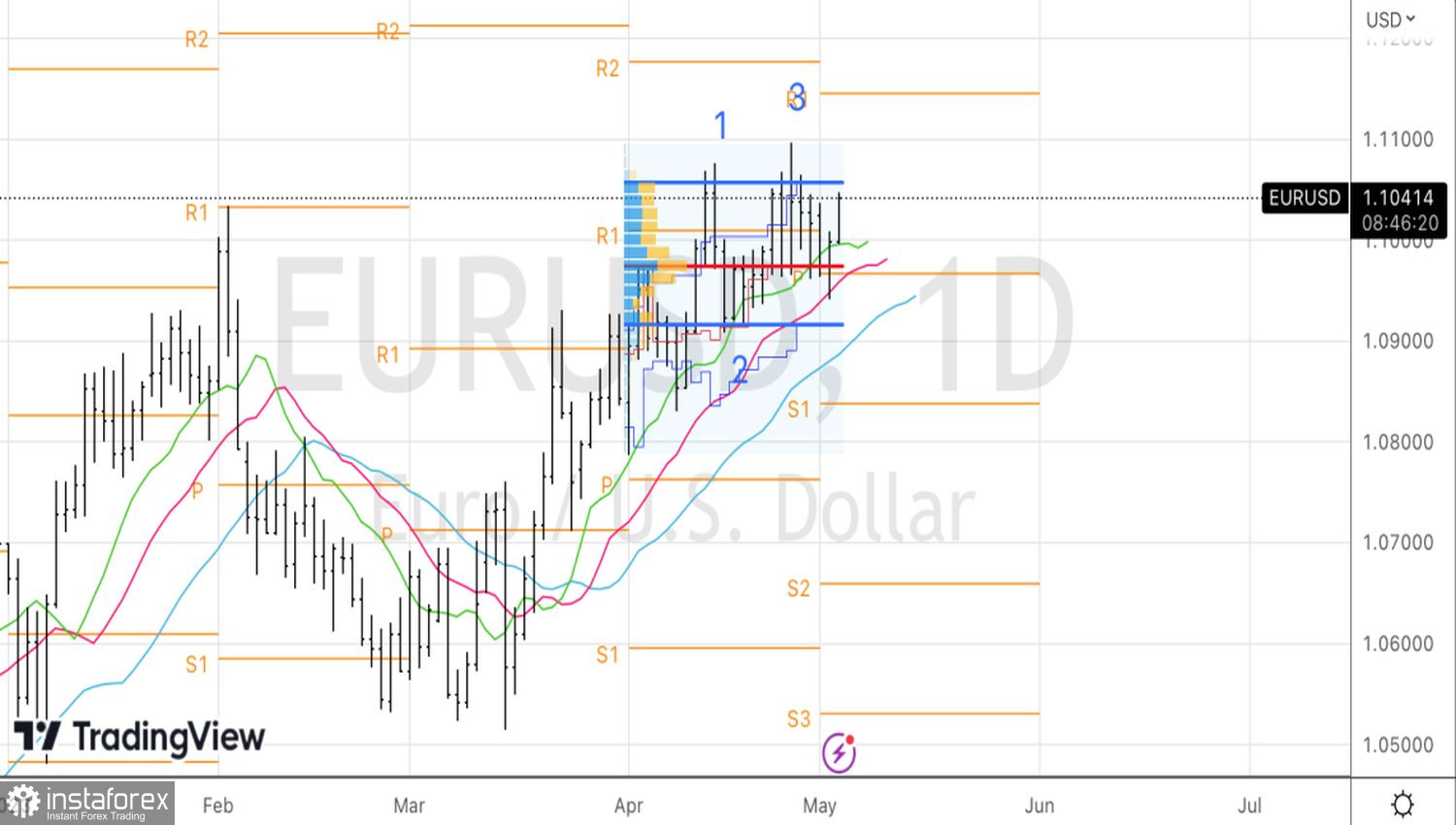

Everything has its reason. The EURUSD pendulum and the numerous false breakouts of support at 1.0975 are related to the market approaching a historic event - the completion of the Federal Reserve's monetary tightening cycle. One of the most aggressive in its 109-year history. Practically everyone is confident in a 25 basis point increase in the federal funds rate, but no one knows for sure whether the 5.25% mark will be its ceiling. Investors will be looking for signs of a pause both in the accompanying statement and in Fed Chairman Jerome Powell's speech.

Monetary policy is the key factor in exchange rate formation in Forex. At its core are the central banks' intentions to bring inflation to the target, which the Fed is doing quite well so far, while the European Central Bank isn't. The 7% increase in consumer prices in the eurozone proves it. The reasons are to be found in both the excessively high energy prices in the eurozone in 2022 and in the slow response of ECB President Christine Lagarde and her colleagues to the threat of high inflation. They started the monetary tightening cycle later than the Fed. They should finish it later as well.

