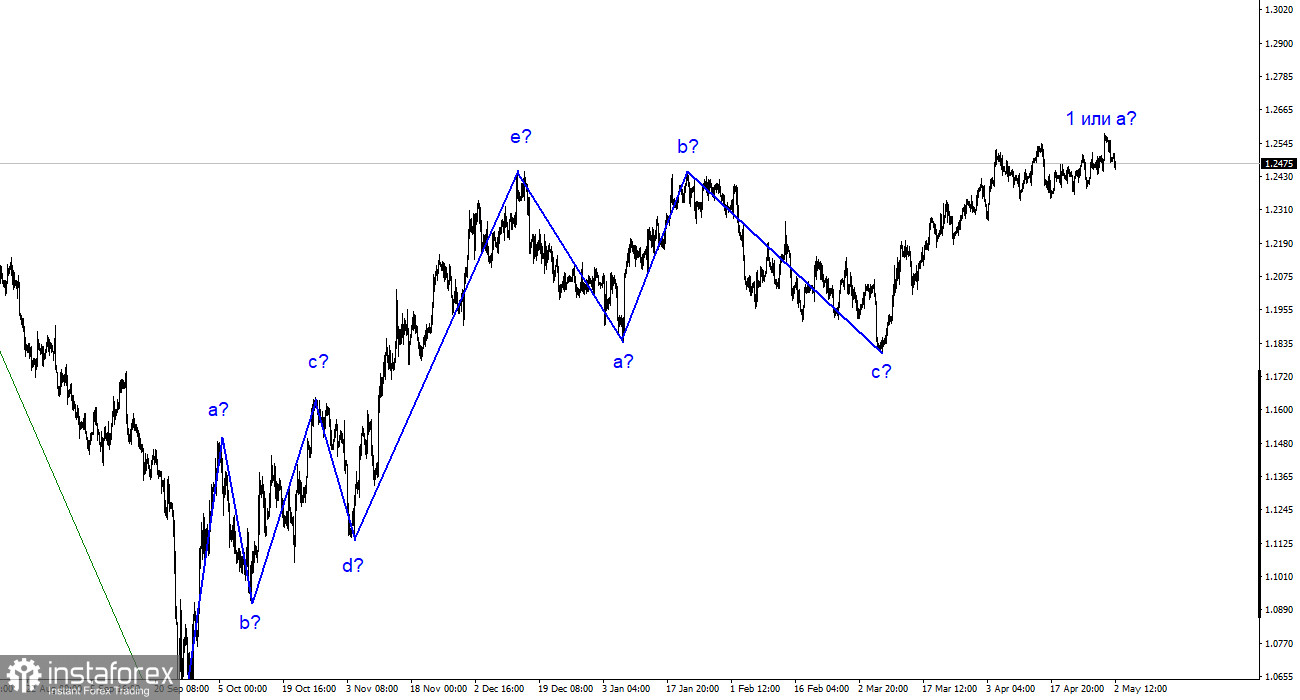

The wave markup for the GBP/USD pair still looks complicated because it does not look like a classic corrective or impulsive trend section. Since the current upward wave went beyond the peak of the last wave b, the entire downward trend section consisting of waves a-b-c can be considered complete. Although it weakly resembles the trend section for the same period in the performance of the euro currency, it must be admitted that both pairs have built descending three-wave sets of waves. If this assumption is correct, a new upward trend has begun for the pound. Since I can identify only one wave starting on March 8, there is every reason to assume that forming a new trend section will take a long time. Both pairs should build similar wave formations. If this is indeed the case, wave 2 or b for the pound may be extended, and at the same time, a descending three-wave can be built for the euro. Thus, I expect a deep wave b, as in the case of building the previous three-wave. Therefore, it is possible to expect a decline in the pair to the 1.1850 mark or slightly higher. However, at the moment, wave 1 or a continues to become more complicated.

