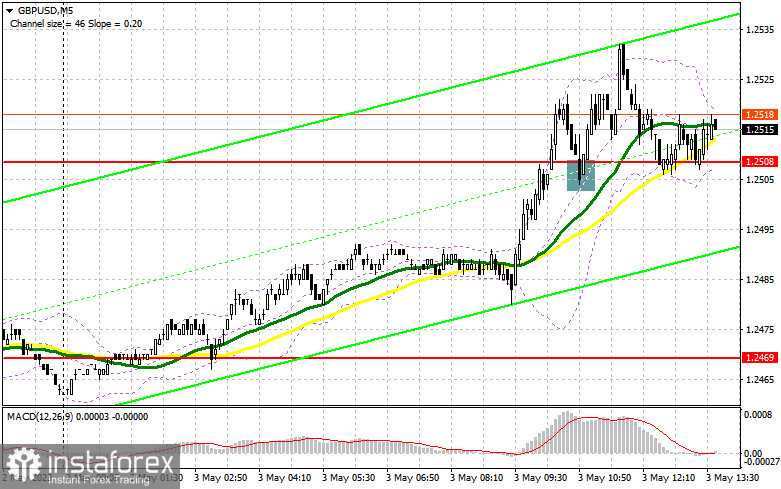

In my morning forecast, I drew attention to the level of 1.2508 and recommended making decisions about entering the market from there. Let's look at the 5-minute chart and figure out what happened there. The breakout and retest of 1.2508 allowed for a signal to buy the pound. When writing the article, this turned into an upward movement of more than 30 points. The technical picture should have been reviewed for the second half of the day.

To open long positions for GBP/USD:

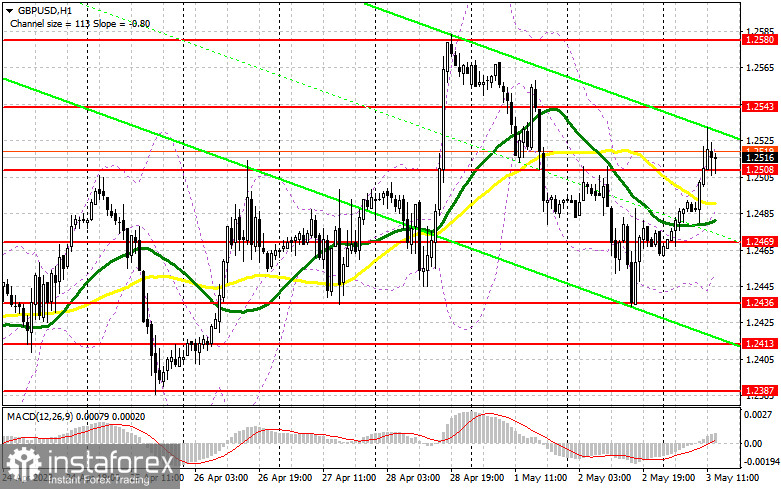

Everything will be decided after the release of reports on the change in the number of employees from ADP and the business activity index in the service sector from ISM. A good active growth of indicators will likely pressure the Fed and market expectations, leading to a momentary strengthening of the US dollar. But the main card will be played after the Federal Reserve decides on interest rates. If plans for future rate hikes are announced, pressure on the pound will return, and the pair will drop. In this case, I will act only on the decline and the formation of a false breakout in the 1.2469 - support formed based on yesterday's results, which will allow for an entry point for long positions with a perspective of a spike to 1.2543. The breakout and retest from top to bottom of this new level will form an additional signal to buy the pound with a move to 1.2580. The furthest target will be the area of 1.2627, where I will fix the profit.

In the scenario of a decline in the area of 1.2508 and the absence of activity from the bulls, which has already been worked out today in the first half of the day, it is best not to rush with purchases. In this case, I will open long positions only on a false breakout in the area of the next support at 1.2469 and 1.2436. I plan to buy GBP/USD immediately on the rebound only from the minimum of 1.2413, aiming to correct 30-35 points within the day.

To open short positions for GBP/USD:

Sellers did not show themselves in the first half of the day, most likely saving their strength for the Federal Reserve meeting. They will need it if the committee announces the end of the tight policy cycle. A good scenario for selling will be a false breakout in the area of the nearest resistance of 1.2543, which may occur after weak US data. This will allow the pound to move down again with the prospect of updating support at 1.2469. The breakout and retest from the bottom to the top of this range will increase the pressure on GBP/USD, forming a sell signal with a drop to 1.2436. The furthest target remains at a minimum of 1.2413, where I will fix the profit.

In the case of GBP/USD growth in the second half of the day and the absence of activity at 1.2543, which is also quite likely, especially considering that everyone is waiting for a soft tone from Federal Reserve Chairman Jerome Powell, it is best to postpone sales until the test of the next resistance at 1.2580. Only a false breakout there will provide an entry point for short positions. Without downward movement, I will sell GBP/USD on a bounce right off the maximum of 1.2627, but only with the expectation of a 30-35 point correction within the day.

Indicator signals:

Moving averages

Trading occurs slightly above the 30- and 50-day moving averages, indicating market uncertainty.

Note: The author on the H1 chart considers the period and prices of moving averages and differ from the general definition of classical daily moving averages on the D1 chart.

Bollinger Bands

In the case of a decline, the lower border of the indicator will act as support around 1.2450.

Description of indicators

• Moving average (determines the current trend by smoothing out volatility and noise). Period 50. Marked on the chart in yellow.

• Moving average (determines the current trend by smoothing out volatility and noise). Period 30. Marked on the chart in green.

• MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

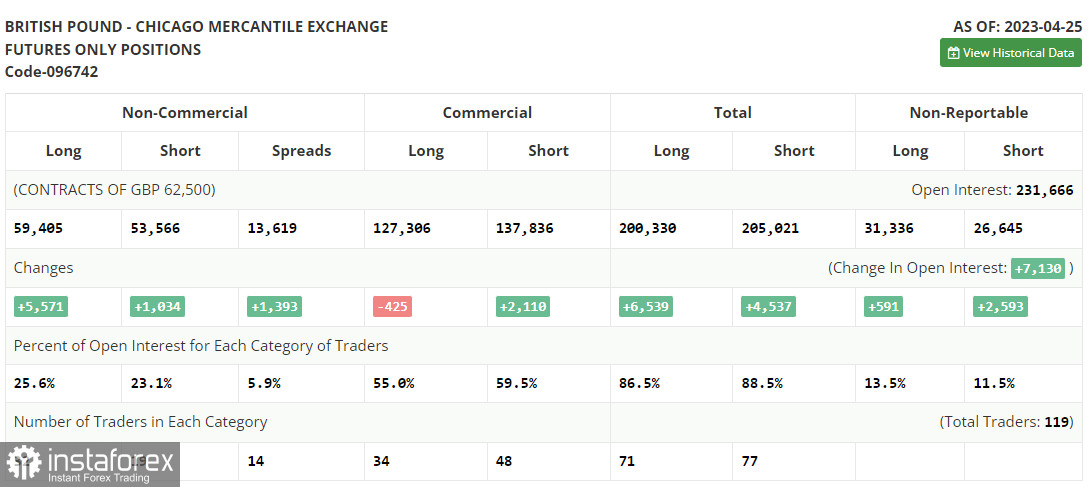

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.