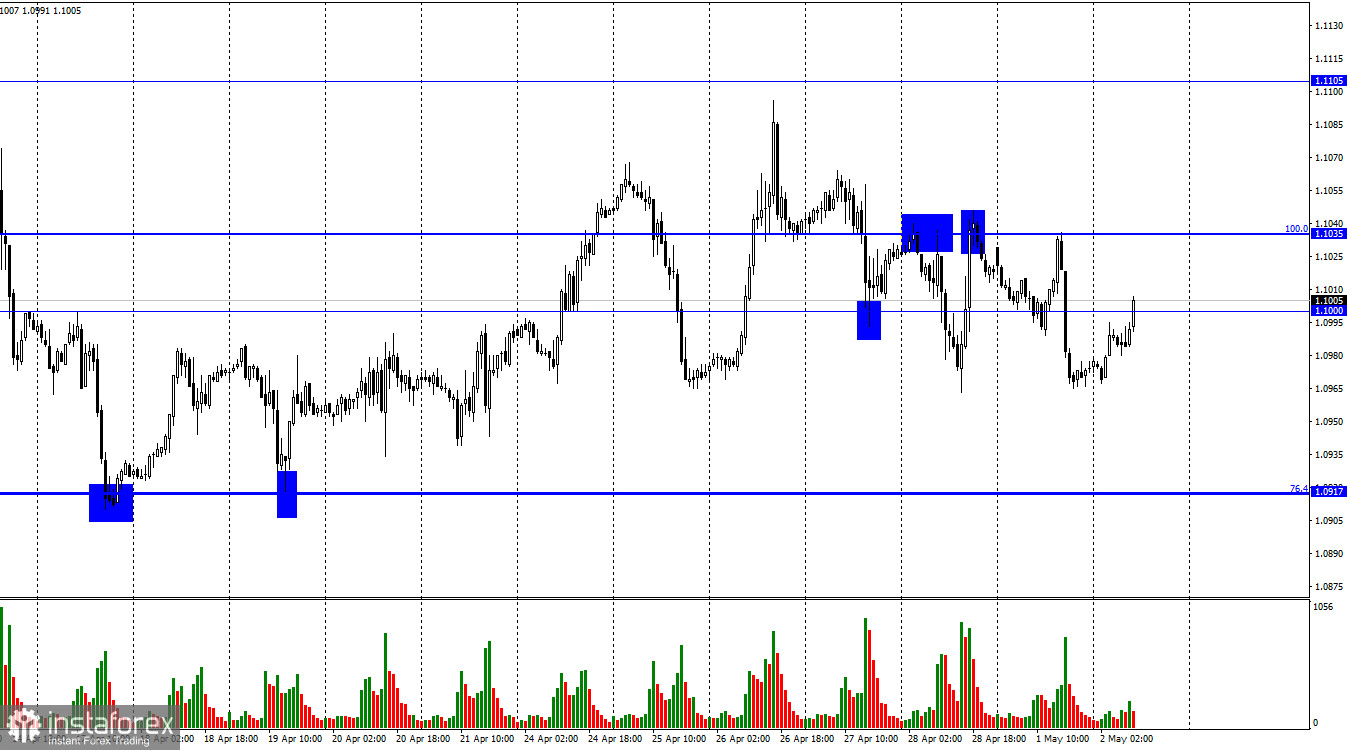

On Monday, EUR/USD pulled back from the Fibonacci retracement level of 100.0% at 1.1035, reversed to the downside, and headed towards 1.0965 where it settled last Friday. I would describe the movement of the pair in recent weeks as flat. Neither bulls nor bears are leading the market now but bulls have slightly more power. The situation can change dramatically this week.

Economists agree that today's inflation and core inflation data will have a big impact on the European Central Bank (ECB) decision, which will be announced on Thursday. Traders still wonder whether the regulator will raise interest rates by 0.25% or 0.50%. If inflation decreases slightly and core inflation accelerates again, a more "aggressive" decision can be expected on Thursday. This scenario would undoubtedly benefit the euro. Currently, the market still leans more towards a 0.25% rate hike. If it is raised by 0.50%, bulls will get a good reason to add more long positions on the pair.

However, it's important to note that this week will also see plenty of significant events in the US, which could support the US dollar. The Federal Reserve's decision can already be considered hawkish as the regulator continues to raise interest rates, while inflation in the US is decreasing at a decent pace, including core inflation. On Friday, unemployment reports and Nonfarm Payrolls will be released, which are no less important, as they will determine when the Fed will begin easing its monetary tightening. Either way, I believe the US dollar has excellent chances for growth this week as well.