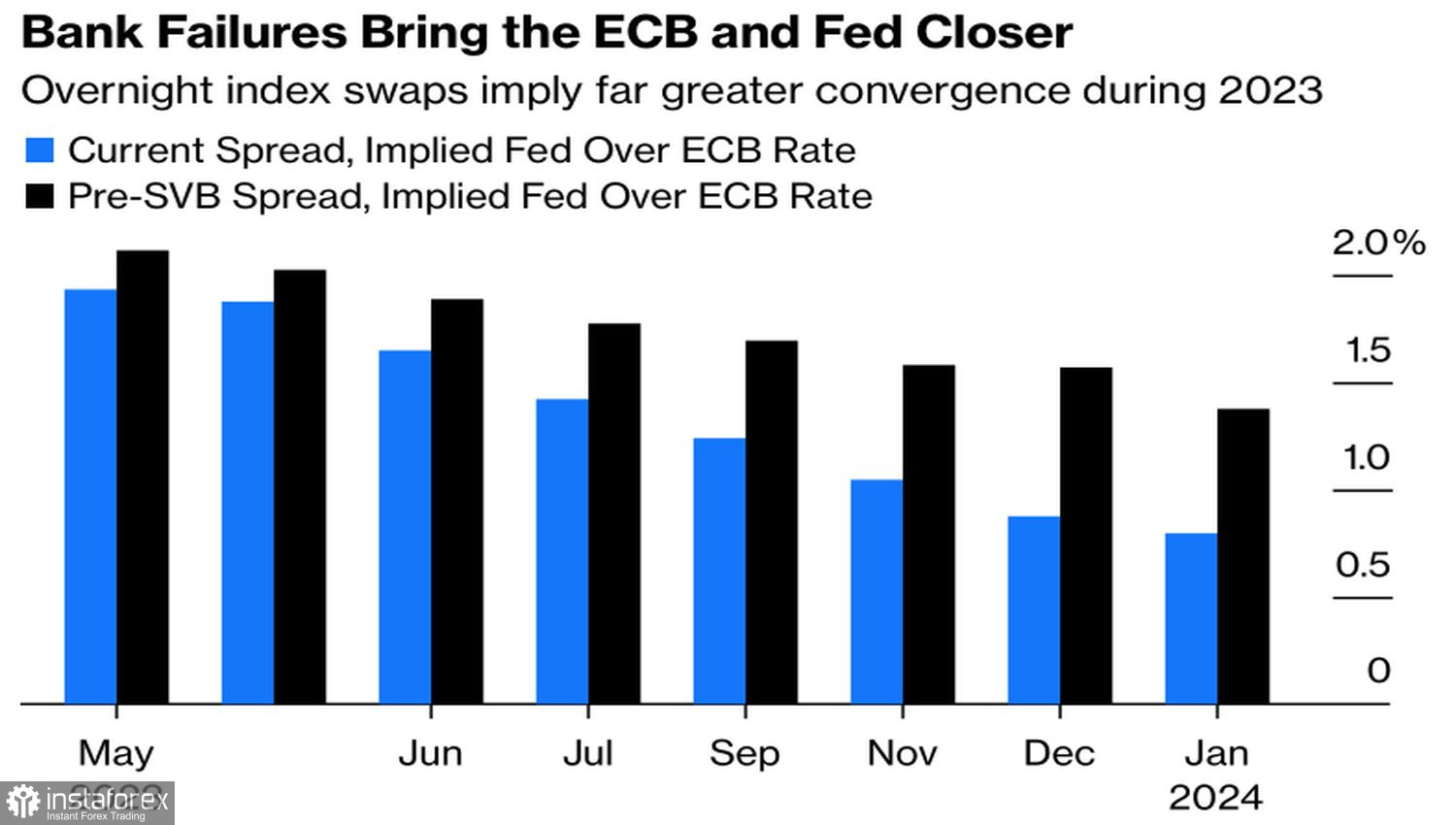

This lagging nature of the ECB's actions last year put pressure on EURUSD and eventually pushed the euro below parity with the US dollar. In 2023, everything turned upside down. The difference in the expected year-end federal funds rate for the Fed and the ECB's deposit rate constantly narrowed, which can explain the rally of the main currency pair.

The dynamics of the differentials of the assumed end-of-2023 rates for the Fed and the ECB

Although the credit market in the US is more flexible than in Europe and less dependent on banks, it was the US that went under. Although only three collapsed, as opposed to several hundred in 2008-2009, these events are equal in terms of assets. The bankruptcies turned out to be the second, third, and fourth largest in American history. This fact allows for discussion on the impact of the credit crisis on the economy and recession. At the same time, the risks of a dovish pivot are growing, no matter how much the Fed talks about the opposite.

