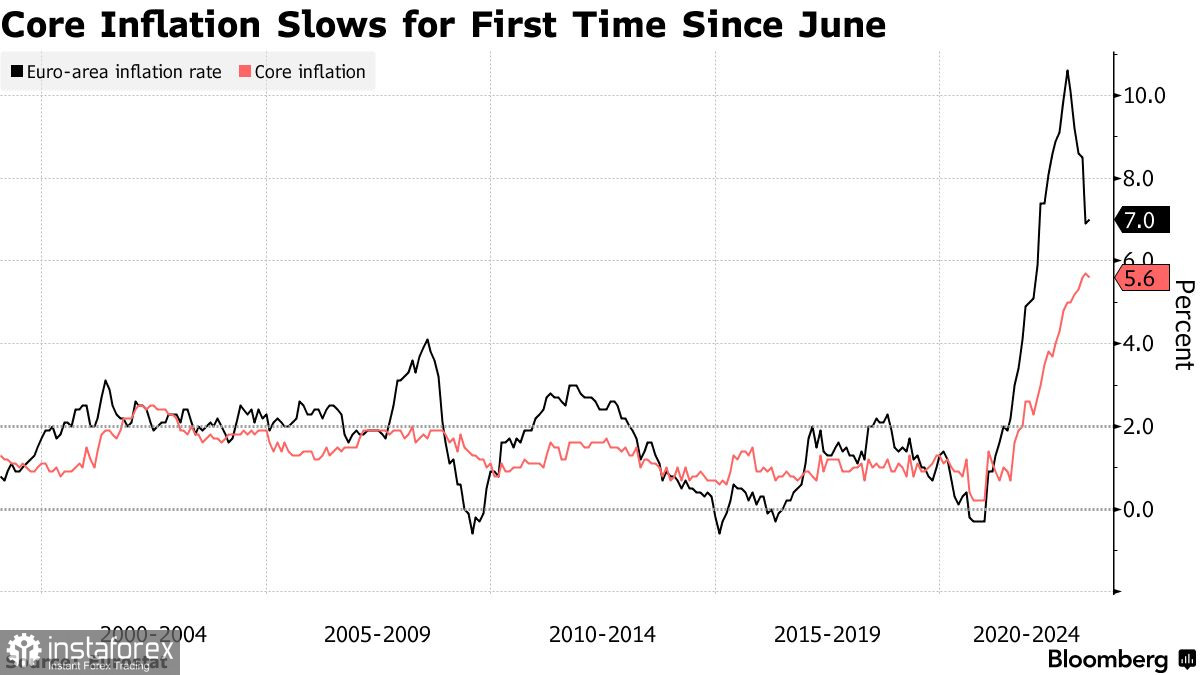

Euro rose on Tuesday afternoon as recent data indicated that core inflation in the eurozone declined for the first time in 10 months, while overall inflation rose again in April. This supported the European Central Bank's arguments that it is necessary to continue an aggressive campaign to raise interest rates.

Even if another rate hike does not lead to euro's growth, it could at least maintain risk appetite. However, the downside is that it severely harms lending, which the ECB is afraid of. Therefore, it is quite difficult to say that the central bank will raise rates by 0.5% tomorrow.

Going back to the recent inflation report, consumer prices excluding volatile categories such as energy and food costs are said to have risen by 5.6% compared to last year in April, slightly lower than the record jump of 5.7% in March. Even so, this was in line with expectations. Overall inflation, meanwhile, jumped to 7%, which is slightly higher than the 6.9% that analysts forecasted and is much higher than the target level of 2%. Price increases for services and energy carriers contributed to the acceleration of inflation.

These numbers are likely to fuel the debate on how much the ECB should raise borrowing costs on Thursday, leaning towards those who advocate a half-point increase. After all, credit standards are tightening even more, with lending only growing by 2.9% after a 3.2% increase a month earlier. Many believe that the central bank will choose a lesser rate hike as they have already tightened by 350 basis points since last summer.

A survey showed that the deposit rate, which is currently at 3%, could peak at 3.75% as early as July this year.

In terms of the forex market, euro bulls have a chance to continue a rally and update the highs, but in order to do so, the quote has to stay above 1.1000 and take control of 1.1030. This will allow a rise beyond 1.1060 and towards 1.1100. In case of a decline around 1.1000, the pair will fall further to 1.0960 and 1.0940.

In GBP/USD, both bulls and bears are trying to control the market. To see growth, the quote has to consolidate above 1.2500 as only that will trigger a much larger rise to 1.2540 and 1.2580. In case there is a decline, bears will attempt to take 1.2470, which could lead to a fall to 1.2430 and 1.2380.