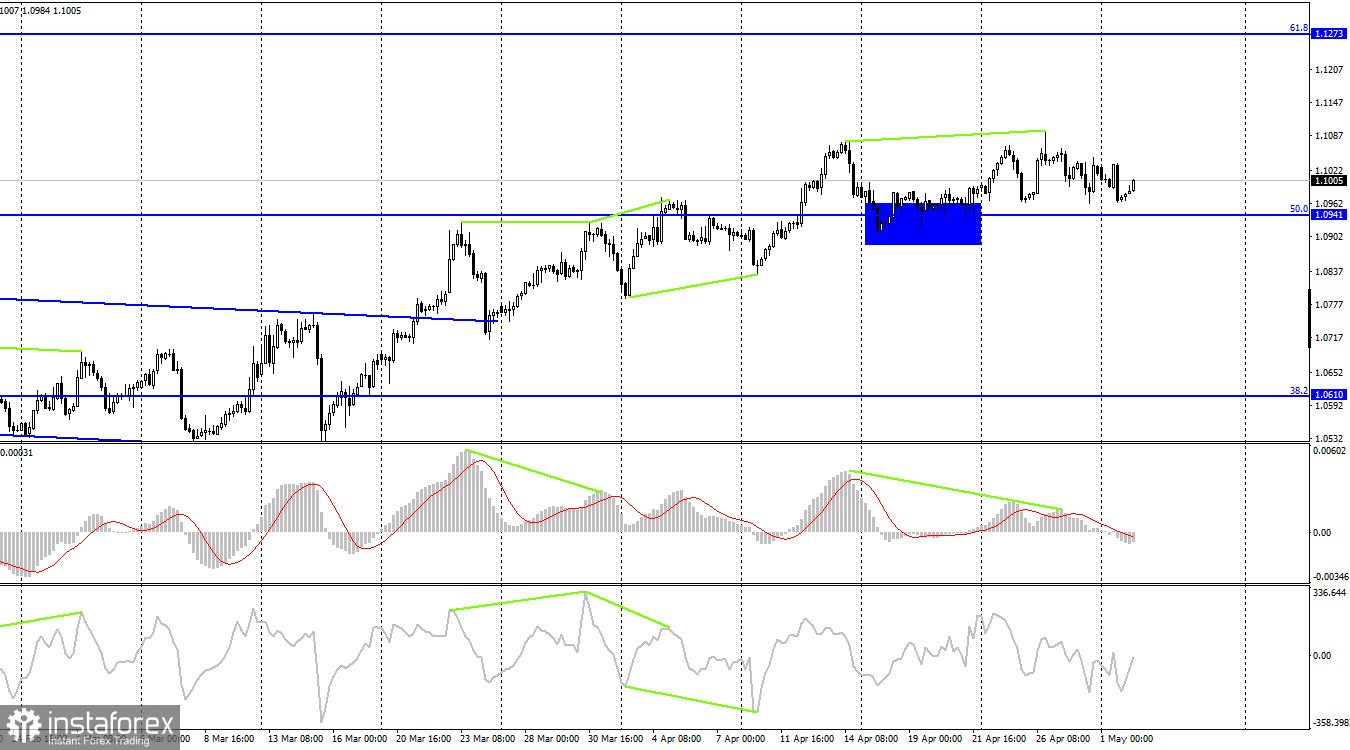

On the 4-hour chart, the pair has consolidated above the sideways channel, suggesting further growth in the direction of the 61.8% retracement level at 1.1273. The bearish divergence of the MACD indicator was in favor of the US currency, initiating a decline towards the 50.0% Fibo level at 1.0941. A rebound from this level will send the price higher while closing below it will signal a continued decline towards the 38.2% retracement level at 1.0610.

