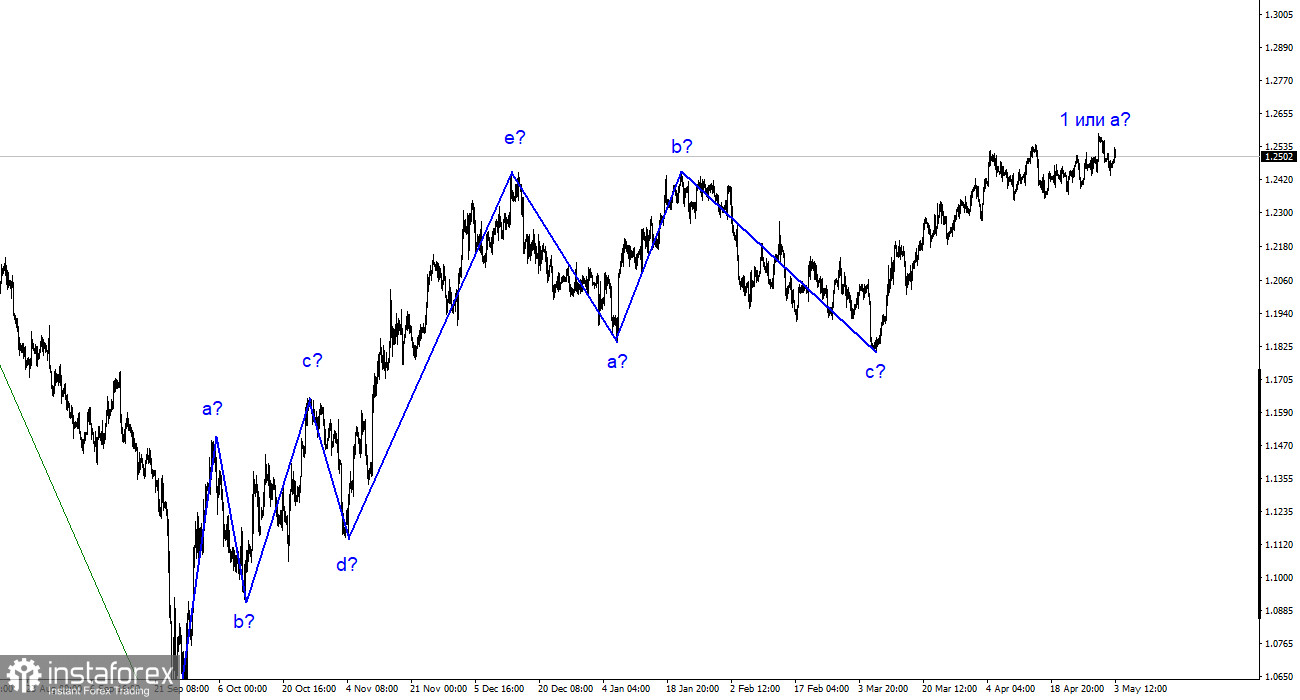

The wave markup for the pound/dollar pair looks complicated because it does not resemble a classical corrective or impulse trend segment. Since the current upward wave has exceeded the peak of the last wave b, the entire downward segment of the trend, consisting of waves a-b-c, can be considered complete. Although it resembles the trend segment for the same period in the performance of the euro currency, it should be acknowledged that both pairs have built downward three-wave sets of waves. If this assumption is correct, then a new upward segment of the trend has begun for the pound. Since I can single out only one wave starting from March 8th, there are good reasons to assume that forming a new trend segment will take a long time. Both pairs should build similar wave formations. If this is indeed the case, wave 2 or b for the pound may be extended, and during this time, a downward three-wave set can be built for the euro. Thus, I expect a deep wave b, as in the case of building the previous three-wave set. Therefore, a decline in the pair can be expected to the 1.1850 mark or slightly higher. However, at the moment, wave 1 or a continues to become more complicated.

The ADP labor market report did not support the dollar but gave hope.

The pound/dollar pair rate rose by 40 basis points on Wednesday. There was no news background in the UK today, but the ADP report on the number of new workers in the non-agricultural sector was released in the US. This report reflects the same thing as nonfarm payrolls. Earlier this week, the JOLTS report on the number of job vacancies in the US labor market was released, and its figures disappointed dollar buyers. Last month, nonfarm payrolls slowed, the unemployment rate increased, and ADP fell almost to the lowest level in the past year. Everything pointed to the new ADP report (and nonfarm payrolls) being below market expectations. But in practice, it exceeded forecasts twice, amounting to 296 thousand in April.

