The ECB meeting will take place this week, which is the main intrigue. The market still needs to understand what to expect from the European regulator, as all the recent statements from its members have yet to answer the question of how much the interest rate will increase in May. The prevailing opinions are "25 basis points" and "50 basis points." However, the market always tries to anticipate regulators' actions, and the answer to this question is crucial for the euro/dollar pair right now.

Most analysts still lean towards a 25-point increase but do not rule out a 50-point rise. They note that 50 basis points would surprise the market, and demand for the EU currency could increase significantly. According to ANZ analysts, the ECB is now caught between three fires: the lagging effect of rate hikes, a banking crisis, and high inflation, which further rate increases can only cool. Based on this, it is clear that the rate decision has yet to be made and will depend literally on one or two votes at the meeting. Tomorrow, the inflation report for April will be released, and the ECB will undoubtedly consider these data when voting. The consumer price index is expected not to decrease and will remain at 6.9%. Core inflation could fall to 5.6% y/y at best. Based on these forecasts, the ECB needs to raise the rate by 50 points, but inflation may not meet the market's expectations.

If it does not decrease in April, the news background will support the euro at least until the end of the week. That is, until Friday, when the US will release data on unemployment and the labor market. Since the American economy is slowing down, it is possible to expect a deterioration in these reports' values, which could further reduce demand for the US currency. It may be an interesting situation where the instrument has been growing for seven weeks, only sometimes with the news background's support. Still, this week, when further growth contradicts everything in the world, the news background could strongly support buyers in the market. The fact that an exciting week awaits us is obvious.

But it is not worth writing off the dollar prematurely. The US economy is slowing down but remains in a very good position. It is not a fact that the reports on unemployment and the labor market will be worse than the market's expectations. For several weeks, the wave markup assumed the formation of a downward trend section for both instruments. Whether this decline starts one week later or earlier no longer matters.

