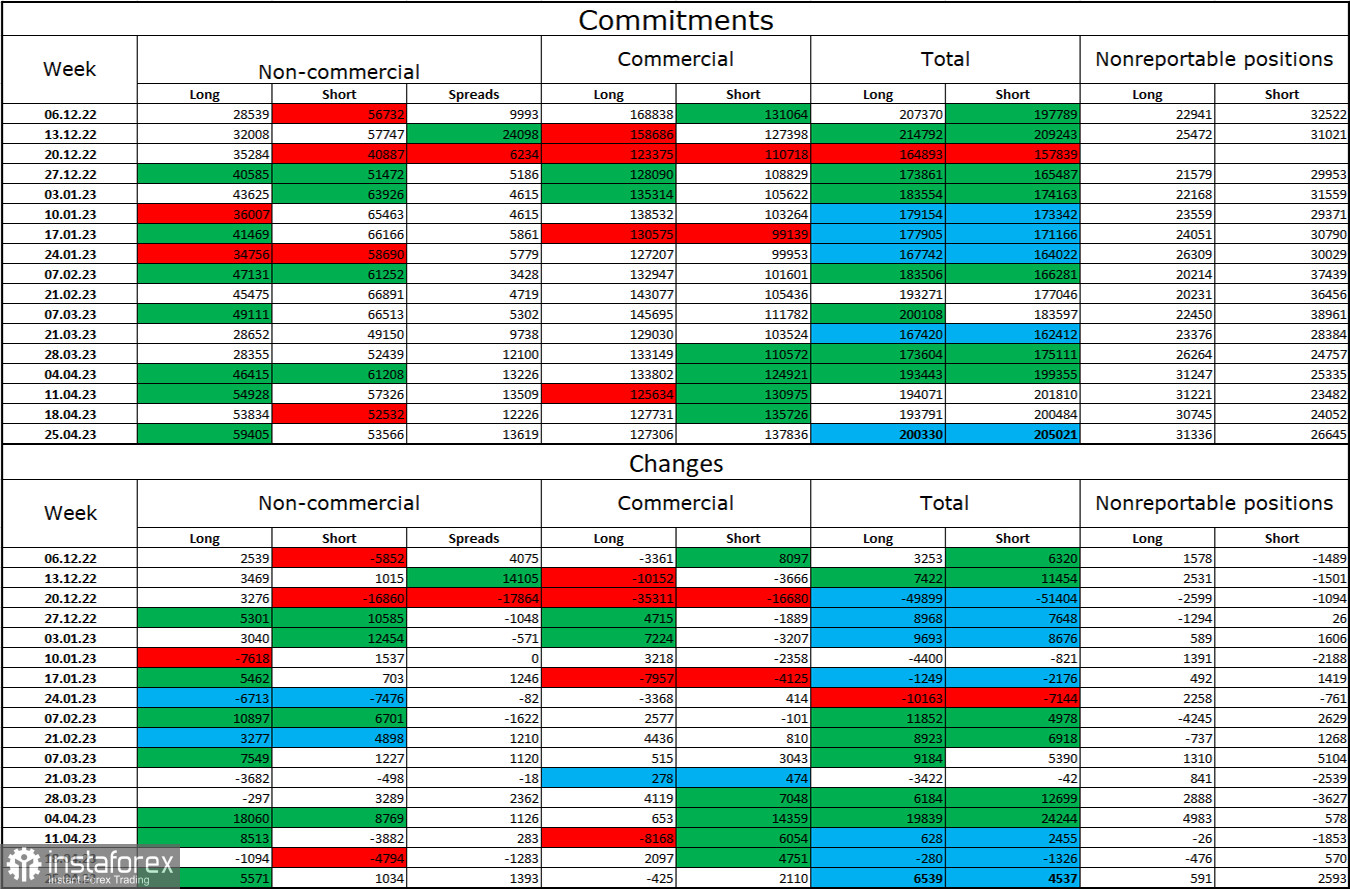

Commitments of Traders report

The sentiment of the non-commercial group of traders has become more bullish over the past week. The number of long contracts rose by 5,571 while the number of short contracts increased by 1,034. The overall sentiment of large market players is now completely bullish. Previously, the market had been bearish on the pair for quite a long time. Yet, the number of long and short contracts is almost equal, with 59,000 vs 53,000 respectively. The pound keeps rising but at a much slower pace than a few months ago. The outlook for the pound remains rather optimistic although it may decline in the near term. The information background no longer supports the bulls.

Economic calendar for US and UK

US – ISM Manufacturing PMI (14-00 UTC).

On Monday, only one important event can be found in the news calendar. Therefore, the influence of the information background on the market will be moderate today.

GBP/USD forecast and trading tips

I recommend selling the pound with the upward targets at 1.2447 and 1.2380 if the pair settles below 1.2546 on the H1 chart. It was possible to buy the pound on a rebound from 1.2447 with the targets at 1.2500 and 1.2546. Both levels have been tested.