It would seem that the news of the second-largest bank bankruptcy in US history should have deprived the EURUSD bears of their support. For a month, SVB remained second on the list, but the long-lived First Republic outperformed it. The bank's assets of $229 billion are second only to Washington Mutual's $307 billion, which collapsed in 2008. The dollar weathered this news with the resilience of a tin soldier. It's not surprising since we are talking about the troubled credit institution being swallowed up by the shark, JP Morgan.

The experience from 15 years ago does not lead to any comforting conclusions. At that time, a global economic crisis erupted. However, the market has a much fresher example in front of its eyes – Credit Suisse, which was also swallowed up by another credit institution – UBS. The stabilization of the situation calmed the euro and caused the franc to rise. So it seems that there is nothing for the EURUSD bears to fear.

Moreover, if everything has indeed settled down, the Federal Reserve's hands will be untied just when it is needed most. The central bank is ready to make a decision that the urgent market has dubbed as historical. Derivatives are almost certain that the 25 basis point hike in the federal funds rate, to 5.25%, will be the last in the cycle. If so, it's time for the dollar to weaken. But for some reason, it does not want to give in.

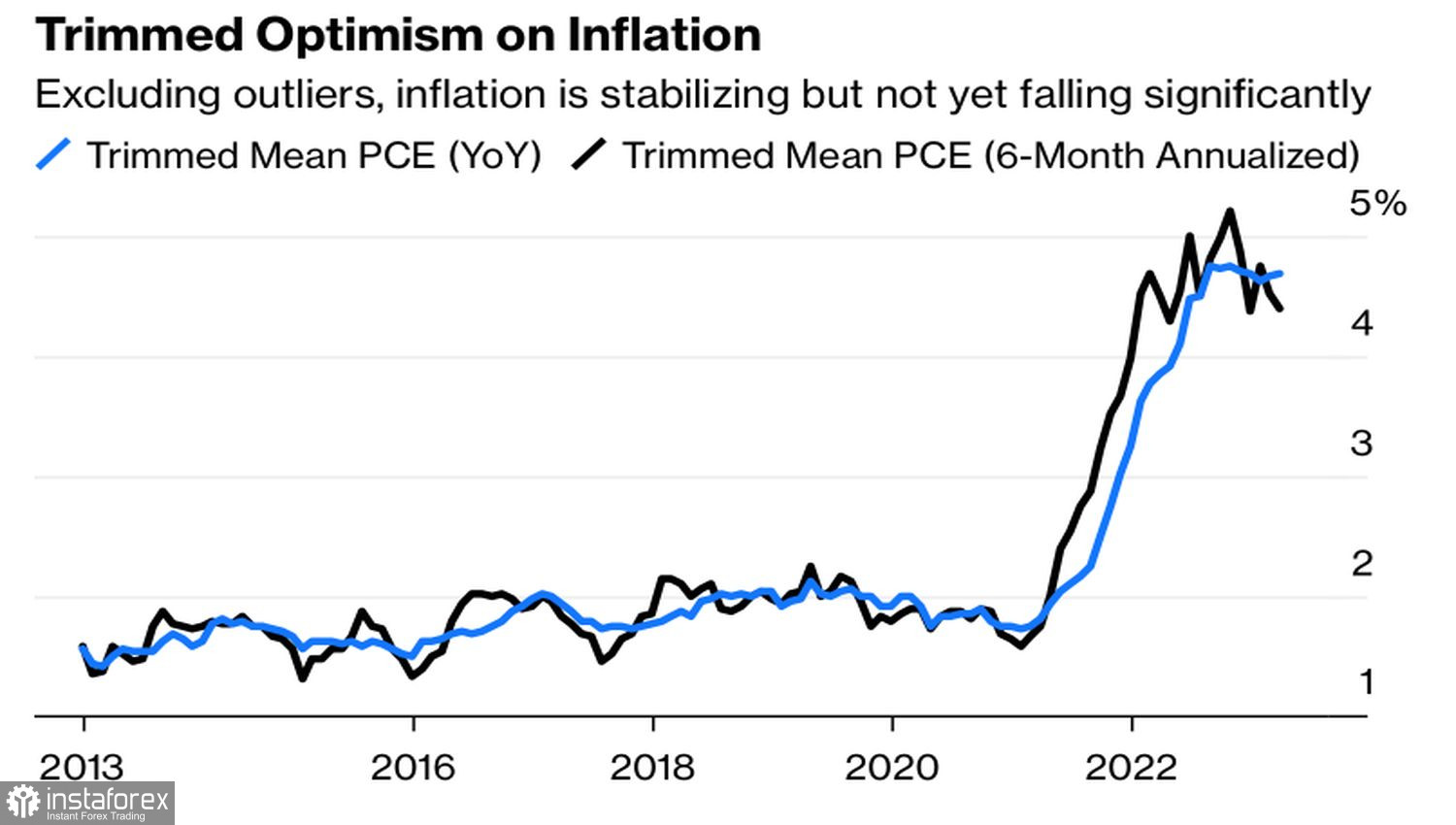

The reasons should be sought both in the stabilization of the situation in the banking sector and in the reluctance of inflation to slow down. Yes, the personal consumption expenditure index seems to have taken a step down, but its truncated average has frozen in place. It seems that the Fed's job is not done yet. Why signal a pause?