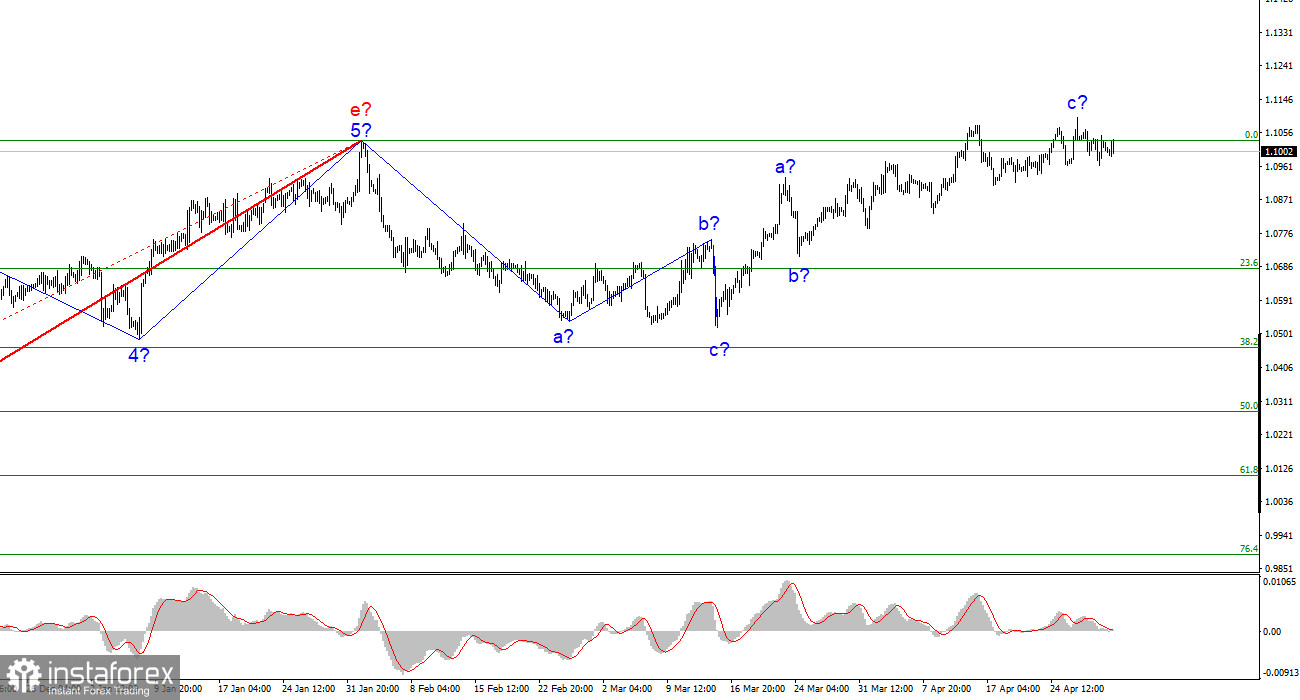

Based on the analysis, the formation of the upward trend section is approaching completion. Therefore, now I recommend selling, and the pair has quite a large space for a decrease. I think the targets in the range of 1.0500–1.0600 can be considered quite realistic. With these targets, I advise selling the instrument on the reversals of the MACD indicator "down" until the instrument is below the 1.1030 mark, which corresponds to 0.0% Fibonacci.

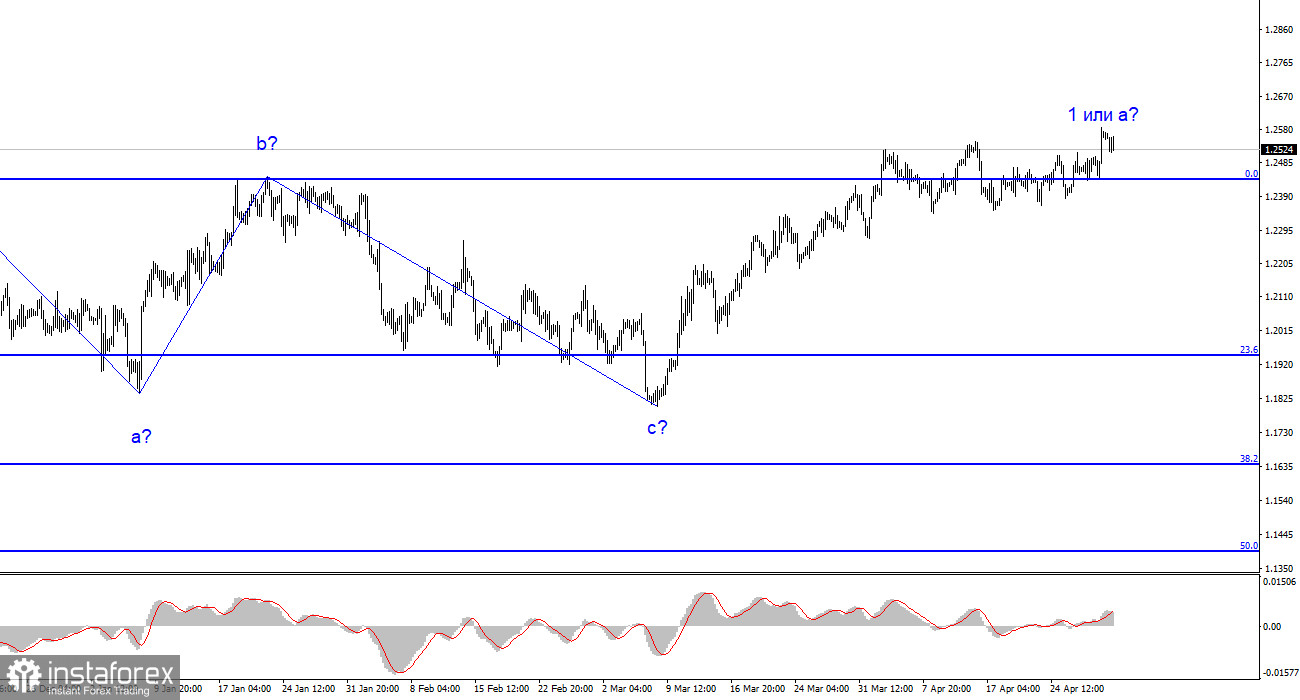

The wave picture of the pound/dollar pair has long assumed the formation of a new downward wave. The wave markup, as well as the news background, is somewhat unambiguous. I do not see factors that would support the pound in the long term, and wave b can turn out to be very deep, but it has not even begun yet. A decline in the pair is more likely now, but the first wave of the upward section continues to become more complex, and quotes have moved away from the 0.0% Fibonacci mark. Now it will be more difficult to determine the beginning of the formation of wave b.