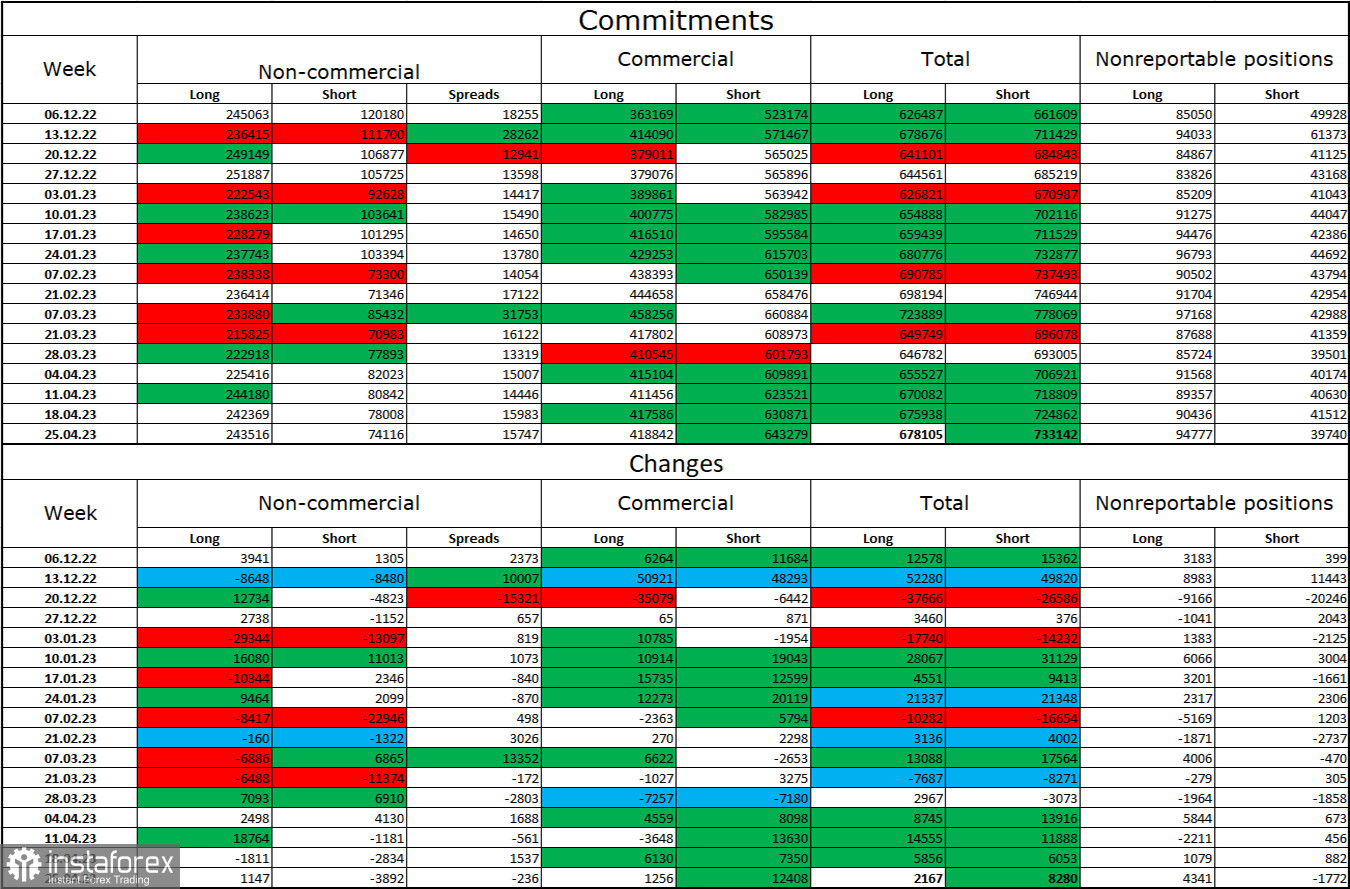

Commitments of Traders report:

In the last reporting week, traders closed 1,147 Long contracts and 3,892 Short contracts. The sentiment of large market players remains bullish and continues to strengthen overall. The total number of Long contracts held by speculators now stands at 243,000, while Short contracts amount to only 74,000. The European currency has been growing for over six months, but the information background is starting to change, which may lead to a decline in the euro. The ECB may reduce the rate hike pace to 0.25% this week, which is unlikely to please euro buyers. The difference between the number of Long and Short contracts is threefold, which suggests that bears may become active soon. At the moment, the strong bullish sentiment persists, but the situation is expected to change in the near future. In recent weeks, the euro has merely been holding at the reached highs without further growth.

Economic calendar for US and EU:

EU – Manufacturing PMI (08-00 UTC)

EU – Consumer Price Index (09-00 UTC)

US – JOLTS Job Openings (14-00 UTC)

On May 2, the economic calendar has several key reports. Therefore, the influence of the information background on traders' sentiment will be moderately strong today.

EUR/USD forecast and trading tips

It was possible to sell the euro on a rebound from the level of 1.1035 on H1 with the targets at 1.1000 and 1.0965. These trades can be closed now. New short positions can be opened after a bounce from 1.1000 or 1.1035 with the target at 1.0965 and 1.0917. You can buy the pair on H1 after a pullback from 1.0917, setting the targets at 1.1000 and 1.1035.