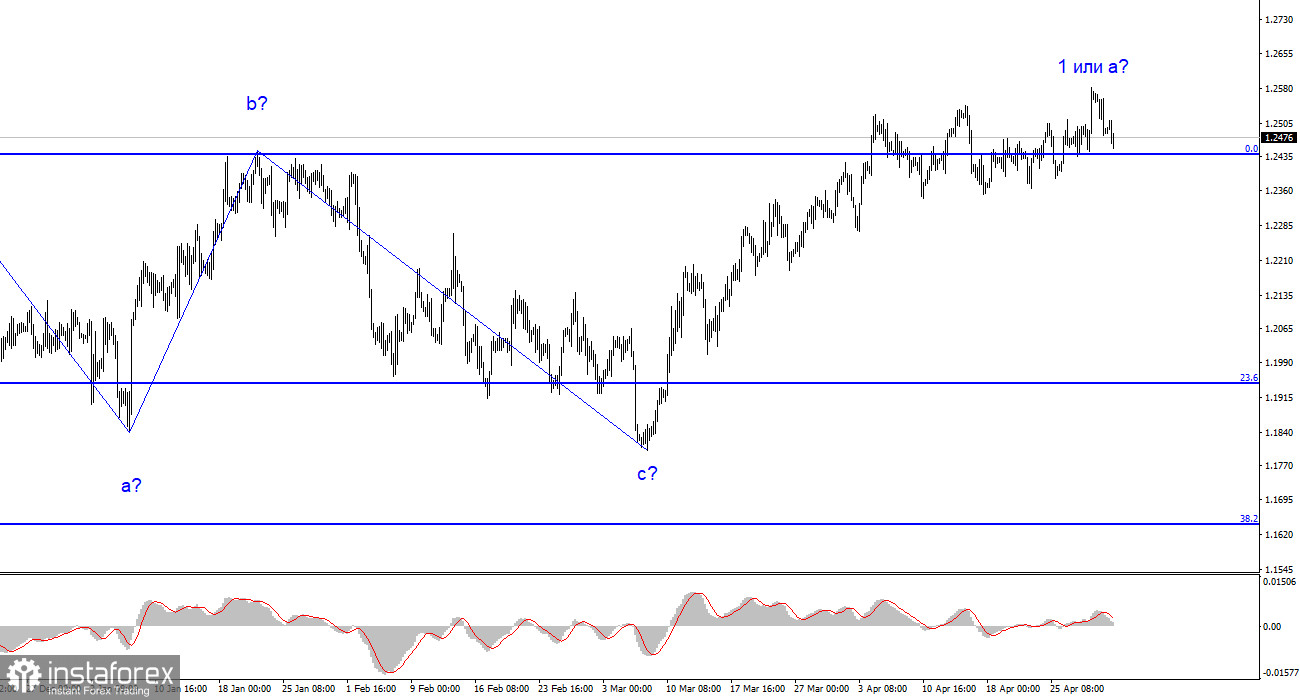

The exchange rate of the GBP/USD pair fell by 20 basis points on Tuesday. In the first half of the day, only one report was of interest to the British pound, but at the same time, demand for the euro currency was declining, and the euro and the pound very often showed similar dynamics. In general, the British pound fell in unison. However, the only report in the UK on business activity in the industry also did not support the pound. The index in April fell from 47.9 to 47.8 points. The decline is insignificant, but the indicator remains below the "red line" of 50.0, below which any value is considered negative. Thus, demand for the pound has been falling for the second day in a row, giving hope for the formation of a downward wave, which objectively should have begun its formation a couple of weeks ago. I admit that the upward wave can take an even more complex and extended form, but this does not prohibit me and other analysts from waiting for a fall based on the wave size and news background, which does not contribute to the further increase of the British pound.

For the remainder of the day, I advise paying attention to the JOLTS report in the United States, which will show the number of open job vacancies in the labor market. In February, the number decreased to 9.931 million; in March, it could fall to 9.7 million. A weak JOLTS report (a more significant decline) will be a harbinger of rising unemployment and may also lower demand for the US currency. Demand for the dollar, in general, remains low; any negative report may lead to a resumption of its decline.

General conclusions.

The wave pattern of the GBP/USD pair has long suggested the formation of a new downward wave. As is the news background, the wave markup is somewhat unambiguous now. I do not see factors supporting the British pound in the long term, and wave b could be very deep, but it has yet to begin. A decline in the pair is more likely now, but the first wave of the ascending section continues to become more complicated, and the quotes have moved away from the 0.0% Fibonacci mark. It will be more difficult to determine the beginning of wave b formation.

The picture is similar to the EUR/USD pair on a larger wave scale, but there are still some differences. At this time, the ascending corrective trend section is completed. But the three-wave descending section may also be completed. And the new ascending trend section can also be three-wave and horizontal.