EUR/USD

Yesterday, American traders fully utilized the thin market moment, pushing the euro down by 53 points – to the lows of April 24-26. Trading volumes were the highest since March 24, so most likely, these were direct sales of the euro. Obviously, this was a preparation for tomorrow's Federal Reserve rate hike.

Today, the Eurozone manufacturing sector's business activity index for April will be released, with a decrease expected from 47.3 to 45.5. Eurozone CPI may even rise to 7.0% YoY from the previous 6.9% YoY. In the US, industrial orders in March could show a 1.1% increase. With such data, the euro is unlikely to return to 1.1033. I expect the quote to fall.

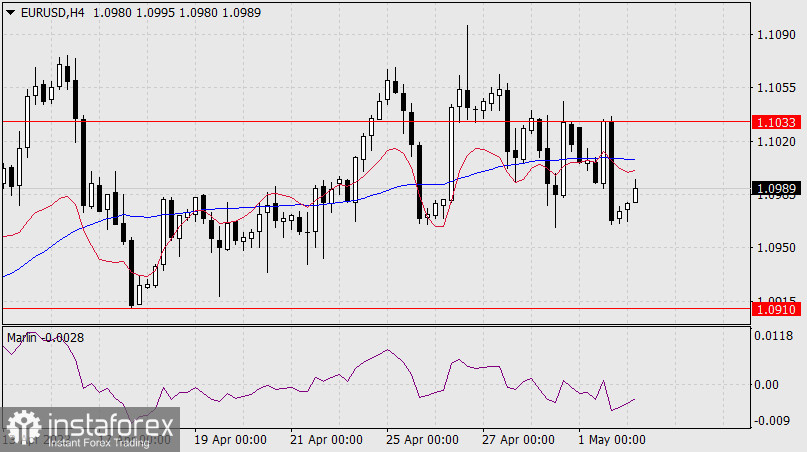

The Marlin oscillator has formed a divergence with the price, and its signal line is already in negative territory.

On the four-hour chart, the price has consolidated below the balance and MACD indicator lines, and the Marlin oscillator has further settled in the area of the downtrend. The short-term trend is downward. We are waiting for the price to overcome the MACD line on the daily chart, which coincides with the low of April 17 (1.0910).