Dynamics of US inflation

Thus, investors may be punished. Firstly, for underestimating the Fed. Secondly, for overestimating the European Central Bank. The market is 88% certain that the ECB will raise the deposit rate by 25 basis points and eventually bring it to 3.75%. This factor is already accounted for in the EURUSD quotes and, according to Credit Agricole, is not capable of becoming a driver that would allow the pair to restore an uptrend. On the contrary, the actions of both central banks, as planned by the market, will open the door for the euro to retreat against the US dollar.

I will have to agree with Credit Agricole, but let's not forget about the risk of a 50 basis point increase in borrowing costs. The 12% probability given by derivatives for such a scenario is extremely small, but anything is possible. Moreover, Isabel Schnabel stated that a half-point in May is not excluded.

EURUSD fans are set to a major key, and among them is Bank of America. It notes that the consensus assumed a weakening of the US dollar from the beginning of the year, but by May, the greenback is in the middle of the G10 list. It has room to fall.

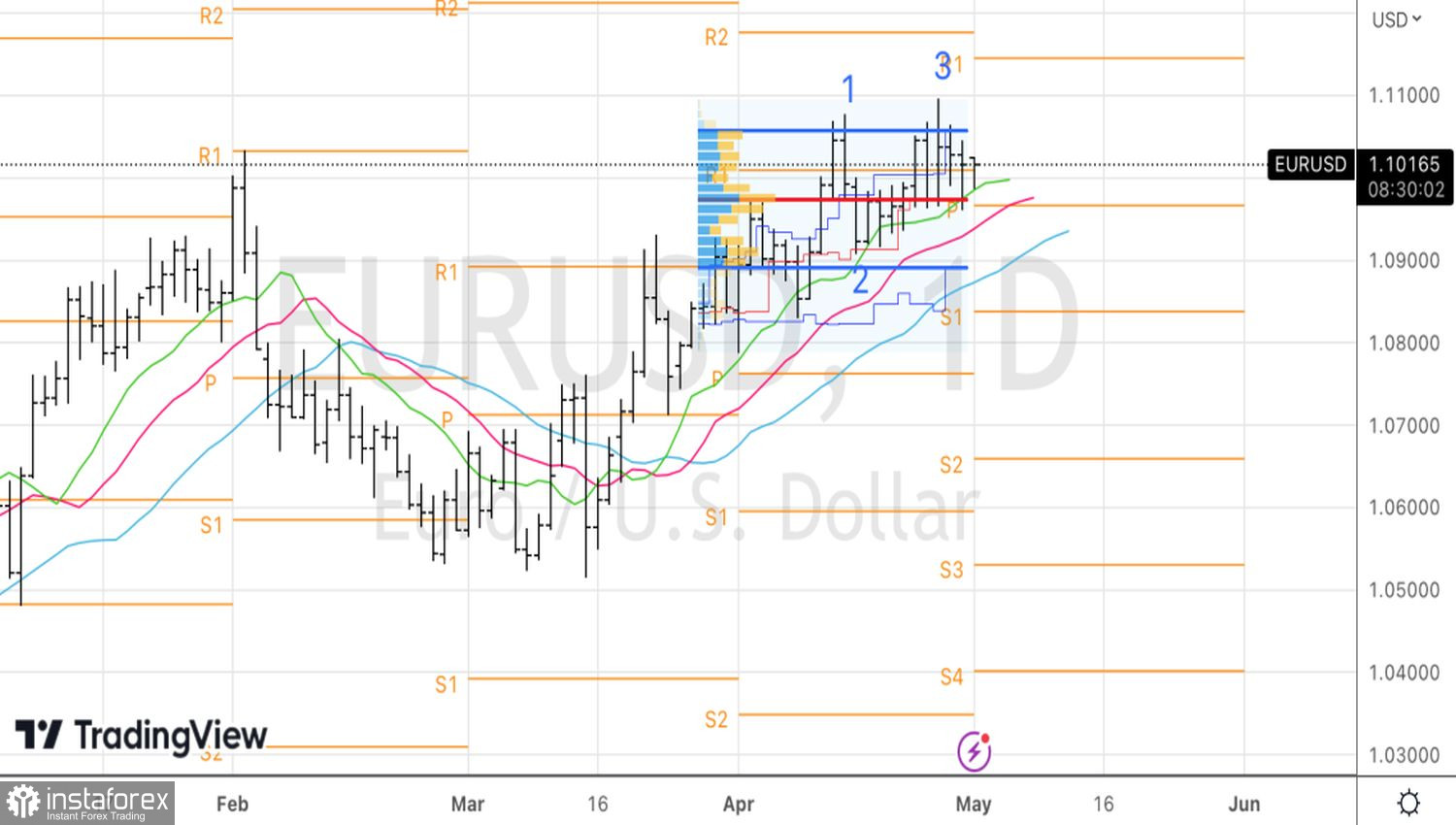

Technically, little has changed on the daily EURUSD chart. The bears' attack on the fair value of 1.0975 ended in fiasco, but who said they won't try a second time? Success in breaking through the support is a reason to open short positions. Buy the euro in case it climbs above $1.1045 and $1.1060.