Unfortunately, the market hardly reacted to this report, showing its strong commitment to the nonfarm payroll report, which will be available on Friday. However, the market received a good signal that the US labor market, despite the FOMC rate hike to 5%, is not as bad as some analysts depict. The opinion that the labor market is shrinking and unemployment is growing has been popular lately. But unemployment has grown by only 0.1-0.2% from its 50-year lows, no more. New jobs are being created consistently, and reducing available vacancies does not mean Americans are losing jobs. It only means that there are fewer new vacancies. But why do we need so many new vacancies if unemployment is minimal?

General conclusions.

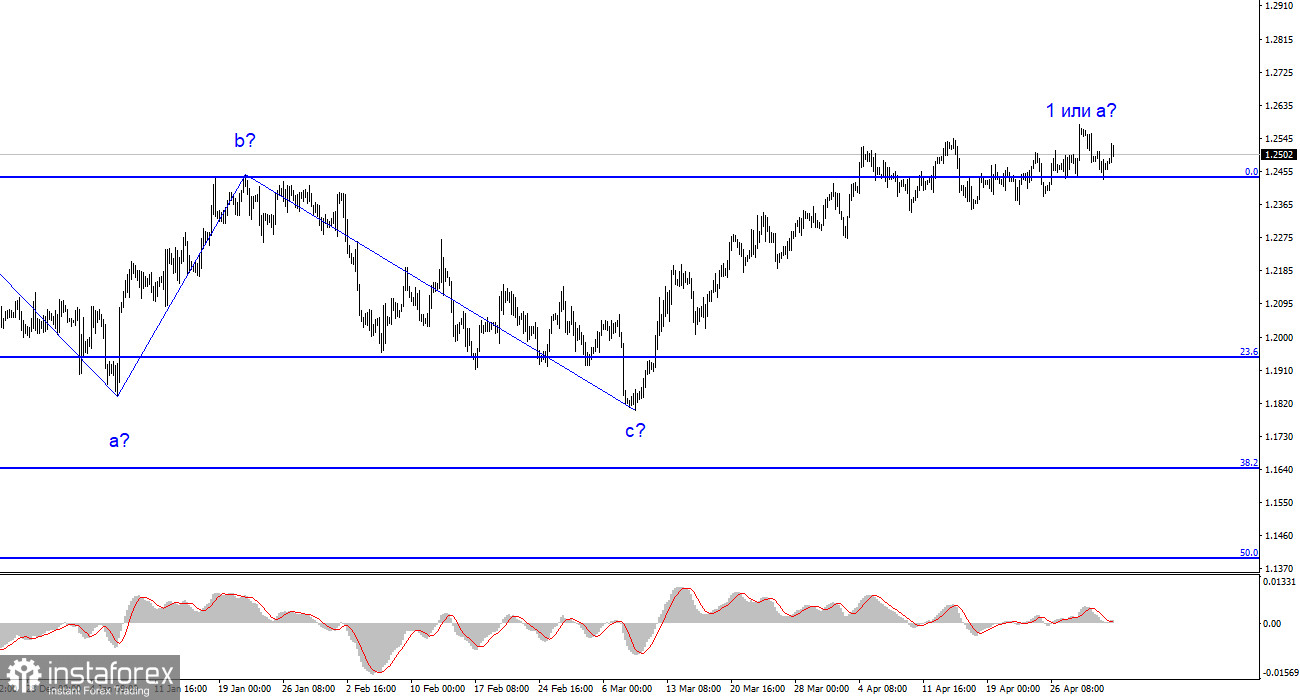

The wave pattern of the pound/dollar pair has long assumed the formation of a new downward wave. The wave markup, as well as the news background, is somewhat unambiguous. I do not see factors supporting the pound in the long term, and wave b may turn out to be very deep, but it has yet to start. A decline in the pair is more likely now, but the first wave of the ascending segment continues to become more complicated, and the quotes have moved away from the 0.0% Fibonacci mark. Now it will be more difficult to determine the beginning of the formation of wave b.

The picture is similar to the euro/dollar pair on the older wave scale, but some differences remain. At this time, the upward corrective segment of the trend is complete. But the three-wave downward segment may also be completed. And the new ascending segment of the trend can also be three-wave and horizontal.