Oil was not able to live up to expectations. Since the beginning of the year, optimism about China's recovery and pessimism about the U.S. dollar created a bullish backdrop for Brent. In the spring, the North Sea grade seemed to receive another powerful growth impulse in the form of an unexpected reduction in OPEC+ production by 1.1 million bpd. Nevertheless, oil squandered all its achievements, losing about 8% of its value since the beginning of 2023.

Many investors considered China to be the main driver of the expected oil rally. According to OPEC forecasts, China's demand will increase by 5% this year, reaching 15.6 million bpd. However, considering the increase in production to 18.2 million tons in March, the highest level since 2014, this Brent bulls' trump card does not look as formidable as expected.

All the more so as the largest economy in Asia continues to send mixed signals. Due to a 5-day holiday, passenger traffic increased by 151.8% YoY, and the number of railway trips jumped to a new record of 19.7 million. At the same time, business activity in China's manufacturing sector unexpectedly fell below the critical level of 50, indicating a contraction in the sector.

The U.S. economy holds no fewer mysteries. Due to a decrease in freight traffic, demand for diesel fuel is falling, which is a sign of an imminent recession. On the other hand, oil reserves are set to decline for the third consecutive week. This is a sign of high demand.

Dynamics of demand for diesel fuel in the USA

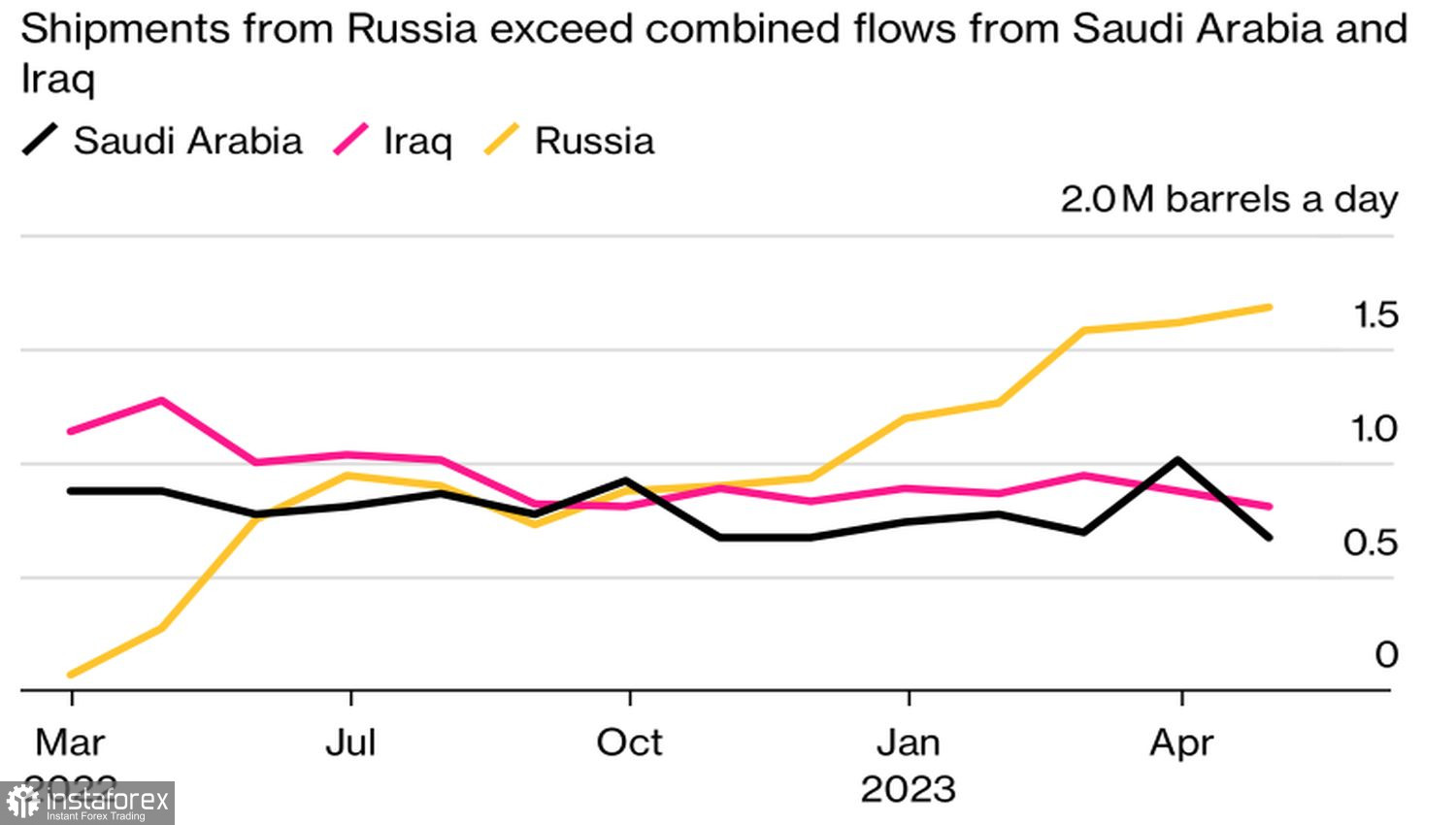

In theory, sanctions against Russia should have reduced the supply of oil from this country. In practice, Moscow managed to find new markets in Asia by lowering prices. As a result, the import of Russian oil to India for the first time in history surpassed the combined supplies to this country from Iraq and Saudi Arabia.

