Dollar rose on Monday even though market activity was sluggish due to the public holiday in Europe. Apparently, demand returned after it was reported that JPMorgan Chase is buying the First Republic Bank.

The decision, however, raised a number of questions as after the acquisition, JPMorgan Chase becomes not only the largest bank in the US but also violates antitrust laws by the total size of deposits. In addition, all measures to save the bank with the involvement of a whole range of large investors have been exhausted. Good thing is that the issue is somewhat resolved and that there was no bankruptcy or writing off losses, which is a positive news for the US dollar.

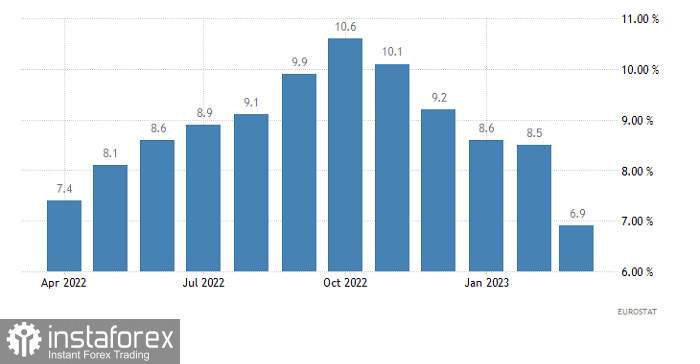

But today, the market is likely to return to the values it was at before the opening of yesterday's trading in the US due to the preliminary assessment of inflation in the eurozone. It is expected to remain unchanged, but some believe that there may be an increase in inflation from 6.9% to 7.0%. If that happens, the ECB will be forced to raise rates by as much as 50 basis points this week. Accordingly, euro will rise, and along with it, the pound. Of course, on the eve of the board meeting, no one will take risks, so today's growth will be somewhat limited.

Inflation (Europe):

Although EUR/USD slipped below 1.1000, there was not much change in the trend as the quote remains in the cycle of medium-term growth. A return above 1.1050 will lead to a new round of rally, while staying below 1.0940 will result in a price decrease.

In GBP/USD, there was an update of the local high, but a pullback occurred immediately after the momentum. It could be a stage for regrouping trading forces. Breaking above 1.2550 will continue the bullish mood.