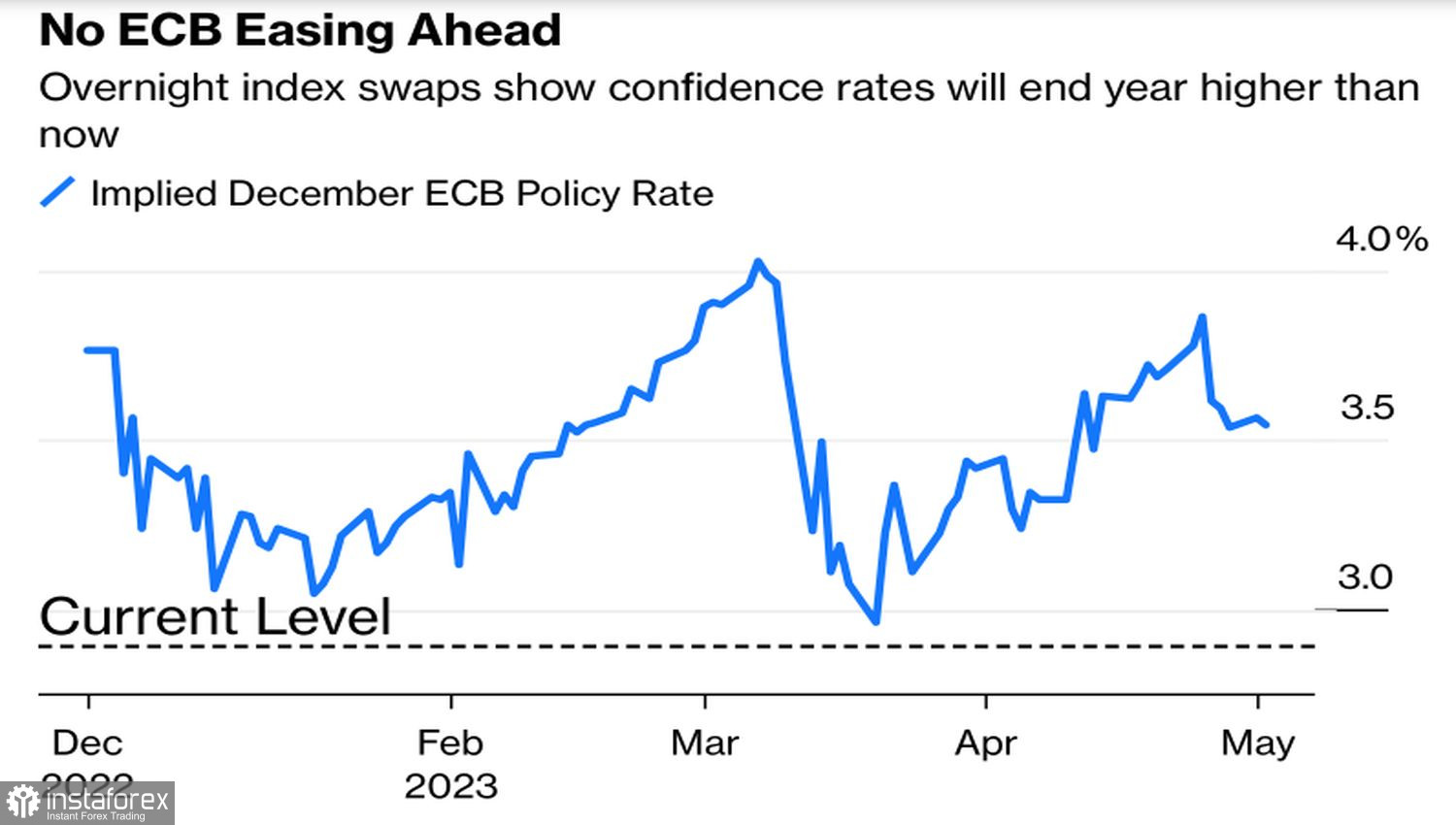

The shocks in the banking systems of the United States and Switzerland have not bypassed the eurozone either. The decline in corporate demand in the eurozone is the most significant since the global economic crisis of 2008-2009. At the same time, banks are tightening lending conditions, which will also reduce the volume of resources provided, slow down GDP, and limit the potential for growth in the ECB's deposit rate.

Dynamics of the expected year-end value of the ECB's deposit rate

It is evident that the decisions of central banks will affect the rates expected by the derivatives market by the end of the year, which is why the market is so nervous. We don't have to wait long.

Technically, the "False Breakout" pattern is playing out. The unsuccessful attack on the lower limit of the consolidation range of 1.0975-1.1055, followed by a return to its middle near 1.1, allowed us to establish long positions. We will increase them in case of a successful resistance breakthrough at 1.1055.