Such contradictory information from China, the U.S., and Russia confused investors, and producers and consumers begin to conflict with each other. Hedge funds that increased their net longs in oil to 15-month highs after OPEC+'s verdict on production cuts are now rapidly reducing them. The IEA accuses the cartel of fueling inflation, and in response, OPEC accuses the International Energy Agency of stoking market volatility through calls for reduced investment in production.

Dynamics of oil supplies to India

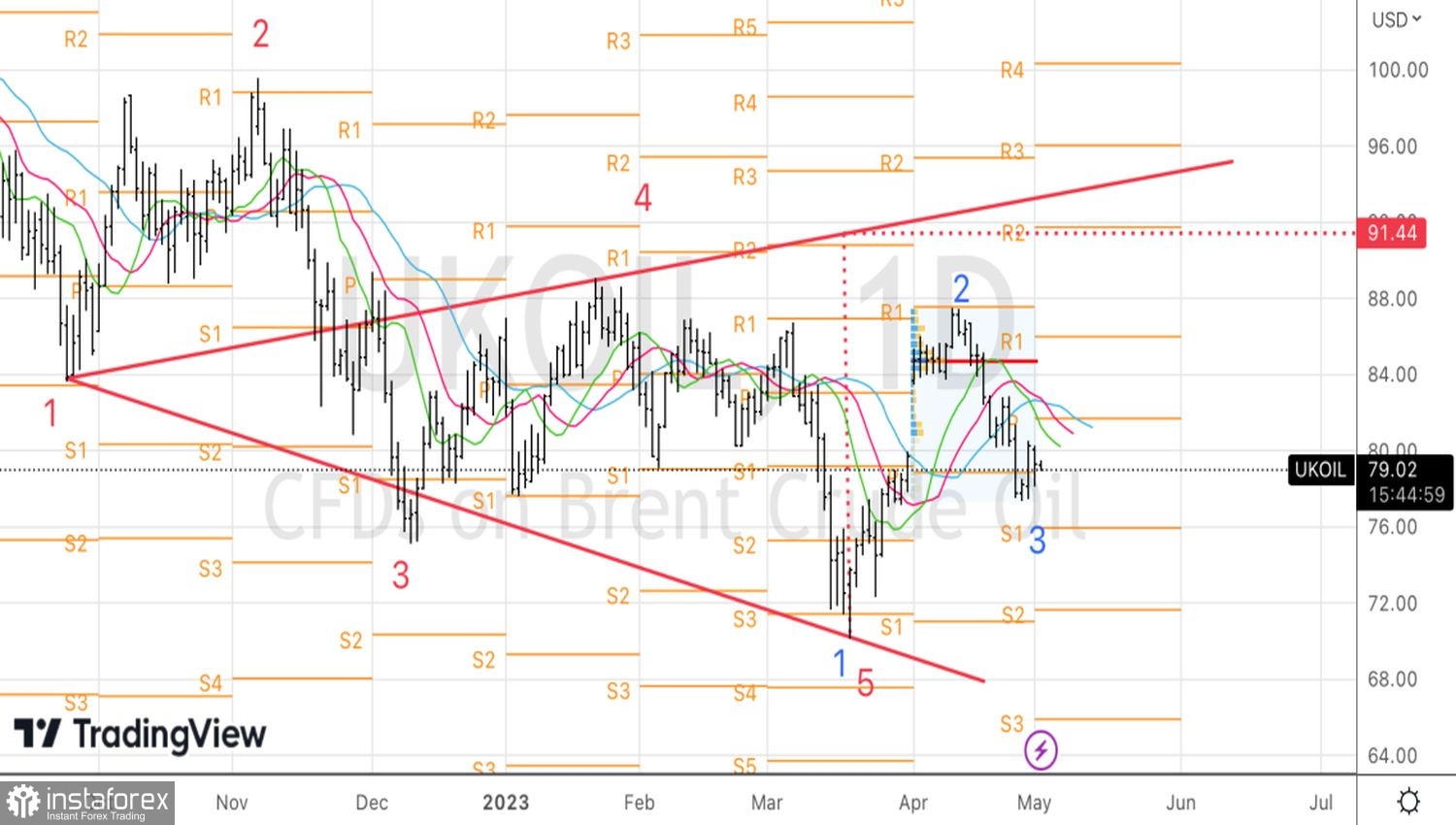

It seems the oil market is stuck in place and doesn't know which direction to move in. In such a situation, there is a high probability that, as usual, it will move in the opposite direction from the U.S. dollar. In turn, the dollar awaits the Fed's decision on the federal funds rate. If Jerome Powell hints at an increase in June, the USD will strengthen, and oil will continue to weaken. The absence of signals will paint the opposite picture.

Technically, a combination of Wolfe Wave and 1-2-3 patterns may come into play, so we'll use the breakout of resistances at $80.15 and $81.65 per barrel for Brent purchases.